Read this article in 中文 Français Deutsch Italiano Português Español

IGSA Power engineers its way into U.S. market

29 May 2024

Company seeks to gain market share with new Baudouin-powered gen-sets

IGSA Power operates out of its U.S. headquarters in Laredo, Texas, supplying power generation solutions ranging from 20 kW up to 3.3 MW to North American customers. (Photo: IGSA Power)

IGSA Power operates out of its U.S. headquarters in Laredo, Texas, supplying power generation solutions ranging from 20 kW up to 3.3 MW to North American customers. (Photo: IGSA Power)

IGSA Power may be a relatively new name to U.S. customers but it’s certainly not new to power generation. Founded in 1970, its parent company IGSA Group produces and sells generator sets in 17 countries through a network of more than 50 distributors. Its 162,000-sq.-ft. manufacturing facility and headquarters just outside of Mexico City, Mexico, produces more than 2,000 gen-sets per year.

“We have been very successful in the Mexican and Latin American market,” said Santiago Paredes, CEO, IGSA Power. “We also have other divisions and companies in the group. We’re a data center provider. We do all EPC (engineering, procurement and construction), sell the equipment, give them service and maintenance. We are also in the [cogeneration] business. We sell turbines, install them and do all the EPC.”

Other business segments include medical equipment and services and pharmaceuticals –making for a highly diversified portfolio. Yet, on its website, IGSA continues to describe itself as an engineering company “specialized in sustainable design and construction, infrastructure, operation, maintenance and power backup.”

Santiago Paredes, CEO, IGSA Power

Santiago Paredes, CEO, IGSA Power

New market and new engines

IGSA Power had its early beginnings about 10 years ago when IGSA Group began to explore entry into the U.S. power generation market. After attending PowerGen International and seeing the opportunities – and requirements – the company began developing products targeted to U.S. customers; secured the necessary industry certifications (UL2200 among others); and began marketing out of a new U.S. headquarters in Laredo, Texas, roughly five years ago.

“We started with small units [powered by] John Deere, Perkins, Volvo [Penta] for selling in the United States,” Paredes said. “We got all our line certified and then… we started working with Mitsubishi for the bigger equipment.”

Now, the company has a new engine partner, French manufacturer Moteurs Baudouin, for even larger gen-set solutions. “We were certified last October with Baudouin and, from that, now we have the whole range. We have equipment going from 20 kW up to 3.3 MW,” Paredes stated.

By November, he anticipates stepping up even further in power node with the launch of a Baudouin-powered 4.2-MW gen-set that he said will be the first of its size powered by a high-speed diesel engine. The company is already in the process of expanding its manufacturing facility in Mexico to accommodate production of the larger equipment.

Short lead times

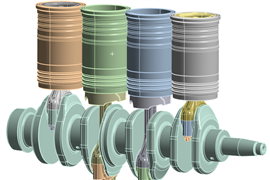

Baudouin has two engine platforms specifically targeted to the emergency standby power market: the M33 and M55, both of which consist of 1,800-rpm high-speed engines that meet NFPA 110 standards.

The M33 platform includes 6-, 8-, 12-, 16- and 20-cylinder configurations rated 600 kW to 2 MW and based on a 150mm x 185mm bore/stroke design. The M55 offers 12- and 16-cylinder arrangements rated 2.3 to 3.3 MW, with bore x stroke dimensions of 180mm x 215mm.

French manufacturer Moteurs Baudouin was chosen to supply engines for large gen-sets due to the quality of their products and speed of delivery. (Photo: IGSA Power)

French manufacturer Moteurs Baudouin was chosen to supply engines for large gen-sets due to the quality of their products and speed of delivery. (Photo: IGSA Power)

“We started working with Baudouin about seven years ago in Mexico,” Paredes noted. “They came in as really high-quality equipment and with quick delivery. That’s something that is always needed.

“The good thing about our partnership is that they’re very agile in their response,” he continued. “Right now, the [EPA-approved] range that they have… is from 600 kW to 3.3 MW and they can have equipment here probably in 12 to 14 weeks. That is actually kind of amazing.”

Such quick turnaround is critical, particularly for customers like data centers. “One of the things that leant us toward working with [Baudouin] for the U.S. is the lead time,” Paredes said. He pointed out that for some engine suppliers, the wait can be as much as a year. “Not all of the projects that you think you’re going to get are going to still be there in one year when you finally get the engines.”

Abbreviated lead times mean more timely delivery of IGSA Power’s gen-sets – with smaller models in customer hands in as little as 24 to 30 weeks and estimated availability for bigger units of six months or less.

Engineering flexibility

IGSA Power’s engineering capabilities are another point of differentiation.

“We’re an engineering firm because we do everything in-house,” Paredes said. “We’re totally vertically integrated. We do our own fuel tanks, silencers, enclosures. And we are also certified to sell fuel tanks in North America. So, we have a very broad product line that we could offer that is made in-house.”

The company also works with a variety of power system and component suppliers in addition to Baudouin, including familiar brands such as John Deere, Mitsubishi, Volvo Penta, Stamford, Leroy-Somer, ComAp, DeepSea and more.

IGSA Power’s engineering capabilities enable the company to customize gen-sets to meet customer specifications. (Photo: IGSA Power)

IGSA Power’s engineering capabilities enable the company to customize gen-sets to meet customer specifications. (Photo: IGSA Power)

The result is the flexibility to customize to customer specifications. “Especially in the United States, when you go to the higher [power] ranges, there is no typical product. You cannot sell a ‘standard’ product because people want the gas line or their controller somewhere else,” said Paredes. “So, it gives us an advantage because we can do all the engineering and switch the equipment however the client wants it.

“As a newbie in the market, we have to differentiate ourselves,” he continued. That means being able to customize enclosures, fuel tanks, locks, etc., as needed – and at no additional expense to customers.

“We don’t charge more to do extra engineering,” Paredes stated. “That differentiates us a lot from our competitors… We give a reason for people to look at us, because we comply with a lot of things usually other companies can’t.”

In it together

Perhaps the biggest competitive hurdle for IGSA Power, and Baudouin, is a lack of familiarity among prospective U.S. customers.

“We see a lot of opportunity right now to sell big units in North America with Baudouin,” said Paredes. “But the thing is that people don’t know the product.

“It’s a very good, very strong engine,” he added.

The two companies are working together to build brand awareness. “We’re starting to do a lot of marketing together… We are developing together the service and parts business. We already have all our service partner [agreements]. We are in the process of training for the gen-sets that we’re going to sell in the U.S.,” Paredes noted. “You have to have service and parts and we’re working really hard to get everything together.”

That includes having 15 distributors strategically positioned throughout the U.S. and Canada.

The company also made a conscious decision to price its gen-sets competitively in order to gain a foothold in a highly competitive environment. “We are probably 10% to 20% lower than anyone else and our lead times are probably six or eight months before anyone else today,” Paredes stated. “We see this as an opportunity to get into the market.

“It’s more of a marketing strategy than a cost strategy, because if we were at the same price against [established] competitors… why bother to try something new at the same price?” he asked. “That price, in the end, is important because I don’t think somebody is going to take the risk at the same price. If it’s a better price, at least they look at it.”

IGSA Power is in the process of training its service partners in service and support of the new gen-sets it plans to sell in the U.S. (Photo: IGSA Power)

IGSA Power is in the process of training its service partners in service and support of the new gen-sets it plans to sell in the U.S. (Photo: IGSA Power)

Proof of performance is another essential element. In addition to participating in PowerGen and Electrical Generating Systems Association (EGSA) events, IGSA Power held a launch event in Houston last fall to show attendees how the Baudouin unit works. A demonstrator model gen-set is also planned.

“We just want people to know the product,” said Paredes. “We’re going to manufacture a gen-set and take it around the U.S… see [customers] at their facilities, make it run, show how it works. We’re partnering with our distributors to do that.”

IGSA Power and Baudouin are seeing results from their joint efforts. “We already sold more than 25 units. For us, it’s a big thing. We started formally introducing the units in November because we had to get all the UL certifications before we started offering the equipment,” Paredes explained. “When that was done, we started promoting and now we have a lot of projects.”

More to come

Paredes recognizes there is still a lot of ground to cover with the standby power line. “Right now, we see a lot of opportunities in the data center business… We have a lot of interest from people in the product, and we’re going to try to be successful in that market,” he said.

The company also has its sights set on Tier 4 Final and is currently in the midst of product development. “It takes a lot of engineering,” Paredes commented, citing changes required in components, aftertreatment, enclosures, etc. “We’re very focused on standby, but certainly down the line – probably for sure next year – we’re going to be in Tier 4 Final.”

IGSA Power intends to continue its efforts to build awareness. “The challenge in the U.S. is that [standby customers] buy what the engineering firm tells them to buy,” Paredes said. “If they want to buy a product and it’s not approved by the engineering firm, they buy it at their own risk. People are not willing to do that.

“So, we started working with engineering firms, but it’s not easy… because in the end, they don’t know us either.”

Fortunately, that’s changing. “We’ve been at this for five years and I think today a lot of people recognize the brand,” said Paredes. “People are starting to notice us and that we deliver a good product, so people have started buying from us. I think it’s good.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM