Eaton’s record Q4 promotes positive full year results

09 February 2023

Eaton Corp. saw its sales for full year 2022 increase to $20.8 billion, up 6% from 2021. The sales increase consisted of 13% growth in organic sales and 3% growth from acquisitions, which was partially offset by 7% from the divestiture of the Hydraulics business and 3% from negative currency translation, the company reported.

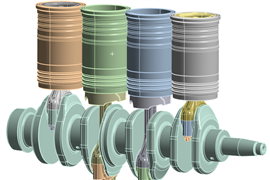

Sales for the eMobility segment in Q4 2022 were $139 million, up 58% from Q4 2021. (Shown is an Eaton four-speed, medium-duty electric vehicle transmission.)

Sales for the eMobility segment in Q4 2022 were $139 million, up 58% from Q4 2021. (Shown is an Eaton four-speed, medium-duty electric vehicle transmission.)

Full year growth was aided by record performance in the fourth quarter of 2022. Sales in Q4 were $5.4 billion, up 12% from the fourth quarter of 2021.

By business segment:

- Sales for the Electrical Americas segment were $2.3 billion, up 20%, driven entirely by organic sales growth. Sales for the Electrical Global segment were flat at $1.4 billion.

- The Vehicle segment posted sales of $707 million, up 16% compared to the same period in 2021.

- Sales for the eMobility segment in Q4 2022 were $139 million, up 58%. However, the segment recorded an operating loss of $2 million, reflecting continued investment in research and development and start-up costs associated with new program wins, the company noted.

- Aerospace segment sales were $812 million, up 7% for the quarter.

“We closed 2022 by delivering another quarter of record results and positive momentum,” said Craig Arnold, Eaton chairman and CEO. “Tailwinds for our performance included strong demand across many of our end markets, robust order growth and continued upward trends in organic growth.

“I’m proud of our performance in 2022, including record profits, margins and adjusted earnings per share. These positive results highlight our ability to weather economic uncertainties by maintaining focus on our strategy.”

Eaton’s outlook for full year 2023 is for organic growth of 7% to 9% and adjusted earnings per share to be between $8.04 and $8.44, up 9% at the midpoint over 2022. For the first quarter of 2023, the company anticipates organic growth of 8% to 10% and adjusted earnings per share to be between $1.72 and $1.82.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM