Read this article in 中文 Français Deutsch Italiano Português Español

Interview: Beau Lintereur, Cummins

14 May 2024

At the recent Intermat 2024 trade fair, held at the Parc de Expositions de Villepinte near Paris, France, the obvious stars of the show were the construction machines and related equipment. But with few opportunities this year to present their new models (Bauma and Agritechnica are coming up in 2025), a small number of engine OEMs used the show to introduce their latest power solutions.

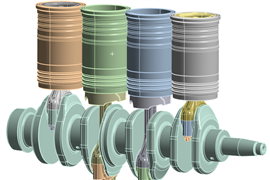

One of those engine manufacturers was Cummins, which unveiled the Off-Highway Next Generation X15 heavy-duty diesel engine. With a power output of up to 522 kW (700 hp) and peak torque of 3200 Nm, the 14.5-litre engine further incorporates tech intended to optimise fuel economy (180 g/kWh). The X15 also has an extended maintenance schedule of 1000 hours, helping to reduce total cost of ownership.

The Next Generation X15 is one of the ‘fuel agnostic’ series of engines now being developed by Cummins. The strategy goes like this: across a given displacement, all engines will share mildly modified version of an all-new platform which is then twinned with a fuel-specific head. Each range will include diesel/HVO variants, through to gaseous fuel versions supporting natural gas (methane), CNG/LNG and hydrogen – another model based on the fuel agnostic strategy, the new B6.7H hydrogen internal combustion engine, was also present at Intermat.

Introducing HELM

The fuel agnostic engine programme has now been rebranded as HELM, an acronym which loosely translates to higher efficiency, lower emissions and multiple fuels. Indeed, while the Next Generation X15 will be compliant with Stage 5 standards, the goal is to have the engine achieve compliance with the anticipated Stage 6 standards.

“As an engine designer and manufacturer, we believe that the internal combustion (IC) engine still has legs,” said Beau Lintereur, executive director Off-Highway at Cummins, in an exclusive interview with Power Progress International.

Beau Lintereur (Photo: Cummins)

Beau Lintereur (Photo: Cummins)

“We’ll look to move customers over time to the new technology, simply because it’s better” Beau Lintereur, Cummins

“We’re all chasing new technology that will get us to zero carbon, but at the same time we’re investing in IC tech. We’re investing about $1 billion in clean-sheet engine designs for our medium- and heavy-duty product lines, together with another billion in the plants to produce those engines.”

That investment essentially covers ground-up development of the HELM range of products and the manufacturing capability. To that end, Lintereur pointed out that the launch of HELM products into the market would ultimately bring an end to those current engine ranges which only offer diesel models.

“There’s definitely a plan for succession,” explained Lintereur. “There’s a couple of reasons why: we won’t be able to sell those engines in the regions with the strictest emissions standards. And in other markets where standards are not so strict, we’ll look to move customers over time to the new technology, simply because it’s better.”

He puts forward the Next Generation X15 engine as an example: “We don’t need to bring this product to market now. While it’s rated to Stage 5/Tier 4, and also supports other emissions levels, this engine will be compliant with the next wave of emissions standards. That means as of now, it will supersede the existing 15-litre product.”

Lintereur continued by saying that if the decision to introduce the new X15 was only based on emissions standards, then it’s likely the model would have only been launched when Stage 6 regulations came into effect. But considering that machine development timelines will already come close to overlapping with the introduction of Stage 6/Tier 5 standards, the goal is to futureproof those customer machines by supporting the respective R&D programmes with the latest low-emissions technology.

Next-gen X15 engine for off-highway applications (Photo: Cummins)

Next-gen X15 engine for off-highway applications (Photo: Cummins)

“A customer might not want to change [their product range] overnight, they have the current engine engineered into their chassis and changing that takes time and money. They might not have plans to change their product for a few years. But over time, we believe that introducing the latest technology now will benefit our customers.”

Emissions markets

Lintereur said he thinks there are three ways of looking at the off-highway power market: leading emissions markets; lagging emissions markets; and local emissions markets (where local refers to larger national markets such as China and India, with Brazil and Japan also in that mix).

Moving forward, he believes that this fracturing of global engine markets based on emissions regulations is coming to an end, where customers will move away from the myriad of products Cummins has developed over the years and instead select from just those engines using HELM platforms. This extends even to those customers buying vintage models still available in unregulated markets.

“The Next Generation X15 we have here at Intermat is already certified in China and will be certified for all the leading, lagging and local emissions regulations. This product range, along with others that have even more proliferation today, will be served by common global base platforms in the future. Imagine one day we’re having this same conversation; I see a point where we will have consolidated all those variants into a single extended product range.”

He added that while the technology behind the HELM products will deliver more customer value, there are other motivating factors.

“There are certain commodity groups where the supply base is changing. The older the technology, the more challenging it gets to source that and maintain existing product ranges. Look at a mechanical fuel pump, there’s just not so many suppliers today as there were 15 years ago. By moving on to the latest technology we can add value, while modernising our supply chain.”

What this boils down to is that while the Next Generation X15 on display will be certified for Stage 5/Tier 4 regulations, even a Stage 3-compliant version of that same X15 would be more fuel efficient than a Stage 3 version of an engine currently on the market.

“Compared to its predecessor, [the new X15 will have] 10% better fuel economy, a working lifetime which is 10% longer, and the service interval will be twice as long, so 50% of the maintenance costs are gone. On top of that, the power density is higher – it’s effectively 15 litres of power in a 13-litre package. On every single metric, it’s an improvement over the out-going model. That all adds up to a tremendous amount of value.”

Hydrogen future

As mentioned, in addition to the X15, Cummins had the B6.7H on the stand at Intermat. The engine features a series of newly-developed, fuel-specific solutions to allow the use of hydrogen in an internal combustion engine, which it can be assumed came at a not inconsiderable cost.

Cummins B6.7H hydrogen internal combustion engine (Photo: Cummins)

Cummins B6.7H hydrogen internal combustion engine (Photo: Cummins)

According to recent news reports, natural gas reserves in Europe are as high as they have ever been at this time of the year and are expected to reach 95% of capacity by the end of the summer. As it was the potential that Europe would run out of natural gas following Russia’s illegal invasion of Ukraine that prompted investment in new fuel technologies, was there now a danger that the market would turn away from hydrogen as a solution?

“I don’t think so,” said Lintereur. “Hydrogen still has the advantage over those other fuel types that it can be zero carbon. If you use green electricity to operate the electrolyser, you have green hydrogen. You can’t do that with natural gas, no matter how you work it. If you have a low-cost supply of renewable energy, using wind or solar, hydrogen can still be an economically successful choice.”

“The power industry is heading for a mixed fuel market where the application and available infrastructure dictates the best, most appropriate fuel” Beau Lintereur, Cummins

Ultimately, Lintereur believes that the appeal of hydrogen has not changed. While not wanting to comment directly on what is clearly a Eurocentric issue, he noted that he has seen no decline in the interest of companies wanting to find out more about the hydrogen tech being produced by Cummins.

“If anything, there’s a growing interest in hydrogen. For example, batteries are very interesting in smaller, lighter machines, but they are simply not feasible in larger applications. The power industry is heading for a mixed fuel market where the application and available infrastructure dictates the best, most appropriate fuel.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM