Read this article in 中文 Français Deutsch Italiano Português Español

Trendlines: Twisted tariff impacts

04 June 2025

April’s tariff announcements threw long-established trading relationships into a tailspin, as companies sought to understand the impacts and do all they can to mitigate them. While the intention is to discourage imports into the U.S. and give a leg up to domestic manufacturers, the reality is that supply chains for manufactured goods are global, so U.S.-based producers will be facing increased input costs and will be working hard to minimize them.

The foreign content of goods will always vary from product to product and manufacturer to manufacturer, so it is not possible to make a blanket statement about how much the tariffs will increase costs for U.S. producers. However, this is something that can be modeled.

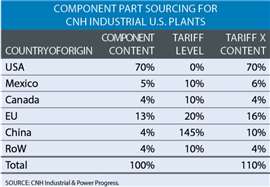

An interesting example was given by CNH Industrial in its first quarter investor relations presentation, where it gave an outline example of its U.S.-made equipment. Although these would certainly be regarded as American machines, the company revealed that about 30% of components are sourced from outside the U.S.

Taking the figures that CNH supplied and applying the announced tariffs reveals that the cost of producing this equipment could go up 10% if the company can’t do anything to mitigate the tariffs (sourcing from less heavily taxed countries, or from within the U.S.). (See table – the percentage component content by country is provided by CNH, while the assumptions about tariff levels and their cost impact is from Power Progress.)

That simple exercise highlights the priority areas. In this case, the combination of volume and content sourced from China and the EU would have the biggest impact on input prices.

A global reality

But life is never that simple. Although there is no tariff on U.S.-sourced components, the suppliers of those items will almost certainly be sourcing the materials they need from around the world.

At the most reductive, it absolutely will not be the case that every atom of an “American” component will have been extracted from within U.S. borders and spent its life within the supply chain inside those borders. At some point, constituent parts of components come into the country (and perhaps cross the border many times) at which point the importer will have to pay a tariff.

As a thought exercise, assume U.S. components have the same content by origin as the finished machine (70% U.S., 30% from other countries, including EU and China), then over time the tariffs will push the cost of those components up by the same 12%. That would translate to adding a further 8% to the cost of the finished goods.

The reality of global supply chains leads on to the unintended and unfortunate outcomes in terms of the policy objective. If for example an American-made component had more than 8% Chinese content, the 145% tariff on those parts when imported would translate to a 20% increase in the cost of the component. It would therefore be compelling to source exactly the same component (with exactly the same amount of Chinese content) from Mexico and take just a 10% tariff hit.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM