Forecast 2023: Commercial vehicles see best-ever demand

28 September 2022

ACT Research foresees shallow freight recession likely followed by recovery in late 2023

This forecast as originally published in the September 2022 issue of Diesel Progress.

“What do you want it to equal?” The punchline to one our favorite economist jokes is darkly humorous as we surveil an economic road beset with pitfalls. We start by warning that the risk of significantly negative events is elevated. Current events call to mind what is now referred to as the Rumsfeld Matrix. Readers may recall Donald Rumsfeld’s inspired, “There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don’t know. But there are also unknown unknowns. There are things we don’t know we don’t know.”

At present, the “known unknown” box in the Rumsfeld Matrix is overflowing and includes:

- Global risks: The duration of Russia’s Ukraine invasion/sanctions; energy constraint impacts on Western Europe’s manufacturing; recession and supply risks; China’s plans concerning COVID policy, supply risks and Taiwan and the South China Sea.

- Domestic risks: Sticky wage inflation; strong job demand amid demographic labor shortfall; Federal Reserve policy tightening; the supply chain and specifically microprocessor chips; an increasingly noisy domestic political scene.

Mild recession?

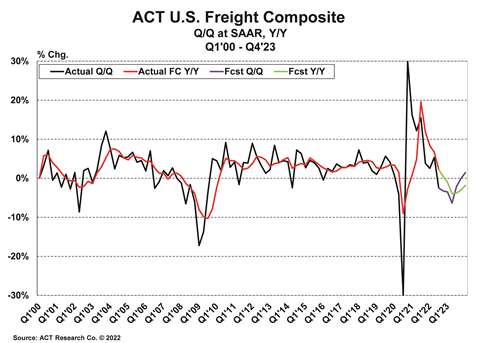

Beyond looking at what could still happen, with high confidence we can assert the post-2020 COVID economic recovery is over and a freight recession has begun. In that light, ACT has adopted a mild recession scenario as the most likely path for the economy between now and 2024.

Despite the first two quarters of 2022 already being negative, strength in consumption, investment and employment metrics make a poor case that the macro economy is already in recession. With the Federal Reserve continuing to aggressively raise interest rates into 40-year high inflation, the two-edged impact of more expensive capital and the corrosive effect of inflation on buying power is projected to tip the economy into recession beginning around the fourth quarter of 2022 and centered on Q1 2023.

Prior to Russia’s actions putting the final nails in the expansion’s coffin, ACT’s economic forecasts assumed a reversion to the mean in consumer goods spending. After two years of sitting at home buying stuff, goods consumption was oversaturated, and vacation/experience demand was pent-up. With inflation eroding buying power at an accelerating rate at the same time as consumers move away from goods, there is significantly less freight per dollar in today’s economy. For consideration, CPI was up 8.5% year over year in July. Bad, but on a two-year stacked basis, consumer prices were up 14.2% in July (core at 5.9% and 10.4%, respectively). All of the above flipped ACT’s freight composite to negative territory in the second quarter and pushed freight growth in our forecast to -3.2% in 2023, its sharpest contraction since 2008-2009.

Despite near-term negatives, sticky wage inflation may prove problematic to our outlook if the Fed remains aggressive in fighting demographically driven wage pressures.

A lot to like

Beyond that, and the list of “known unknowns,” there remains much to like about the U.S. economy’s footing that we believe supports a modest – rather than severe – recession forecast. With the world economy slowing, commodity and supply chain inflation look more (dare we say) transient, even if inflation is unlikely to return immediately to its longer-term 2% trend.

Looking forward, workforce constraints should support the job market, the millennial generation continues to come of age (marriage, babies, houses), consumer and business balance sheets are well padded and there was little evidence of excess capacity in the freight-heavy machinery sector. To that end, the forecast anticipates the economic ship will begin to right itself into the end of 2023, setting the stage for renewed economic growth in 2024. This in turn will set the stage for commercial vehicle demand to return to peak-type early cycle demand levels by 2025.

Demand, meet recession

Every major cycle prior to this one has been characterized by material overproduction and overbuying on the part of truckers right in front of the inevitable downturn in the freight cycle. This is especially true in the case of the freight-reliant heavy-duty tractor market. As such, volume declines in the Class 8 market following a strong freight cycle tend to be sharp. And because of overbuilding and overconsumption at the top of the cycle, recoveries tend to lag. Being more exposed to the broader consumer economy, declines in the medium-duty market tend to be less steep into downturns, but the traditional path into recession is downward.

As currently projected, the forecast anticipates that Class 8 production in 2023 will fall just 6% to 291000 units, while our expectations for medium-duty vehicles actually rise 7% to 247000 units.

As ACT has discussed for nearly two years, persistent and broad-based supply chain disruptions at the same time freight volumes were exploding left the industry with considerable pent-up demand and an older fleet than you would typically find at the end of a freight cycle. That pent-up demand will provide support through the first half of 2023, filling the void left by slowing economic activity and lower freight intensity.

As we look toward the end of 2024, we believe around 10% of the market’s buyers will be prebuying to initially avoid CARB’s low NOx and warranty extending Advanced Clean Truck rule, scheduled to take effect Jan. 1, 2024. ACT’s analysis suggests this rule, and the one being contemplated by the EPA, will drive major prebuys if enabled by carrier profitability, as is likely.

It’s different

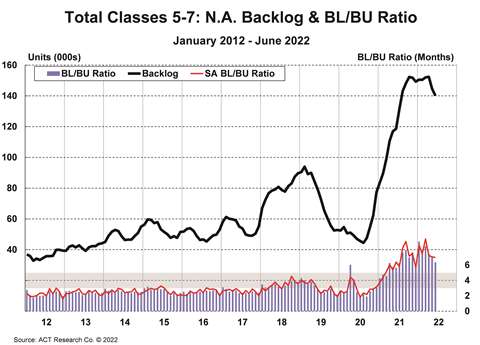

The medium- and heavy-duty markets both have key supports for our “it’s different this time” 2023 projections. The medium-duty market continues to enjoy the secular move toward online shopping. Cyclical factors are also at work as the heavy-duty OEMs have spent the better part of the past two years borrowing chips from their medium-duty product lines in order to maximize more profitable heavy-duty vehicle production.

Despite near-record backlogs to start 2022, our expectation is for medium-duty vehicle production to fall around 2% from 2021 levels to 230000 units in 2022. We note that on a year-over-year basis, Classes 5 to 7 order backlogs in June were +18% from 2021 at 140100 units. The mid-year 6.5-month BL/BU ratio was more than double its pre-pandemic 2.7-month average.

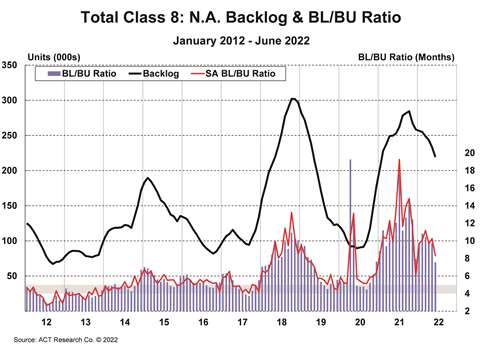

Support for cycle-defying Class 8 demand comes in the form of still strong carrier profitability into 2023. While the “spot” freight rates that small truckers rely on have fallen sharply, large truckers compete in “contract” markets, which are only now beginning to come under pressure. Profitability is expected to fall into 2023 for the group of public carriers tracked by ACT after (potentially) back-to-back record years. While not at record levels, 2023 is nevertheless projected to be the fourth best-ever on a margin basis, and third best-ever on a free-cash basis. Historically, there is a strong correlation between profits and equipment demand.

Big backlogs

Like the medium-duty market, the heavy-duty market continues to enjoy outsized backlogs and long lead times. The Class 8 backlog at midyear was 219000 units, down 13% from June 2021, and 62000 units from its September 2021 peak. The BL/BU ratio in June was 7.7 months on a very strong build rate. We note that some of the backlog constraint is being driven by the OEMs, who are considerably more cautious about extending order boards owing to the supply chain constraints that have left them unable to meet output obligations cycle-to-date. Wild swings in commodity prices have also made it difficult for the OEMs to post a sale price and make it stick.

Kenny Vieth, president and senior analyst, ACT Research

Kenny Vieth, president and senior analyst, ACT Research

As a final thought, the third quarter is traditionally the weakest period of the year for new vehicle orders. Hence, we anticipate further backlog erosion through the quarter. With activity and profitability trending lower, the expectation is that new order activity in Q4 will be sufficient to raise backlogs seasonally but will be muted in comparison to activity in years marked by healthy freight markets.

To conclude, while demand is heading lower, and while there is a stack of caveats, many of which could tip the economy into a deeper-than-forecast recession, there remains a lot to like about the footing of the industry – and the economy - heading into what we believe will be a shallow recession, with recovery in the latter part of 2023 into 2024.

About the Author: Kenny Vieth is president and senior analyst at Americas Commercial Transportation (ACT) Research Co., LLC, a global publisher of commercial vehicle industry data and forecasting services based in Columbus, Ind.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM