Accenture survey: 76% of semiconductor execs expect supply chain challenges to ease by 2024

11 January 2023

According to an Accenture report that surveyed 300 senior semiconductor executives globally, 76% of respondents said they expect the industry’s supply chain challenges to ease by 2024, though companies should prepare to withstand other market pressures with investments that will help drive future growth.

The report, titled “Pulse of the Semiconductor Industry: Balancing Resilience with Innovation”, collected the perspectives of executives (based primarily in the U.S., China, Japan, the Netherlands, South Korea and the U.K.) who evaluate their companies’ supply chain outlooks and innovation roadmaps.

Graphic: Business Wire

Graphic: Business Wire

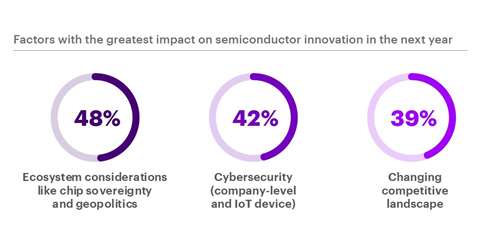

Though three-quarters of the executives replied with optimism about the effects of COVID-19 abating by 2024, the survey also detailed which supply chain challenges respondents are still experiencing. They cited geopolitics (48% of those surveyed), cybersecurity threats (42%), the changing competitive landscape (39%) and talent shortages (35%) as the most common issues.

Specifically regarding the changing industry landscape, 65% of the executives said that the rate of Moore’s law, in which the number of transistors in an integrated circuit doubles about every two years, will slow down by 2024. And for 56% of respondents, promoting strong IP protection and enforcement is a good solution to enhance the industry’s resilience moving forward.

“As the demand for chips slows down amid inflationary concerns and an easing of the chip shortage, semiconductor businesses face a new set of challenges driven by geopolitics and a growing talent shortage,” said Syed Alam, global lead of Accenture’s High Tech industry practice. “To succeed, companies need to balance being resilient in tough times with continued investments in innovation.”

The report identified four main areas for investment that will drive future semiconductor growth, including mobility, the metaverse, digital health and sustainability.

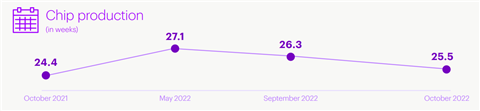

Lead times for chip deliveries have lessened as supply chain issues ease. (Source: Accenture)

Lead times for chip deliveries have lessened as supply chain issues ease. (Source: Accenture)

In the mobility sector, while extended chip shortages and cost concerns were cited as the biggest challenges for the semiconductor industry, there are signs that these issues are improving. Susquehanna Financial Group research showed lead times for chip deliveries at 25.5 weeks in October 2022 — an improvement from 26.3 weeks in September 2022 and closer to the 24.4-week figure in October 2021. The peak for lead times was 27.1 weeks in May 2022.

To overcome current obstacles, 93% of executives surveyed by Accenture believed motor vehicle manufacturers should partner with semiconductor and technology companies to develop and ultimately deploy next-generation digital mobility technologies. Forty-two percent of respondents expected autonomous vehicles — which will need semiconductors for all the digital technologies onboard — to become mainstream for personal use in the next two years, and a large majority predicted that autonomous vehicles will be common for mass transportation and long-haul and local trucking in three to five years.

The Accenture report stated that the mobility sector will gain more attention from semiconductor companies in the near future, with a growing portion of production dedicated to mobility-related products. Only 25% of respondents said their semiconductor company is currently committing a medium amount (21-50%) of allocated production to mobility; that number jumped to 42% when predicting the same production allocation just two years in the future.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM