Read this article in 中文 Français Deutsch Italiano Português Español

2025 forecast: solid foundation for on-highway, but uncertainty ahead

23 December 2024

Potential changes in trade policies and regulations add to uncertainty in the commercial vehicle outlook.

Ahead of 2025, the U.S. economy remains resilient with steady, above-trend growth, gradually slowing inflation and a cooling labor market. With ongoing healthy income growth, consumer spending continues to beat expectations, supporting the broader economy despite still restrictive interest rates and high price levels constraining interest-sensitive sectors. The Fed’s inflation-fighting efforts have slowly provided results, finally allowing a shift away from inflation fighting towards more balanced monetary policy.

Ken Vieth is president and senior analyst for ACT Research, a publisher of commercial vehicle truck, trailer and bus industry data, market analysis and forecasts for the North America and China markets.

Ken Vieth is president and senior analyst for ACT Research, a publisher of commercial vehicle truck, trailer and bus industry data, market analysis and forecasts for the North America and China markets.

Despite the start of Fed rate cuts, Treasury yields have risen, creating renewed risk in rate-sensitive sectors. Bond yields rose in the run-up to the election – suggesting an expectation that a second Trump term would be inflationary. Those higher Treasury yields have driven up mortgage rates, adding to downward pressure on the housing market and across housing-related industries. Similarly, rising borrowing costs could delay a manufacturing sector recovery, where capital is crucial for funding investment and maintaining competitiveness.

As a result, both sectors may experience weaker demand, resulting in a potential drag on the broader economy. Despite the setback, Fed rate cuts are expected to continue.

Trade Policy Risks

The impending Trump presidency brings economic uncertainty. In regaining the presidency and securing control of Congress, the Republican Party has wide latitude to implement Trump’s vision. We expect the new Congress to quickly move to cut taxes and boost spending.

We don’t know how, or if, campaign rhetoric translates into policy, but we see three items that are likely to negatively impact the medium-term outlook:

- Tariff policy: Tariffs mean higher prices, so inflation. Counter tariffs would pressure U.S. exporters. Global supply chain disruption risk.

- “Mass deportations”: The U.S. economy is labor constrained, so less labor and the chilling effect of regressive policy. Likely inflationary.

- Fed independence: A weaker dollar and higher interest rates would be likely outcomes of political interference in monetary policy. Inflationary.

The threat of tariffs is already buoying import demand as U.S. import buyers pull shipments forward. U.S. exporters’ customers are likely getting in front of their countries’ retaliatory tariffs.

Source: ACT Research Co.

Source: ACT Research Co.

Importantly, these factors change the timing of demand, pulling freight forward, but aggregate demand. We do not know the timing or level of tariffs, but as an example, a pull-forward lasting through first half 2025 (1H’25) would trigger a payback period later in the year, setting up conditions for freight volumes to contract in late 2025 or early 2026.

While the U.S. economy remains robust, it faces substantial risks and uncertainties. A more gradual Fed easing and higher Treasury yields may constrain growth in interest-sensitive sectors, while Trump’s tax and trade policies could actually strengthen near-term results, even as they reverse progress on inflation and widen fiscal deficits.

With that caveat, ACT’s expectations for 2025 currently call for a modest slowdown in growth to more trend-type levels. After projected growth of 2.7% in 2024, we expect GDP to moderate to a 2.0% rate in 2025.

After contracting across the end of 2022 and into early 2023, activity in the economy’s freight-generating sectors continues to grow faster than the overall economy. After projected 3.3% growth in 2024, ACT’s Freight Composite (Fig. 1), a freight-weighted GDP proxy, is projected to grow 2.5% in 2025.

Regulatory Uncertainty

While not 2025-specific events – at least not exactly – a more hostile-to-regulation Republican Party is taking the reins of power in late January at a time when significant regulations are inbound. Decisions made about upcoming regulations are consequential for the industry in both the short and long term.

Source: ACT Research Co.

Source: ACT Research Co.

ACT’s current forecasts assume that the U.S. Environmental Protection Agency’s (EPA) Clean Truck and GHG-3 regulations will take place. With the Republican sweep of power, and with the Supreme Court’s Chevron decision as a second avenue of threat, a compelling case can be made that the EPA’s aggressively ambitious and technology-forcing GHG-3 regulation will either be repealed or re-envisioned.

Even as we believe GHG-3 aspirational targets will change, we believe the already impactful 2027 EPA Clean Truck regulation is likely to be stickier. Deep into the fifth year of a seven-year process, and after considerable industry investment, 2027-compliant engine technology is coming to market in 2025, so clearly a top-of-mind consideration for the industry. The regulation was promulgated during the first Trump administration, and we would assume that influential presidential advisor Elon Musk would favor a regulation that makes diesel engines simultaneously more complex and expensive.

Source: ACT Research Co.

Source: ACT Research Co.

While these reasons make us inclined towards this regulation’s survival, one compelling counter argument is that it took a Joe Biden veto two summers ago to stop Congressional action to repeal the mandate. From a forecast timing perspective, this is an existential question: If the EPA’s Clean Truck regulation goes down, the pre-buy thesis boosting demand into 2026 disappears, returning vehicle demand to market-based levels.

With a young fleet, heavily stocked inventories and low carrier profits today, the removal of the pre-buying incentives would flip 2026 from “pre-buy” to “payback.”

Ongoing On-highway Overcapacity

We have finally started to see improvement after a 10-quarter freight downturn. There remains very little coil in the spring of demand, as unhealthy levels of Class 8 tractor sales into private fleets prolong the downturn in for-hire freight rates.

Source: ACT Research Co.

Source: ACT Research Co.

The two freight-related graphs illustrate where the freight market is at present. The first graph (Fig. 2) illustrates DAT’s spot freight rates and the rate’s y/y performance. As illustrated, DAT freight rates (black line) in early November were essentially unchanged from where they were at the end of Q1’23, an eight-quarter bottom. Positively, rates have inflected to positive in August and are now up 7% y/y.

Rates determine carrier profitability. Truckers buy more equipment when they are making money. The second chart (Fig. 3) illustrates the relationship between for-hire carrier profitability and U.S. Class 8 tractor production. As illustrated, the spread between the black line (carrier profits) and the red line (tractor builds) was at a near-record negative in Q3’24. While still dismal, after falling to a 14-year low in Q2, margins rose 70bps q/q to 3.8%.

As guidance, 4% net profit margins correspond to a 140,000-150,000 unit market, in line with ACT’s current U.S. tractor forecasts at around 150,000 units.

Commercial Vehicle Markets

In an unusual turn of events, segments within the medium-duty (MD) Classes 5-7 and heavy-duty (HD) Class 8 markets are counter cycling in our forecast, leading to a shallow-by-historical-standard downturn in 2025.

Source: ACT Research Co.

Source: ACT Research Co.

In the Class 8 market, vocational truck demand is poised to rise to generational-best levels next year, even as tractor market fundamentals drive an overdue sales correction in the U.S. and Canada. In the MD market, pent-up demand and electrification continue to drive robust Classes 6-7 school bus demand, while strong build rates and body-builder constraints have created record inventories. Interest rates continue to weigh on MD RV demand.

Medium-duty market: Classes 5-7 are simultaneously strong and fragile as build rates outstrip both order and sales levels, resulting in shrinking order backlogs and rising inventories.

While inventory accumulation is occurring across the board (Fig. 4), the worst of the accumulation is coming in the pickup-based Class 5 segment. According to anecdotes, the challenge in the accumulation of MD inventory has been ongoing supply constraints at truck bodybuilders who have not been able to ramp their capacity at the same speed as the OEMs or manufacturing supply base.

A big assumption in our 2025 MD forecast is that the industry will slow production to tackle the inventory problem. Seeing orders slow into the end of 2024 supports ACT’s thesis. If we are wrong in our inventory correction assumption, industry build is likely to be higher than we currently expect.

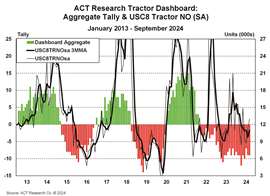

Heavy-duty market: ACT Research maintains a “Tractor Dashboard” (Fig. 5) based on 15 variables ranging from macro-economic to freight to industry indicators. In Q2, the Dashboard averaged -10.3, improving to a “less worse” -8.7 in Q3.

Based on this collection of data points, U.S. tractor demand in 2024 has defied fundamentals in a market marked by bottom-scraping freight rates and collapsed carrier profitability. Shallow weakness in the economy’s goods-producing sectors, ongoing tractor overcapacity pressuring freight metrics and industry imbalances conspired to keep the Dashboard signaling at unhealthy levels.

Source: ACT Research Co.

Source: ACT Research Co.

The bright spot in the Class 8 market is vocational equipment. U.S. industrial policy and infrastructure spending stimulus plans have manufacturing and private construction expenditures running at record levels. And much of the ~$2 trillion in stimulus (CHIPS, IRA, IIJA) put in place in 2021 and 2022 continues to be deployed into the economy, providing healthy tailwinds into 2026.

With well-supported end markets and technology-forcing regs on the horizon, vocational truck buyers not only have a willingness to get a head start on fleet refreshment, but importantly, the ability to do so.

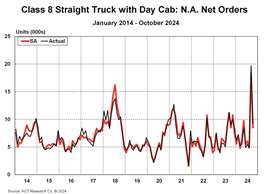

Combined with September’s record orders, it appears that backlog queuing for 2026 (EPA’27) and 2028 (GHG-3 HD vocational) appears likely. With tractor demand suspect, vocational truck production should continue to surge into 2025 (Fig. 6).

Forecasts

The U.S. economy remains resilient and freight demand is broadly supported, with growing retail sales, durable goods spending, imports, cross-border Mexico shipments, intermodal volumes and inventory stocking expected to accelerate.

Freight rates (y/y) have been up low- to mid-single digits the past few months, suggesting a new freight cycle is beginning even as carriers work through this overcapacity. Private fleet insourcing is expected to end in 2024, generating lower tractor volumes as supply and demand are right sized in 2025.

With the EPA’s 2027 Clean Truck mandate looming, the market does not fully correct before 2027 as truckers and dealers pull demand forward into 2026 to avoid a very expensive mandate. Without direct guidance from the Trump administration on their plans for the regulation – whether it is kept, killed or adjusted – our forecast assumes the status quo.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM