Read this article in Français Deutsch Italiano Português Español

ACEA reports decline in CV, truck and bus sales across EU

12 May 2025

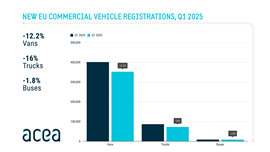

ACEA, the European Automobile Manufacturers’ Association, has reported declines across all commercial vehicle segments over Q1 2025.

The downturn over the same period in 2024 was noted as being due to ‘sluggish economic growth’ and a complex regulatory landscape contributing to business uncertainty.

Across the EU, new van sales fell by -12.2%, with the three largest markets all contributing to the downturn. Italy recorded the steepest drop (-15.2%), followed by France (-10.7%) and Germany (-10.7%). Conversely, registrations in Spain increased by +12.6%.

New EU truck registrations also fell by -16% to 72,941 units. Heavy trucks saw a decline of -16.6%, while medium-truck sales fell -12.5%. All major markets recorded declines, with Germany and France dropping -25.4% and -17.6% respectively. Spain and Italy also saw significant drops of -12.8% and -9.4%.

New bus sales also fell across the EU, with numbers dropping -1.8% over Q1 2024 (8,674 units). Germany recorded a sharp decline (-15.0%), followed by Italy (-7.3%) and Spain (-0.5%). There were small increased across France (+0.1%). In other markets, Sweden (+189.9%) and Greece (+187.6%) reported significant increases.

Diesel was the preferred choice for new van buyers in Q1 2025, although sales declined -14% to 290,870 units (82.5% market share, down from 84.2% in Q1 ’24). Sales of petrol models decreased by -25.8% (share total 5.2%). Electrically-chargeable vans grew by 32.6% for an 8.7% market share, an increase of +5.7% over Q1 ’24. Hybrid registrations grew by +0.7%, although this sector only accounted for 2.5% of the total market.

Looking at truck fuel types, diesel remained dominant over Q1 2025, accounting for 93.4% of new EU registrations. This, despite a -17.7% drop in volumes compared to Q1 ’24. Electrically-chargeable trucks grew by +50.6% and a market share of 3.5%, up from 2.0% last year. The Netherlands reported sales growth of +342.7%, accounting for 25% of total sales across the EU.

Sales of electrically-chargeable buses increased 50.3% over Q1 ’25, with market share increasing from 13.0% to 19.9% year-on-year. Germany posted the largest market growth (+118.9%), while Sweden recorded the second-largest number of registrations, with 237 electric buses over 9 in Q1 ’24. On the other hand, hybrid-electric bus sales dropped by -28.7% (10.7% market share). Diessel bus registrations declined by 5.6%, while market share fell from 68.5% in Q1 ’24 to 65.9%.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM