Liebherr And Its Expanding Engine Business

07 January 2019

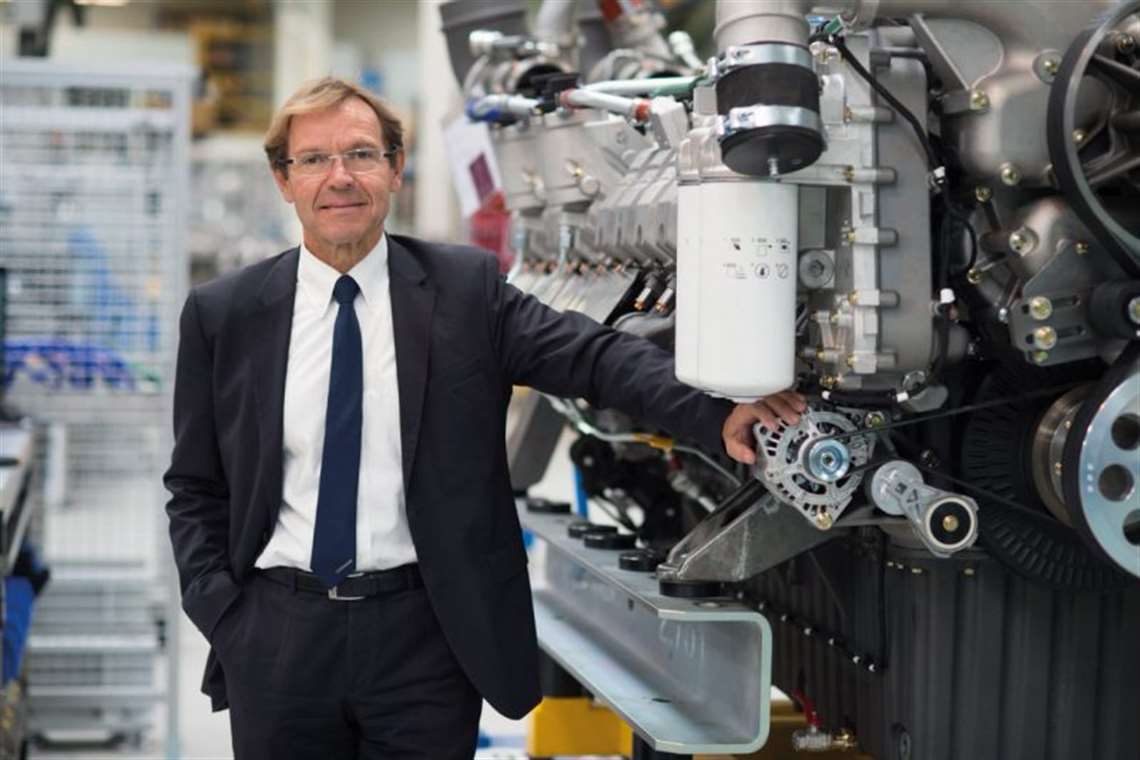

Gebhard Schwarz, managing director, Liebherr-Component Technologies, talks about the division’s many engine developments and deals

The Liebherr Group in Switzerland, now a US$11.16 billion (€9.845 billion) family-owned manufacturer and service provider, is spread across 11 product divisions covering construction, mining and concrete equipment, three different crane groups, aerospace and transportation systems, plus hotels and domestic appliances.

The company also includes an expanding and increasingly active components division, Liebherr-Component Technologies AG, founded in 2007. The division manufactures diesel and gas engines, fuel injection systems, engine control units, axial piston pumps and motors, hydraulic cylinders, slewing bearings, gearboxes, electric drive and control technology, drive systems, electronic components and software, and also remanufactures used components.

While probably best known as an off-highway equipment manufacturer, as far back as the 1950s, Liebherr also began to develop its own components, starting with gear wheels for gearboxes. Since then, Liebherr has continued to expand the development and production of components culminating in the company’s first diesel engine, the D926, which began series production in 1984.

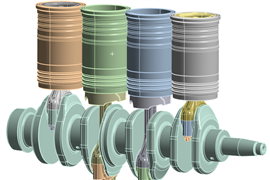

Since the launch of the D926, Liebherr’s diesel range has grown to cover engines from four to 20 cylinders with outputs from 176 to hp 6110 hp (130 kW to 4.5 MW). In 2012/2013, the company also added natural gas engines in the same cylinder range with outputs from 197 to 1454 hp (145 to 1070 kW). Over that time, Liebherr certainly established itself as a global engine supplier, initially driven by the demand for its own machines, as well as for power generation. But in recent years, the company has become very active outside of its own equipment, providing engines to other OEMs as well as end users and entering cooperations around the world.

Engine Expansion

The engine expansion started in 2014 with an agreement with KAMAZ to develop in-line diesels with production starting in Russia late last year. Germany’s Deutz and Liebherr announced an agreement in 2017, under which Deutz would distribute four Liebherr models from 272 to 843 hp (200 to 620 kW) under its own brand in 2019, just in time for EU Stage V emissions regulations. Liebherr and Kohler signed a supply agreement for Liebherr diesel engines from 27 to 103 L for a new line of Kohler and Kohler-SDMO generator sets. These are new engines, carrying the Kohler brand name, are assembled by Liebherr at its new facility in Colmar, France, as well as at an extended facility at its headquarters in Bulle, Switzerland. That was followed by an agreement with John Deere Power Systems to jointly evaluate engine technologies, designs and development processes for future power needs of each company. And the news continued with the signing of a cooperation agreement with Voith Turbo GmbH & Co. KG for the development, distribution and service of diesel engines for rail vehicles.

Diesel Focus

Given all that activity, our sister publication, Diesel Progress, visited Gebhard Schwarz, managing director of Liebherr-Component Technologies AG, to discuss this rapid expansion of the company’s engine business.

“In 2007, Liebherr Components was established. The division produced various components, but the main focus was on diesel engines,” Schwarz said.

At that time the company produced mainly four- and six-cylinder engines, covering up to 13 L displacement, as well as V-engines covering up to 24 L.

“But, as Liebherr is very popular with larger machines, the customers asked for engines that could also power those huge pieces of equipment. So step-by-step we decided that other engines needed to be developed. Liebherr has machines up to 5400 hp (4 MW) in its portfolio, so that was the maximum power target we had to cover.”

At that time, Liebherr only assembled engines in Bulle, Switzerland, but the need for more engines also meant more production capacity was needed, leading the company to open a second engine facility in Colmar, France, near the Liebherr Mining Division site. That facility has recently been expanded.

Fuel Systems

continued to grow, the company expanded engine manufacturing at

its facility at its headquarters in Bulle, Switzerland.

There were other key strategic decisions to follow in 2008/2009. This timeframe also coincided with the increase in global diesel emissions regulations.

“Back then, we were buying fuel injection systems and made the crucial decision to produce them ourselves in the future,” said Schwarz. Fuel injection systems, one of the business units within the Components Division, is now also expanding, with a new manufacturing facility in Deggendorf, Germany. Also at that time, the global financial meltdown occurred.

“It was certainly a critical time with the global economic situation. But the Liebherr family had a very forward-thinking approach. We had just decided to start developing high horsepower engines, and once that decision was made, the Liebherr family went forward with that development plan, despite the global market situation, which again, looking back was an important decision,” said Schwarz. “Once the markets began to recover and stabilize, that decision proved to be right. We could not imagine what was coming up, back in 2008. Therefore, we were very happy to be contacted by several companies with an inquiry to start cooperations.”

Expansion Strategies

“One of the main reasons why Kohler and Liebherr started cooperation was that both are family-owned companies and showed a clear commitment and understanding towards each other. It was a perfect fit. With Kohler, Liebherr targets to serve a significant share of the power generation market and to benefit from significant economies of scale that an engine manufacturer must have to be in the market,” Schwarz said. “The gen-set business covers about 60% of the market share in the 1 to 5 MW power range. So if you want to be a significant engine player, you cannot ignore this market. Kohler and KohlerSDMO are major players in this segment and are therefore valuable partners.”

The situation with Deutz was a little different.

“Deutz is a renowned engine manufacturer pursuing the strategy to widen the power range up to 18 L engines. To do so, Liebherr was exactly the right partner.”

“John Deere and Liebherr have been working together in various fields for over 20 years now. A new stage in the relationship was the signing of an agreement in August 2017 to jointly evaluate, design and develop engine technologies. The collaboration targeted specific horsepower and displacement range,” he said. “The cooperation with KAMAZ was a very special one, since it targeted on-highway applications for the first time in Liebherr’s diesel engine history. For that, Liebherr developed a new range of six-cylinder, in-line diesel engines with the power output ranging from 408 to 707 hp (300 to 520 kW). In the course of three years, the KAMAZ engine production site has undertaken large-scale adaptations to facilitate the manufacturing of the new engines. In December 2017, the first components for the new KAMAZ 910.10 engine were manufactured and put onto the assembly line,” Schwarz said.

to 13 L displacement, as well as V-engines up to 24 L. But demand

for larger engines has increased for external sales, as well as for

larger Liebherr machines, leading the company to now build engines

up to more than 6000 hp.

Gas Engines

“Also gas engines have been part of our product line for many years. However, in the beginning we only built base engines and shipped them to packagers of complete gen-sets. So part of the competence was given up to them. About five years ago, we decided to develop our own complete gas engines. We started with four-cylinder in-line versions – R4, R6, V8 and V12 – from 8 to 25 L. We have extended those with a 48 L V20 model, which puts us in a beneficial position in the cogeneration market,” he said. “Most gas engines are used for cogeneration and power generation. Now we are feeling the pressure of emission regulations in power generation, as well, and for that natural gas engines are exactly the right choice.”

More to come?

“We made the decision to sell engines to the external market in 2008/2009. Development took time, and we started selling engines outside of the group in 2013/2014. With all these agreements, about 20% of our annual engine sales is currently going to external customers, and the trend is still upwards. We are very proud to achieve this result in a relatively short time,” Schwarz said. Might there be other agreements to come? “We actually have other ideas in mind. The Liebherr family supports us in the best way. We have made a lot of pre-investments with that in mind. Liebherr is well-known in the machine business. Customers know they can count on us long-term,” he said. “Whenever the market goes up and down, we remain stable, which is important to our customers. So, I don’t think this is the last article you will be writing about Liebherr and its engines.”

–By Mike Osenga

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM