FTC looking at ExxonMobil, Pioneer merger deal

06 December 2023

Federal agency was urged to investigate by U.S. senators

ExxonMobil’s plan to acquire Pioneer Natural Resources for $60 billion is being probed by the Federal Trade Commission.

Pioneer made the disclosure in a filing with the Securities and Exchange Commission (SEC).

“On December 4, 2023, Pioneer and ExxonMobil each received a request for additional information and documentary materials (a “Second Request”) from the Federal Trade Commission (FTC) in connection with the FTC’s review of the merger,” Pioneer stated. “The effect of a Second Request is to extend the waiting period imposed by the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), until 30 days after each of Pioneer and ExxonMobil has substantially complied with the Second Request issued to it, unless that period is extended voluntarily by the parties or terminated sooner by the FTC. Completion of the merger remains subject to the expiration or termination of the waiting period under the HSR Act and the satisfaction or waiver of the other closing conditions specified in the Merger Agreement. Pioneer and ExxonMobil continue to work constructively with the FTC in its review of the Merger and continue to expect that the Merger will be completed in the first half of 2024, subject to the fulfillment of the closing conditions, including receipt of required regulatory approvals and approval of Pioneer’s stockholders.”

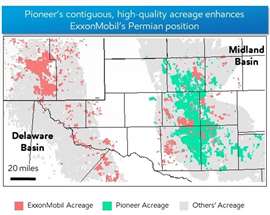

The merger would combine Pioneer’s more than 850,000 net acres in the Midland Basin with ExxonMobil’s 570,000 net acres in the Delaware and Midland Basins, creating the industry’s leading high-quality undeveloped U.S. unconventional inventory position. Together, the companies will have an estimated 16 billion barrels of oil equivalent resource in the Permian. At close, ExxonMobil’s Permian production volume would more than double to 1.3 million barrels of oil equivalent per day (MOEBD), based on 2023 volumes, and is expected to increase to approximately 2 MOEBD in 2027.

ExxonMobil said the transaction represents an opportunity for even greater U.S. energy security by bringing the best technologies, operational excellence and financial capability to an important source of domestic supply, benefitting the American economy and its consumers.

The FTC’s action comes just over a month after 20 U.S. senators, led by Majority Leader Chuck Schumer (D-N.Y.), sent a letter asking the department to investigate industry merger plans.

“We write regarding our concerns about two blockbuster oil-and-gas deals announced in October: ExxonMobil’s (Exxon) proposed $60 billion acquisition of Pioneer Natural Resources (Pioneer) and Chevron’s proposed $53 billion acquisition of Hess Corporation (Hess)– two of the largest oil-and-gas deals of the 21st century,” the letter states. “By allowing Exxon and Chevron to further integrate their extensive operations into important oil-and-gas fields, these deals are likely to harm competition, risking increased consumer prices and reduced output throughout the United States. At the regional level, the deals threaten to harm small operators and suppress wages. The Federal Trade Commission (FTC) must carefully consider all of the possible anticompetitive harms that these acquisitions present. Should the FTC determine that these mergers would violate antitrust law, we urge you to oppose them.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM