Read this article in Français Deutsch Italiano Português Español

Siemens Energy discusses the growing wave of electrification

12 March 2025

Ampere, the world’s first electric car and passenger ferry, uses a Siemens Energy propulsion system and hydro-powered lithium-ion batteries, saving Norled up to 60% on fuel costs. (Photo: Siemens Energy)

Ampere, the world’s first electric car and passenger ferry, uses a Siemens Energy propulsion system and hydro-powered lithium-ion batteries, saving Norled up to 60% on fuel costs. (Photo: Siemens Energy)

Edward Schwarz, head of Marine Unit Sales, U.S. and Canada at Siemens Energy, started his career working on steam ships in the early 2000s.

“It wasn’t because I was a big fan of steam ships or something. It was just that made up a lot of our domestic fleet – these boats that were built in the ‘50s and ‘60s that operated steam turbines with boilers,” he commented. “And then we had diesel engines.”

Edward Schwarz

Edward Schwarz

Diesel became predominant in newbuild ships back in the 1960s, marking a major transition for the maritime sector. Yet, as Schwarz’s experience indicates, such shifts can take time to be fully realized.

Now, Schwarz believes the industry is in the middle of another transition – one with the potential to be just as significant.

“We’re seeing a shift from conventional diesel mechanical systems to electric propulsion. We’ve had electric propulsion vessels for over 100 years, but it’s becoming more adapted to new types of applications,” Schwarz noted. “Vessels that typically were not electrified before are now looking for electrification.

“Seeing this transition to this new technology – whether we talk about full electric, hybrid-electric or fuel cells, alternative fuels – it’s a major, major shift within the industry,” he continued. “We’re seeing this shift that’s probably not been seen in the industry since the move from steam to diesel.”

Such new technology makes this “a great time to be an engineer within the marine industry,” Schwarz added. Yet, he acknowledged there are plenty of challenges that come with it. As such, part of his role at Siemens Energy is to educate vessel owners about “what’s possible” and to help in the creation of initial designs that not only reduce a vessel’s emissions but improve its safety and reliability, as well.

Small vessels test the waters

Schwarz’s background in the marine industry spans nearly three decades. He began as a shipboard engineer and grew to serve as chief engineer working on U.S.-flagged tankers, container ships and a variety of ocean-going vessels. The last 20 years or so were spent working shore side on the development of safer, more effective propulsion systems.

Schwarz landed at Siemens Energy in September 2024, where he is charged with overseeing the company’s hybridization and electrification efforts. As in other industrial sectors, he said the driving force behind adoption of such technology is decarbonization.

“I think 2% to 3% of global emissions is attributed to the maritime industry, mostly global shipping,” he pointed out. “So, the industry is looking at how to be more responsible, how to continue to move a lot of goods in a very efficient [and] very safe way, but then also reducing this carbon footprint of the industry.”

The Esperanza 'Hope' Andrade ferry, with Siemens Energy's BlueDrive PlusC system, enhances travel for Galveston and Bolivar Peninsula visitors by boosting tourism and reducing wait times with its higher capacity and efficient design. (Photo: The Shearer Group, Inc.)

The Esperanza 'Hope' Andrade ferry, with Siemens Energy's BlueDrive PlusC system, enhances travel for Galveston and Bolivar Peninsula visitors by boosting tourism and reducing wait times with its higher capacity and efficient design. (Photo: The Shearer Group, Inc.)

Virtually 100% of the marine industry is interested in seeing what’s possible with electrification, Schwarz asserted. Yet, while the technology is theoretically scalable to a range of applications, it is not practical or feasible for every vessel. For some, it’s too cost restrictive, and for others the vessel operational profile may not lend itself to the solutions that currently exist.

For example, in cargo ships, the sheer magnitude of the systems needed to travel the distances required, combined with the priority placed on cargo space vs. onboard energy storage, make electrification in its current form largely impractical. On the other hand, a short-distance ferry that moves solely between Point A and Point B readily lends itself to the technology.

While a ferry is small relative to a container ship, its footprint is large in relation to the power required to operate the vessel, said Schwarz. “That gives the opportunity to install a significant amount of energy storage… for that operation,” he explained. “They can have the generators on board for emergency use, but then also be able to fit batteries on board for the regular operations and all the power conditioning equipment and electrical distribution equipment needed to operate that vessel.”

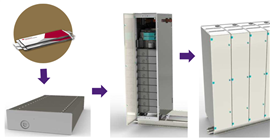

Siemens Energy’s BlueVault lithium-ion battery system is scalable and has been installed on more than 60 hybrid and all-electric vessels worldwide. (Photo: Siemens Energy)

Siemens Energy’s BlueVault lithium-ion battery system is scalable and has been installed on more than 60 hybrid and all-electric vessels worldwide. (Photo: Siemens Energy)

Because such applications are inherently more feasible, the smaller fleet operations within local communities have been leading the push to electrify.

“The really big changes in design usually happen within the companies that have the widest shoulders and deepest teams and investors that can afford to do these kinds of changes,” said Schwarz. “But in the maritime industry it’s unique as we’re seeing that the side of the industry that’s most for change is these smaller vessels. It’s short-distance shipping vessels – locally operated, locally owned. They’re the ones that are… really kind of driving the investigation into electrification.”

Such early adopters are laying the groundwork for those to come. “Companies that are willing to take the risk of integrating new technology, to go through the regulatory process, to go through the extended design period, possibly the additional cost of delivering these vessels to the market – [they are in effect] supporting and kind of developing all the people that will come after them,” Schwarz stated.

“They take the risk to do these first vessels. For me, it’s a personal passion to support them to make sure that they’re successful because they’re pioneering a lot [of these] things.”

From independence to partnerships

As the energy transition in the marine industry progresses, Schwarz expects many companies over the next five to 10 years to reexamine their entire installed power systems.

“It used to be the most appealing vessel to design would be the most independent vessel – a vessel that can do everything independent of any support,” he noted. “You created your own electricity. You had your own sewer treatment system. You created and purified your own water on board. You wanted to limit your dependency on shore side activities as much as possible because it made you super independent, super versatile, and you could control your own destiny within your own design.

“Now what we’re seeing as part of this huge shift in technology, in this effort to decarbonize, is companies are reducing the desire to be as independent as possible, and rather looking at how do they partner with whether it be utility providers in order to provide [electricity] to their vessels and to their fleet, or whether it be integrating in these alternative fuels and new technologies.”

Vessel owners and fleet operators who are moving away from the “microstate” approach will need industry partners to deliver solutions that can ensure their growing dependence on greener shore side energy sources is a decarbonization benefit and not a liability. That’s where Schwarz said Siemens Energy comes in.

“At Siemens Energy, we’re a great partner for doing that full design, that full systems approach, understanding how vessels operate, understanding the needs of the vessels, but then also understanding the utility side and the grid side of these applications,” he asserted. “We’re looking at all the way from the utility who provides the power to the propeller, to supporting that owner in that effort to electrify or decarbonize.”

Schwarz described the company not only as a product company but as a solutions provider – a position he said makes Siemens Energy “uniquely qualified to provide that full-breadth approach when looking at designing new vessels.”

Listen for more insights:

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM