Q2 Sales Fall 14% For Volvo Construction Equipment

17 July 2020

Impact of COVID-19 partially offset by a strong rebound in the key Chinese market

The negative effects of the COVID-19 pandemic on society and economic development characterized Volvo Construction Equipment’s (Volvo CE) second quarter results, the company said in an announcement. Weak demand in Europe and North America was partially offset by a strong rebound in the Chinese market, the world’s largest. Despite lower demand impacting sales profitability held up well during the period.

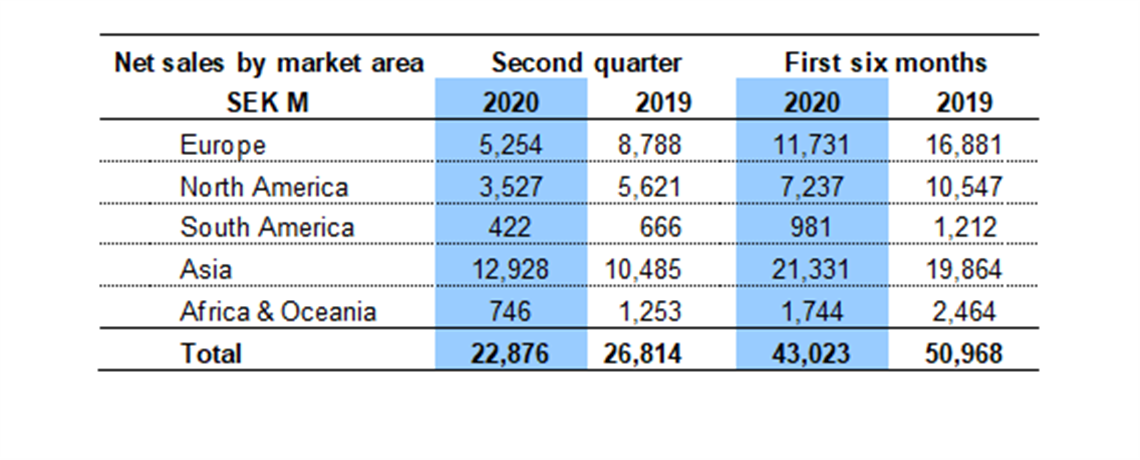

Adjusted net sales in the second quarter decreased by 14%, amounting to approximately SEK 22,876 million ($2.52 billion) versus SEK 26,814 million ($2.968 billion) in Q2 2019. Higher sales in China did much to compensate for lower sales in all other markets. Operating income was also impacted, at 3,108 million ($342.5 million) was down from the SEK 4,153 ($4137) reported in the same period the year before, equating to an operating margin of 13.6% versus 15.5% in 2019.

Despite the impact of the pandemic on sales, the second quarter 2020 saw order intake increase by 11%, driven by a strong demand for the company’s SDLG branded machines, which were up by 31%. Notwithstanding that most factories in Europe and the Americas were shut down for a month during Q2, a result of countrywide lockdowns and supply issues, deliveries increased by 8% in Q2.

Market Development

The year up to the end of May saw both the European and North American markets, measured in units, shrink by 22%, while the Asian market (excluding China) reduce by 21%. The Chinese market has recovered strongly and was up 13% at the end of May. The South American market was also in positive territory, up by 8% at the same point in the year.

“While demand for construction equipment in both Europe and North America was weak during the second quarter we were able to leverage our strong position in China, which rebounded strongly in the period,” commented Melker Jernberg, head of Volvo Construction Equipment. “This is allowing us to act from a position of relative strength and to drive transformational technologies that are moving our industry to more sustainable solutions. We are continuing to invest in electrification, automation and connectivity.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM