Read this article in 中文 Français Deutsch Italiano Português Español

Wärtsilä sees ‘all-time high’ order book in Q1

26 April 2024

Q1 net sales fell 10% but order intake rose by 11%, signaling strong demand

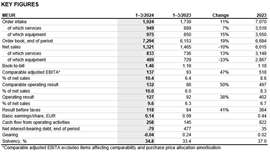

In its interim report for the period from January to March 2024, Wärtsilä indicated net sales decreased 10% to EUR 1,321 million compared to the same period last year. Comparable operating results increased, however, by 50% to EUR 132 million, representing 10.0% of net sales.

Order intake was up by 11% to EUR 1,924 million and service order intake increased by 7% to EUR 949 million. The order book at the end of the period was up 19% to EUR 7,294 million.

Wärtsilä’s Interim Report January–March 2024

Wärtsilä’s Interim Report January–March 2024

Hakan Agnevall, president and CEO, Wärtsilä, said the company continued to make good progress during the first quarter of 2024. “Our profitability improved, cash flow from operations increased and our order book ended up at a new all-time high driven by a continued strong order intake. We also made good progress in services, with service net sales growing by double-digits in both Marine and Energy,” he noted.

“In the first quarter, Wärtsilä’s order intake grew organically at 17% supported by good equipment order intake in Marine and engine power plants, as well as continued growth in service. Net sales decreased organically by 6%. While we saw growth in service net sales, equipment net sales decreased in both Energy and Marine, with the largest decrease in Energy Storage & Optimisation (ES&O).”

Wärtsilä noted its continued investments in R&D to develop sustainable and future-proof technologies. During Q1 2024, it launched Quantum2, a fully integrated high-capacity battery energy storage system designed and optimized for global large-scale deployment. (Photo: Wärtsilä)

Wärtsilä noted its continued investments in R&D to develop sustainable and future-proof technologies. During Q1 2024, it launched Quantum2, a fully integrated high-capacity battery energy storage system designed and optimized for global large-scale deployment. (Photo: Wärtsilä)

Agnevall cited the impact of global economic headwinds that persisted during the quarter. “In the energy market, the current macroeconomic situation caused uncertainty and delayed decision making. On the positive side, the global energy transition advances steadily. The move to renewables, combined with significant volumes of traditional inflexible assets nearing retirement, has resulted in a need for more flexibility in energy systems around the world. This creates ample growth opportunities for Wärtsilä in the mid to long term,” he indicated.

“In the marine market, trade flows around the world have been impacted by the conflicts in the Middle East, the attacks on ships in the Red Sea and the drought affecting the Panama Canal, which have led to longer average shipping distances, increased transportation costs and delays to global supply chains,” he continued. “Driven by the increasing demand for ship capacity and decarbonization-related ship renewal, investments in new ships were clearly higher than in the first quarter of 2023. Higher capacity utilization and a continued increase in shipyard capacity supported the growth in ship delivery volumes.”

Agnevall pointed to favorable market sentiment for the company’s key segments, particularly on the passenger side, “with good development in passenger volumes creating demand for new vessels in both cruise and ferry.” He also noted a healthy level of uptake of alternative fuels in light of emissions requirements for the shipping industry. “This incentivizes shipping companies to reduce emissions and modernize fleets, either through renewals or retrofits. As an established technology leader, and with a wide range of technologies and specialized services, Wärtsilä is well positioned to support customers on their decarbonization journeys.”

Wärtsilä stated it expects the demand environment for both the marine and energy sectors for the next 12 months (Q2 2024 to Q1 2025) to be better than that of the comparison period.

“In 2024, equipment deliveries and revenue recognition in Energy will be tilted towards the second half of the year, both in engine power plants and ES&O,” said Agnevall. “In Marine, the lead times from equipment order intake to net sales are currently slightly longer, due to remaining constraints in shipyard capacity.

“We expect the demand environment for the coming 12 months to be better than the comparison period in both Marine and Energy. We are on a clear path to reach our financial targets, and we remain very well positioned for the future.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM