EIA Predicts Slow Down In Gas-Fired Power Plants

20 January 2020

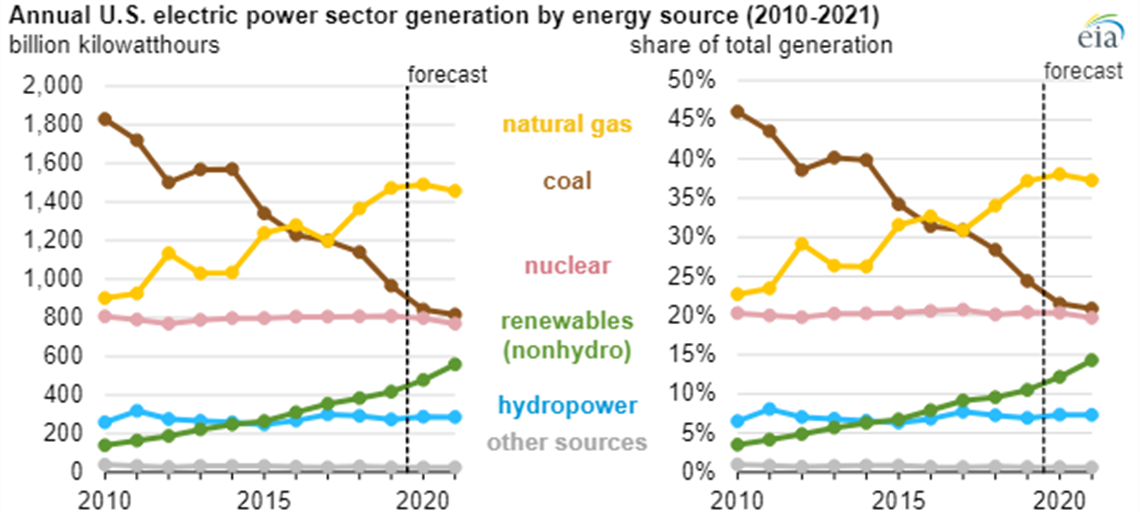

The U.S. Energy Information Administration (EIA) forecasts that electric power generation from natural gas-fired power plants will grow by just 1.3% in 2020—the slowest growth rate since 2017.

The EIA’s Short-Term Energy Outlook forecasts that generation from non-hydropower renewable energy sources, such as solar and wind, will grow by 15% in 2020—the fastest rate in four years. Forecast generation from coal-fired power plants declines by 13% in 2020.

During the past decade, the electric power sector has been retiring coal-fired generation plants while adding more natural gas generating capacity. In 2019, EIA estimates that 12.7 GW of coal-fired capacity in the U.S. was retired, equivalent to 5% of the total existing coal-fired capacity at the beginning of the year. An additional 5.8 GW of U.S. coal capacity is scheduled to retire in 2020, contributing to a forecast 13% decline in coal-fired generation this year. In contrast, EIA estimates that the electric power sector has added or plans to add 11.4 GW of capacity at natural gas combined-cycle power plants in 2019 and 2020.

Generating capacity fueled by renewable energy sources, especially solar and wind, has increased steadily in recent years. EIA expects the U.S. electric power sector will add 19.3 GW of new utility-scale solar capacity in 2019 and 2020, a 65% increase from 2018 capacity levels. EIA expects a 32% increase of new wind capacity—or nearly 30 GW—to be installed in 2019 and 2020. Much of this new renewables capacity comes online at the end of the year, which affects generation trends in the following year.

EIA expects 1.0% less total U.S. power generation in the electric power sector during 2020 than in 2019. Electric power sector generation in the forecast falls by an additional 0.3% in 2021. Electricity produced by combined-heat-and-power generators in the industrial and commercial sectors will grow by 1.9% in 2020 and 2.9% in 2021.

Forecast generation mix varies in each of the 11 STEO electricity supply regions. A large proportion of the retired coal-fired capacity is located in the mid-Atlantic area. EIA forecasts that coal generation in the mid-Atlantic will decline by 37 billion kilowatthours (kWh) in 2020. Some of this decline is offset by more generation from mid-Atlantic natural gas-fired power plants; EIA expects generation from these plants to grow by 23 billion kWh.

In the Midwest, where the Midcontinent ISO (MISO) manages electricity, EIA expects coal generation to fall in 2020 by 33 billion kWh. This decline is offset by an increase in natural gas electricity generation (12 billion kWh) and by non-hydropower renewable energy sources (13 billion kWh). The regional increase in renewables is primarily a result of new wind generating capacity.

The electric power sector in the area of Texas managed by the Electrical Reliability Council of Texas (ERCOT) is planning to see large increases in generating capacity from both wind and solar. EIA expects this new capacity will increase generation from non-hydropower renewable energy sources by 24 billion kWh this year. EIA expects the increased ERCOT renewable generation will lead to a regional decline of natural gas-fired generation and coal generation of 14 billion kWh for each fuel source in 2020.

EIA expects these trends to continue into 2021. EIA forecasts U.S. generation from non-hydropower renewable energy sources will grow by 17% next year as the electric power sector continues expanding solar and wind capacity. This increase in renewables, along with forecast increases in natural gas fuel costs, contributes to EIA’s forecast of a 2.3% decline in natural gas-fired generation in 2021. U.S. coal generation in 2021 is forecast to fall by 3.2%.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM