Oil Supply Will Remain Up, Prices Down In 2020: EIA

16 March 2020

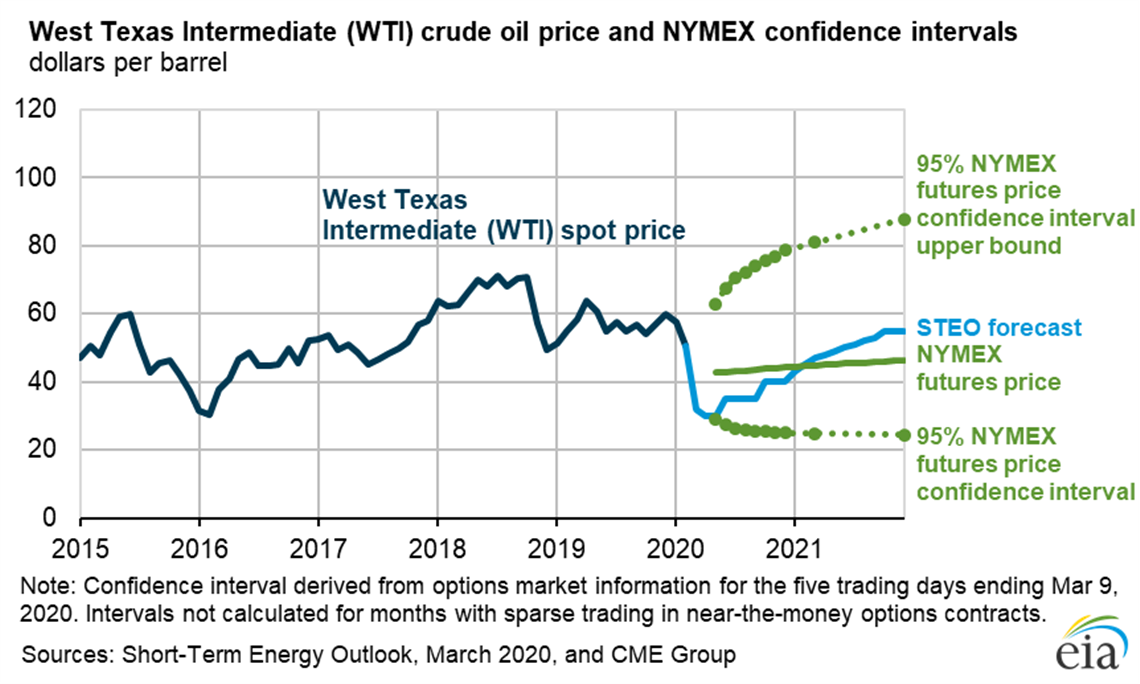

The U.S. Energy Information Agency (EIA) forecasts Brent crude oil prices will average US$43 per barrel (b) in 2020, down from an average of US$64/b in 2019.

For 2020, EIA in its March Short-Term Energy Outlook (STEO), said it expects prices will average US$37/b during the second quarter and rise to US$43/b during the second half of the year. EIA forecasts that Brent prices will rise to an average of US$55/b in 2021 as a result of declining global oil inventories putting upward pressure on prices. EIA expects that global liquid fuels inventories will grow by an average of 1.0 million barrels per day (b/d) in 2020 after falling by about 0.1 million b/d in 2019 and that inventory builds will be largest in the first half of 2020, rising at a rate of 1.7 million b/d.

After its March 6 meeting, OPEC and partner countries announced that they did not agree to extend production cuts beyond those currently expiring March 31. EIA said it no longer expects active production management to target balanced global oil markets among OPEC members and partner countries. These countries have been limiting production under a pact agreed to in 2016.

Because of the outcome of the March 6 OPEC meeting, EIA increased its OPEC liquid fuels production forecast by 150,000 b/d in 2020 and by 200,000 b/d in 2021 from the February STEO. EIA expects OPEC crude oil production will average 29.1 million b/d in the second and third quarters of 2020, up from 28.7 million b/d in the first quarter. Although this growth is a relatively small increase in a market where global production exceeded 100 million b/d in 2019, this production level represents a marked change from recent production targets that were focused on keeping global inventories near the five-year (2015–19) average.

“OPEC’s current strategy appears to be focused on regaining market share by elevating production levels to the point that the resulting depressed prices limit production growth from other market participants, particularly non-OPEC producers,” the report states. “In addition, the increase in OPEC production is significant in light of the downward revisions to the outlook for global demand resulting from COVID-19.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM