Rizon Truck gives EVs wider appeal

22 July 2025

While a new entry to the electric CV market, US-based Rizon Truck already has a series of market advantages. Here, we take a look at the tech and which features will support the brand moving forward

Examples from the Rizon Truck range (All photos courtesy of Rizon Truck)

Examples from the Rizon Truck range (All photos courtesy of Rizon Truck)

Over recent years a series of companies involved in the development and production of battery-electric (BE) trucks have made a big media splash as they launched, only to disappear a few years later. It’s a familiar story; the collective history of vehicle manufacturing is littered with names which have quickly come and gone.

Many readers will be familiar with the failure and/or takeover of nascent passenger car brands in the United States (and elsewhere) in the early 1900s. The same is now happening in modern China – consultancy firm AlixPartners estimates that of the 129 EV brands currently active across the country, only 15 will remain by the end of this decade. McKinsey is only marginally more positive; the belief is fewer than 50 companies will survive beyond 2030.

Manufacturers of BE trucks have encountered many of the same problems faced by new passenger car companies – massive capital requirements and cash burn compounded by difficulty in raising investment funds. From its peak valuation of $30 billion, BE truck OEM Nikola was reported to be losing around $200 million per quarter before it filed for Chapter 11 bankruptcy in February 2025. In the end, the company built fewer than 400 trucks.

Better footing

The Rizon Truck brand was launched at the ACT Expo in Anaheim, California in 2023. The company went on to make its Canadian debut at Truck World in Ontario the following year. First deliveries in the US were made in the US in Q1 2024; the first Canadian handover was completed 12 months later.

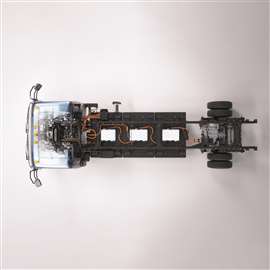

Battery packs positioned within chassis body

Battery packs positioned within chassis body

Unlike other BE vehicle startups, Rizon has a series of advantages working in its favour. The company is the ninth brand of Germany’s Daimler Truck, which alone brings with it some considerable backing (note that Rizon is not part of Daimler Truck North America, a division of Daimler Truck).

Further, Rizon has not needed to invest in development of technology to support its BE truck range. To date, all vehicles sold in the US are versions of the Mitsubishi eCanter, produced in Kawasaki, Japan by Mitsubishi Fuso Truck & Bus (Daimler Truck is the majority shareholder in MFTBC). Vehicles imported into North America are certified and reconfigured for operations in the region.

And there’s more. Instead of a big truck with only meagre single-charge range (Nikola, etc.), Rizon offers a series of Class 4 and 5 vehicles which are ideally suited to operating on shorter routes in any urban/suburban location across the country. This creates a broad potential market which should help support the brand.

Fit for purpose

The current Rizon Truck range comprises six vehicles. The e16M, e18M and e18Mx are fitted with two lithium iron phosphate (LFP) battery packs, while the e16L, e18L and e18Lx use three packs. Respectively, the drivetrains offer maximum energy storage of 74 and 116 kWh which powers a single motor delivering 175 hp/129 kW.

Recharging can use AC or DC connection

Recharging can use AC or DC connection

Recharging can be completed using a CCS1 DC fast charger at up to 104 kW that can replenish packs in about 1.5 hours. The Level 2 J1772 AC connection has a maximum charge rate of 15.4 kW. This can recharge two packs in approximately six hours and three packs in nine hours.

“Range varies depending on the model,” said Michael Carter, spokesperson for Rizon. “It can be between 70 and 105 miles for our e18Mx model and from 115 to 160 miles for our e16L. These range figures were made under standard testing conditions with 50% payload.” He added that range may vary based on a series of factors including environment, battery health and charge level, [energy] recuperation, driving conditions and driving style.”

All models use an e-axle which combines the motor, inverter and gearbox in a single unit which drives the rear wheels. There is also an ePTO outlet for powering auxiliary functions. As Carter stated, the self-contained unit makes it “relatively easy” to change the vehicle wheelbase to accommodate the correct number of battery packs during vehicle assembly.

The chassis can accommodate a variety of bodystyles, including box bodies, refrigeration units, trash collectors, or stake/flatbeds.

Better fit

Michael Carter, Rizon Truck

Michael Carter, Rizon Truck

As noted earlier, fitting a Class 8 truck with a battery-electric powertrain in a country the size of the United States could be seen as somewhat of a mismatch. Unlike this pairing, electric drives are a natural fit for Class 4 and 5 trucks that will be used for short-haul and municipal applications.

“Our trucks are an excellent starting point for businesses and fleets looking to electrify their vehicles and enjoy the benefits which come with that,” said Carter.

To support that, he highlighted the lower running costs of the vehicles. “EVs don’t have engine oil or oil filters, which makes maintenance easier and less frequent. Regenerative braking helps to preserve brake pads and rotors. Electricity rates are typically more stable and cheaper than diesel, which is another big plus.”

It’s understood that cold weather has an adverse effect on battery packs. To help offset this, Rizon vehicles are fitted with a pre-conditioning function which can bring the packs up to temperature while still on charge, helping to save onboard battery power. Carter added that a heated seat and steering wheel are used to reduce dependence on a cabin heater which uses more energy.

Carter, though, is realistic about achieving total cost of ownership benefits: “Reducing an EV’s TCO begins with replacing the right vehicle with an electric equivalent. It requires evaluation of daily range requirements, while ensuring the EV is driven sufficient miles over the year to generate savings on fuel, maintenance and general operations. It’s up to owners to evaluate their use case when considering whether to electrify their operations.”

New - again

Electric vehicles are not new; the earliest examples predate the introduction of the internal combustion engine by some decades. That said, in a world which has come to rely on vehicles powered by diesel engines, the switch to electric power can be daunting for new customers.

Rizon Truck with box body

Rizon Truck with box body

By leveraging existing technology that offers a solution for various customer use-case scenarios, Rizon looks to be in the right place at the right time. That could help to keep the brand viable over the coming years, although there are still hurdles – tariffs on trucks coming into North America from Japan could have a negative impact on retail prices.

There’s also the need to educate the buying public. Carter: “Drivers are still unaccustomed to electric vehicles, particularly commercial units. That makes it important to address questions, provide facts and dispel myths. We want people to know that our trucks not only fit the bill for a range of use cases, but can bring benefits that they didn’t realise.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM