Trendlines: Widening the loader gap

10 May 2021

Compact track loaders such as this Bobcat machine have taken over the number one spot in compact machines from the skid-steer loader.

Compact track loaders such as this Bobcat machine have taken over the number one spot in compact machines from the skid-steer loader.

By Peter T. Yengst

It seems like a daily occurrence – every direction you turn, you see a growing number of irregularities, inequalities and gaps forming all around us. While the writing may be splattered all over the walls and right before our eyes, these changes often occur at a very slow pace and over a long period of time. They can be impossible to see unless you look back and spot the trend as it emerges.

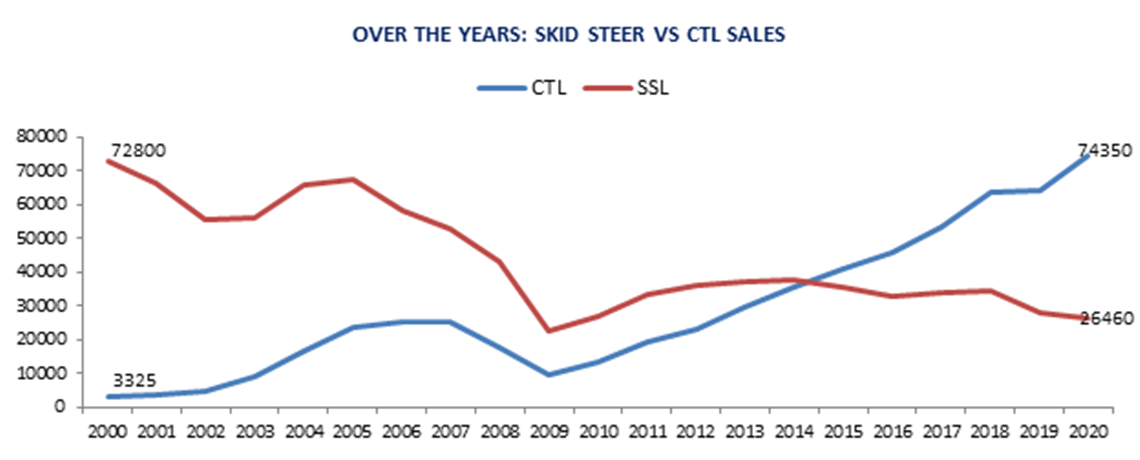

This is true in many areas of life in general as well as some much closer to home, specifically, the growing gap between skid-steer loader and compact track loader (CTL) sales. There is a divergence that has been growing between these siblings over the past two decades that really accelerated during the pandemic.

Let’s take a brief trip back to the early 2000s, where our story of these two compact dynamos really takes shape. We’ve followed skid-steer loaders as far back as the late 1980s, but for the sake of this discussion, let’s focus primarily on when the CTL entered the scene around the year 2000. The skid-steer was well-known and had surged from sales of less than 30,000 units in the late ‘80s to roughly 73,000 units in 2000. A very successful story indeed for all OEMs participating, which included familiar names like Case, New Holland, Gehl, Deere and the market-dominating Bobcat, which accounted for half of annual sales.

CTL’s cool trick

When we started covering CTLs in 2000, sales were a mere 3300 units, less than 1/20th of the skid-steer loader market. Yet it didn’t take long for this new variant to become a hit as it had a cool trick the skid-steer couldn’t match – it didn’t skid. The CTL floated, sometimes gracefully, over certain surfaces the skid-steer dreaded. CTLs enjoyed getting dirty and especially flourished when it came to slick areas and muddy job sites.

The CTL was also more forgiving on loose ground and turf, leaving a smaller footprint than its wheeled sibling. Those attributes gained much attention in short order and sales exploded more than 650% between 2000 and 2006. That success didn’t come at any great detriment to skid-steers, as demand ranged between 50,000 to 60,000 annual unit sales over that same timeframe. The two brothers each had their purpose and loyal following of contractors and landscapers.

Enter the housing crisis and subsequent great financial collapse. Both markets took a staggering hit along with pretty much all other earthmoving machine segments. As the markets began emerging from the rubble, both skid-steers and CTLs climbed their way back. Yet in 2015 it became apparent that the recovery was becoming K-shaped and CTLs took the lead for the first time. Sales of CTLs exceeded 40,000 units compared to 37,000 skid-steers sold that year. From that point, CTLs have never looked back.

CTL gap grows

The Coronavirus added to the growing sales gap, as 2020 sales actually ended up positive for CTLs with a gain of roughly 12% year over year, versus a 7% decline for skid-steers.

Peter T. Yengst is president of Yengst Associates, a market research and consultancy in Wilton, Conn. www.yengtassociates.com mail@yengstassociates.com

Peter T. Yengst is president of Yengst Associates, a market research and consultancy in Wilton, Conn. www.yengtassociates.com mail@yengstassociates.com

As of today, CTLs command nearly three times the sales volume of the skid-steer market. Together, both had a combined sales total of over 100,000 units in 2020, a silver lining considering the bloodbath the rest of the markets endured.

Over the years, Bobcat has reigned supreme in both the skid-steer and compact track loader markets, so the shift has been a win-win situation for the top dog (or cat). Other major CTL suppliers include Caterpillar, Kubota, Deere, Takeuchi, Manitou and ASV.

We expect skid-steers to maintain a firm position with tens of thousands of annual unit sales, but the machine that spawned the CTL 20 years ago will never see the No. 1 spot again.

Similar evolutions have taken place in automobiles, and even more recently, with the advent of electric vehicles after more than a century of internal combustion power, where it also could take some time to see the true divergence take place.

Trendlines is a column devoted to the off-highway equipment markets that appears each month in Diesel Progress. For a free print or digital subscription, click here.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM