Read this article in French German Italian Portuguese Spanish

Trendlines: Back to normal for global construction equipment sales

25 March 2024

Global construction equipment segment is returning to a more natural and sustainable state, reports Chris Sleight, managing director of Off-Highway Research.

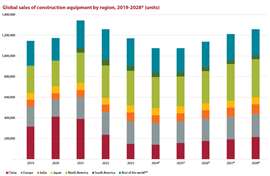

Global construction equipment sales fell 7% last year following 2022’s 6% decline. The first and most important takeaway from this is DON’T PANIC.

In a cyclical industry like ours, a single digit rise or fall in any given year is a fairly mild change. Two years of shallow falls is not anything more serious than a normal (if not unusually gentle) cyclical downturn.

Source: Off-Highway Research

Source: Off-Highway Research

And remember where we came from. At the height of the stimulus-driven boom in the pandemic, equipment sales hit an unprecedented 1.34 million units in 2021. That was 17% higher than the recently passed “normal” cyclical peak of 1.15 million units sold, which was seen just two years earlier in 2019.

That highlights that 2021 and even 2022, to some extent, were exceptional years in terms of sales, driven by exceptional circumstances and policies. It could therefore be argued that we are not even in a normal cyclical pattern, rather that we are seeing the global market correct back to normal levels after the unprecedented pandemic years.

Chinese market bottoming out

The current reset is forecast to bottom-out this year and next at around 1.07 million machines sold in each of those years. Thereafter, modest growth is expected to resume in response to the long-term drivers of our industry worldwide – the need to house a growing global population and the need to serve them with infrastructure.

Having said that, the global market is not without its problems, the main one being China. After two years of abnormally high sales in 2020 and 2021 thanks to stimulus spending, the Chinese market collapsed in 2022 with a 39% decline.

This was not only due to the stimulus money running out. The impact was compounded by turbulence in the Chinese real estate sector coupled with the country’s difficulties in getting to grips with the COVID pandemic. A further 38% fall followed in 2023 as the issues of falling prices and mounting bad debts in the real estate segment continued to manifest themselves.

A further 4% decline in sales is expected in 2024, which essentially signifies the market bottoming-out and is arguably the best-case scenario for China. More bad news and insolvency among property developers could push the equipment market down even further.

Chris Sleight, managing director, Off-Highway Research.

Chris Sleight, managing director, Off-Highway Research.

Competitive pressures

The long-term depression at home means China’s leading OEMs are increasingly targeting overseas markets. For the first time ever last year, more Chinese-made construction machines were sold overseas than in the home market. It has to be noted that this volume includes many of the international brands which built up manufacturing capacity in China in the 2000s and which now use these factories as global hubs.

Still, in order to weather the current storm, China’s large indigenous OEMs are having to sell high volumes overseas, and this is changing competitive pressures in many markets, particularly the more price-sensitive developing economies.

Click here for a more detailed summary by key global regions.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM