EIA: Higher marine fuel costs spur demand for residual fuel oil

15 February 2022

Higher costs make scrubbers more cost-effective

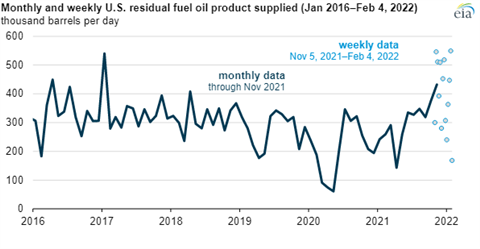

U.S. consumption of residual fuel oil—primarily used as a bunker fuel—was higher in November 2021 than during any month since January 2017, according to the U.S. Energy Information Administration (EIA).

High crude oil prices indirectly contribute to higher overall bunker fuel prices, and higher prices give ship owners stronger incentives to install scrubbers to take advantage of the price discount that 3.5% high-sulfur fuel oil has to 0.5% very-low-sulfur fuel oil, the EIA said.

The EIA noted that the International Maritime Organization (IMO) instituted tighter maritime fuel sulfur specifications on Jan. 1, 2021. Before 2020, marine fuel could have a sulfur content as high as 3.5%, which is considered high-sulfur fuel oil. The IMO now requires ships to switch to fuels with a 0.5% sulfur content or less, forcing ships to use a more processed, and more expensive, variety of residual fuel oil called very-low-sulfur fuel oil.

Ships comply with the IMO specification as long as their actual emissions meet the target sulfur emissions level, regardless of the specification of the fuel they use. Ship owners can install sulfur scrubbers on board to reduce sulfur emissions while still consuming high-sulfur fuel oil and remain compliant. Ship scrubbers are expensive and require ongoing maintenance, but vessels can lower operating costs by purchasing high-sulfur fuel oil instead of higher-priced very-low-sulfur fuel oil or low-sulfur marine gas oil.

The increase in residual fuel oil demand comes with record increases in maritime shipping volumes and rising high-sulfur fuel oil prices in Singapore. The Singapore market is a global benchmark for marine shipping. Since the beginning of November 2021, the Singapore very-low-sulfur fuel oil price premium over high-sulfur fuel oil increased to more than $20 per barrel (b) and neared $30/b throughout December 2021 and January 2022.

The IMO regulation applies to global shipping. Marine vessels operating within the North American or U.S. Caribbean Sea Emission Control Areas (ECA) were already required to meet 0.1% sulfur content while operating within those waters.

Since spring 2020, overall production of residual fuel oil has decreased because of substantially less refinery production resulting from the effects of the COVID-19 pandemic.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM