Boom in U.S. data center

06 April 2022

727 MW of facilities under construction in 2022

Driven by demand from large cloud service providers and social media companies in the age of COVID, North American data center leasing reached record levels in 2021, according to CBRE, a global leader in commercial real estate services and investment.

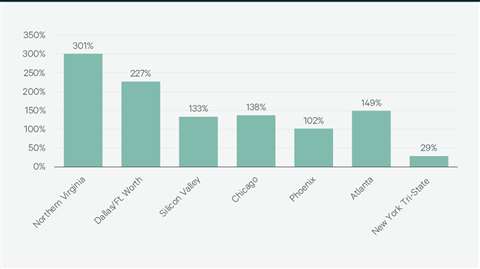

CBRE’s latest North American Data Center Trends Report shows that there was 493.4 MW of net absorption in the seven primary U.S. data center markets in 2021, a 31% increase over 2019’s then-record level, and up 50% from 2020.

Despite a 17% year-over-year increase in primary-market inventory, vacancy fell to just 7.2%. Occupiers in need of data center capacity in markets with low vacancy should see more options in 2022 with 727.6 MW of facilities under construction. However, 44% of this space has been preleased.

“We expect continued strong data center demand from cloud service providers and social media companies in 2022 as these firms race to build out their digital infrastructure to support demand for cloud services and metaverse and other digital communities,” said Pat Lynch, Executive Managing Director, Data Center Solutions, CBRE. “We also anticipate increased appetite for highly connected colocation space from enterprise users, and pricing increases and longer lead times for available capacity in certain markets due to power constraints and supply chain challenges.”

Northern Virginia remained the most active data center market with net absorption of 303.3 MW in 2021 – more than four times that of Atlanta, the second-most-active market.

Also according to the report, power-delivery challenges will continue to affect the pace of new construction. Supply chain and workforce shortages will delay substation deployments.

More 100+ MW leases will be signed, as purpose-built data centers attract single-tenant occupiers with growing data requirements. These large-scale requirements likely will remain driven by cloud service providers and ever-growing social media companies.

The availability of clean power will have to increase exponentially as data centers move toward carbon neutrality. More industry players are beginning to consider the option of nuclear power, although there are concerns over its sustainability.

More 100+ MW leases will be signed, as purpose-built data centers attract single-tenant occupiers with growing data requirements. These large-scale requirements likely will remain driven by cloud service providers and ever-growing social media companies.

The availability of clean power will have to increase exponentially as data centers move toward carbon neutrality. More industry players are beginning to consider the option of nuclear power, although there are concerns over its sustainability.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM