2025 forecast: market bounce

22 December 2024

Declines over the second half of 2024 should be reversed over 2025 as stability supports machine sales rebound.

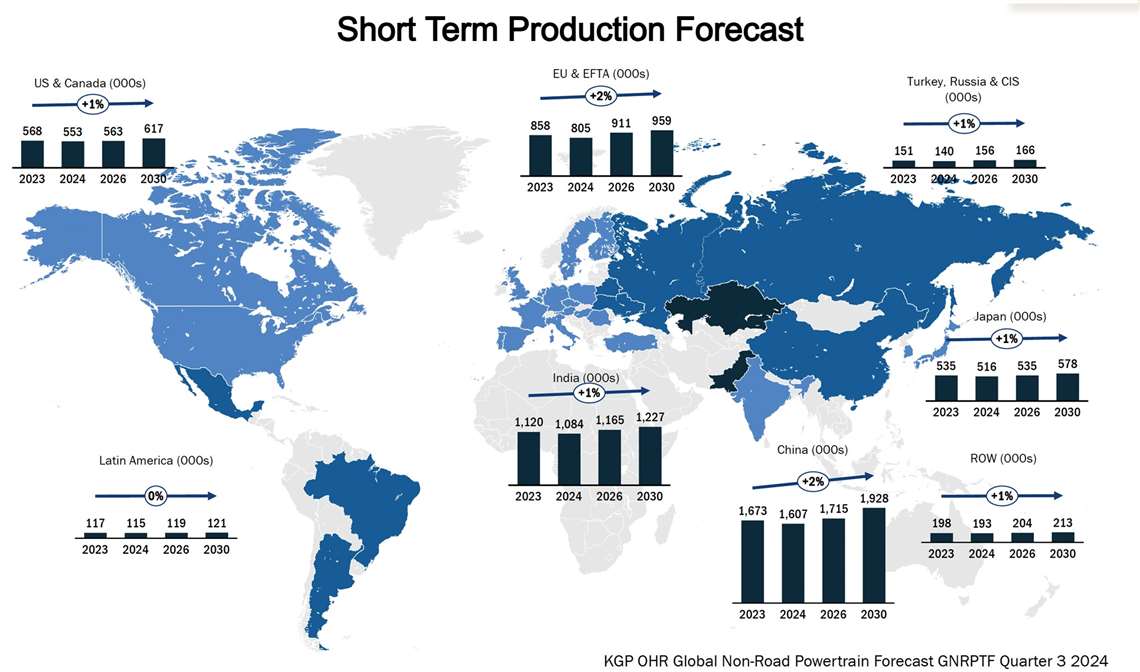

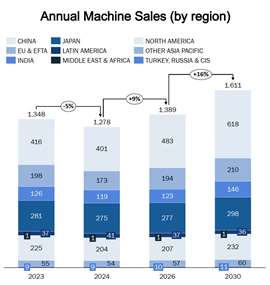

Despite a strong first half of 2024, which might have resulted in a slowdown over the latter part of the year, production of machinery across the agriculture, construction and materials handling sectors has remained robust. However, the second half of the year has seen the sales market worsen, although varying by market and segment. As such, all major markets are expected to see reduced production in 2024 compared to 2023, with volumes remaining flat into 2025 before resuming growth in 2026.

Alex Woodrow, is managing director of the off-highway technology consultancy Knibb, Gormezano and Partners (KGP) Email: [email protected] Phone: +44 (0)1332 856301

Alex Woodrow, is managing director of the off-highway technology consultancy Knibb, Gormezano and Partners (KGP) Email: [email protected] Phone: +44 (0)1332 856301

The forecast for Q3 2024 has been revised downwards from -2.2% in Q2 to -4.0% for the full year 2024. While the growth outlook for 2025 remains unchanged, overall production is anticipated to be approximately 100,000 units lower than previously expected in Q2. However, Q3 growth is projected to be higher in 2026, with forecasts converging at 5.37 million units.

Most markets have experienced slight downgrades in their forecasts, with European construction equipment production and Japanese agricultural machinery output being the key market sectors/regions negatively impacting the short-term outlook. Stakeholders have conveyed a narrative of strong fundamental drivers but low demand through 2024 and into early 2025.

Negatives:

- Construction activity, particularly residential, remains weaker than expected due to persistently high interest rates.

- Agricultural commodity prices are historically strong, but high input costs and poor yields are limiting farmers’ purchasing power.

- A high number of machines in the fleet following Covid stimulus means purchasing decisions can be postponed without significant business impact.

Positives:

- Infrastructure and the global need for housing will drive construction activity and provide a strong foundation for growth.

- Financial markets are stabilizing, inflation falling, which means a more assured outlook. However, decision makers may wait for reduced interest rates, possibly in 12 to 18 months. Population growth, protein-rich diets and less arable land make investment in agriculture a priority for policymakers.

- 2024 marks the third consecutive year of decline in the non-road sector, which should be the bottom of the trough. While fundamental drivers remain strong, short-term headwinds and an excess of machines in the fleet are causing a 12 to 18 month delay in prime purchasing conditions.

Source: Knibb, Gormezano and Partners. KGP OHR Global Non-road Powertrain Forecast, Q3 2024.

Source: Knibb, Gormezano and Partners. KGP OHR Global Non-road Powertrain Forecast, Q3 2024.

Source: Knibb, Gormezano and Partners

Source: Knibb, Gormezano and Partners

Regional Round Up

The outlook for agricultural machine output in 2024 has been slightly downgraded, from -3.3% in Q2 to -5.5% in the Q3 2024 forecast, primarily due to production downturns in Japan and Latin America. The forecast for construction equipment has also been moderately downgraded to -5.2%, compared to -3.4% in Q2.

China has seen a slight improvement in its outlook due to fiscal policies, including a scrappage scheme for non-road equipment and significant investments in infrastructure and energy grids. Notably, China installed the greatest amount of renewable energy equipment in 2024 compared to any other country, although it also increased capacity in coal and gas power stations. The forecast for China is -3.6% for 2024, up from -4.1% in Q2.

The EU and EFTA region is one of the hardest-hit markets in the Q3 outlook, with production estimates for 2024 revised to -12.4% from -5.5% in Q2, resulting in the lowest production levels seen to date. Output is expected only reach 173,000 units for the full year 2024. Economic challenges and an excess of machinery in the fleet are dampening demand, but strong fundamental drivers are expected to drive a robust recovery towards the end of 2025.

Japanese and Korean production levels have fallen in the Q3 outlook, switching from slight growth to slight decline. This is primarily due to reduced exports to North America and Europe and increased competition from China OEMs in the compact construction equipment space. Both countries also experienced domestic demand downturns. Production volumes are expected to recover strongly in 2025 as uncertainty reduces.

Source: Knibb, Gormezano and Partners

Source: Knibb, Gormezano and Partners

Engine Market

Engine production below 56 kW in the agricultural sector is dominated by captive supply, accounting for approximately 69% of total production in 2024. Limited opportunities for greater non-captive share are expected from new China State IV and Bharat Stage V emissions legislation. Engine supply above 56 kW has a greater non-captive supply, approximately 45%. For example, AGCO plans to add a sub-4.0 L engine to its CORE engine range. Battery electric operation is more challenging above 56 kW, with hybridization being the optimal path for decarbonization.

In Japan, poor rice yields and subsidy policies based on reduced production output have left many farmers over-exposed to volatile pricing. In Latin America, adverse weather events and high sales in previous years have led operators to hold onto machinery longer than usual. The agricultural commodities market is entering a period of relative stability, which is much needed after several years of high volatility resulting in severe market shocks. Food prices have been relatively stable through most of 2024, with food inflation falling to acceptable levels in most markets.

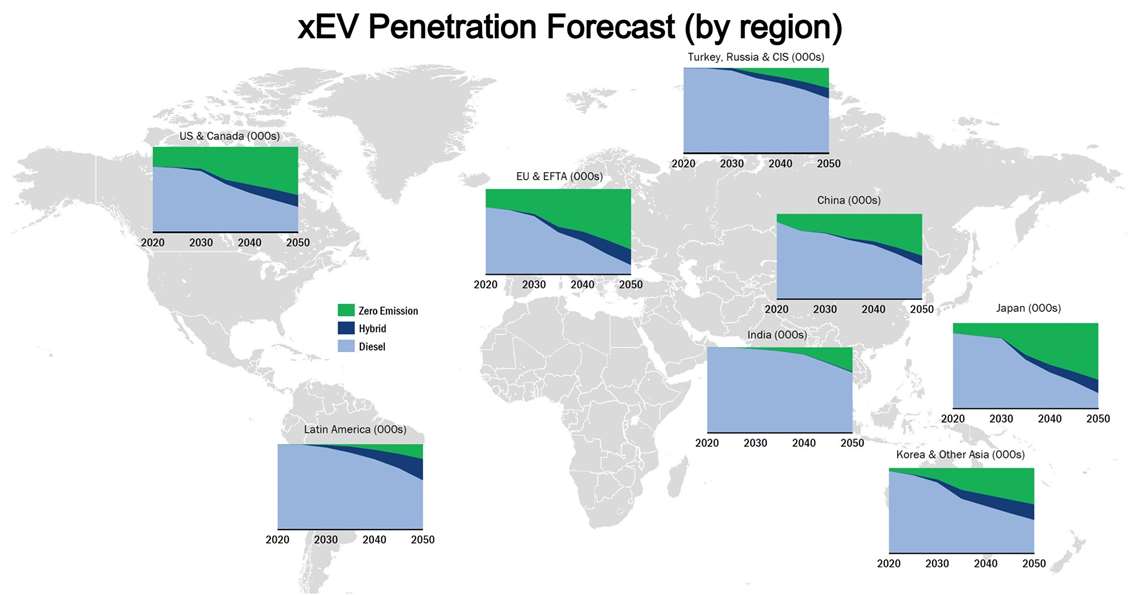

Supply and Tech

Supply chain challenges and extended lead times for new machines have resulted in a rapid downturn across OEM order books, which has had a knock-on impact across the supply chain. As for new tech, in the short term at least, electric machine sales volumes are not significantly impacting sale of combustion engine versions due to minimal legislation and limited availability, further compounded by infrastructure concerns. This may change with upcoming legislation in California, Tier 5, and its PACE regulation aimed at driving electric machine uptake across machine markets.

Editor’s note: this article originally appeared in the October - December 2024 issue of Power Progress International.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM