2025 forecast: machine markets rebalance as headwinds bite

22 December 2024

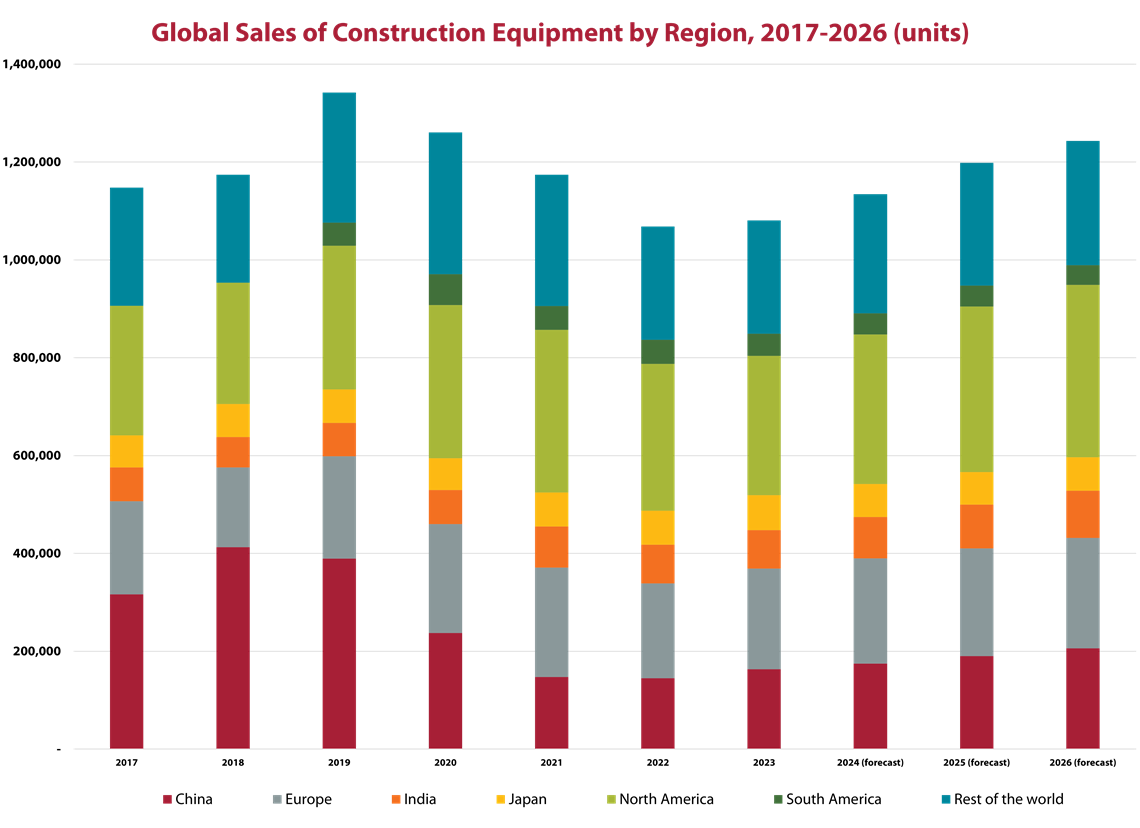

While underlying reasons vary, global regions are facing a readjustment in machine sale volumes.

The global construction equipment market is readjusting from the unsustainably high sales of the pandemic years. While volumes around the world are still good, high interest rates are now making it a more painful slowdown.

Pick any country in the world and at some point between the Covid years of 2021 and 2023 it probably enjoyed record sales of construction equipment. Market conditions continued to be good for most countries until at least mid-2023, with the main exception being China which experienced a sharp downturn in 2022 due to the bursting of the real estate bubble.

Troubles in China meant the global market fell 6% in 2022 and 7% in 2023, but it remained the only major market with problems at that point. The world excluding China reached its high tide marker in 2023.

Changing Market

Conditions have now changed. Key features of the pandemic years were stretched supply chains and logistics bottlenecks which meant the supply of finished machines could not keep up with demand. That led to a spike in inflation, which resulted in central banks pushing up interest rates to combat the problem.

Source: Off-Highway Research

Source: Off-Highway Research

Inflation is now much more under control, yet interest rates are not falling quite so rapidly. Which, dependent on your view, is either an attempt to avoid reheating markets or simply old generals still fighting the last war when they should be looking to address the new foe of weak economic growth.

In the context of construction and construction equipment, high interest rates have caused a double whammy. The increased cost of borrowing has had a direct impact on housebuilding around the world. Although many countries have a housing shortage, activity is falling as the higher cost of mortgages has priced some potential buyers out of the market.

The second impact of high interest rates (and the expectation that they will come down in the short- to medium term) is that equipment buyers are putting off purchases until the cost of finance is more reasonable.

Both factors might be contributing to a certain amount of pent-up demand for equipment, but if that is the case, the rebound is somewhere on the horizon. For the moment the industry is simply feeling the slowdown.

Regional Performance

Europe - Interest rates and the housing market are key issues in Europe and the situation has hit the compact equipment segment particularly hard. Mini excavators represent the highest volume product in Europe and their sales are expected to decline 18% in 2024. That equates to more than 15,000 units, or half the fall in total equipment sale volumes from 2023 to 2024.

Although some improvement is expected in late 2024, total equipment sales in Europe are expected to drop 14% this year.

North America - The region enjoyed a third consecutive year of record equipment sales in 2023, with a 6% increase taking the volume of machines sold to 332,396 units.

The market is widely expected to fall 10% this year as demand cools due to higher interest rates. There has also been uncertainty ahead of the presidential election, with buyers holding off on purchasing until the policy agenda for the next four years is clear.

However, even if sales fall by the 10% forecast, it will still be the third best year in the market’s history in terms of machines sold. Key to this is a soft landing for the housing market, with the single-family new build segment trending upwards after cooling in 2023.

Japan - The 7% rise in Japan’s equipment market last year was an unusually steep one for the country. It is more common to see demand move by one or two percentage points per year.

There was some hope at the start of the year that the positive momentum form increased spending on public works would be carried over into 2024. However, that has not been the case in the year to date, and the market is expected to be flat as a result.

India - With its 21% in equipment sales, 2023 was the year that the Indian market finally bounced back. The previous high water mark was in 2018, when sales totalled almost 81,000 units. Demand fell in 2019 due to the disruptive effect of the general election and the following three years were blighted by the pandemic.

Last year’s steep rise took demand to a record high of nearly 84,000 units, 4% above the previous record volume seen five years earlier.

Although this year there was also a general election, which always disrupts the market, the downturn was not as long or as deep as had been previously anticipated. Another helpful factor this year is that new engine emission standards will come into force at the start of 2025, which could drive pre-buy activity towards the end of this year. As a result, the downturn in the India market is forecast to be limited to 6% this year.

South America - After strong growth during the pandemic, the construction equipment market in South America declined 21% in 2023 to 48,789 units.

The historic context to this is that 2022 sales represented a record high for a market which had been unnaturally weak for almost a decade. Brazil is the economic powerhouse of the region, but was severely weakened over the 2010s by the Petrobras bribery scandal. Even though some of the region’s smaller markets developed well during this period, their growth was not enough to offset the depression in Brazilian construction equipment sales.

The forecast for this year is for a 1% increase in sales across the region. Brazil is expected to enjoy a modest rebound, while slight growth is expected in Chile and Peru. Colombia will see a further readjustment back to more sustainable levels. The only bad news will be in Argentina, where extremely high inflation is expected to pull the market down by more than 40%.

China - Meanwhile, the China market continues to march to the beat of a different drum. After two years of abnormally high sales in 2020 and 2021, the national market collapsed in 2022 with a 39% decline. This was due to stimulus money running out, but also turbulence in the Chinese real estate sector and the Covid pandemic. The market dropped a further 38% in 2023 due to falling prices and mounting bad debt in the real estate segment.

A further 5% decline is expected in 2024. This, though, essentially signifies the market bottoming out and is arguably the best-case scenario for the country. That said, more insolvency among property developers could push the equipment market down even further.

Air quality and carbon emissions are both big issues in China. There is a clear desire to replace polluting machines with either all-electric equipment or diesel machines at the highest standard (China IV). This will help, but volumes in China will remain unnaturally low (albeit improving) while other problems are addressed.

Elsewhere in the world, commodity prices tend to drive what happens in the market. As a result, equipment sales are slowing from the highs seen in the pandemic years, but volumes are still good.

Add all this together and the global construction equipment market will bottom out this year and next before returning to a growth phase. That upswing should take sales back past record numbers set in the pandemic years, but with with added sustainability.

Editor’s note: this article originally appeared in the October - December 2024 issue of Power Progress International.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM