Are electric mini excavators a better choice than diesel?

05 June 2023

One of Sunbelt’s JCB electric mini excavators, pictured on the Clyde River in Glasgow, Scotland.

One of Sunbelt’s JCB electric mini excavators, pictured on the Clyde River in Glasgow, Scotland.

The range of electric mini excavators on the market is growing all the time, as the construction industry looks for ways to slash carbon emissions.

Electric mini excavators offer undoubted benefits, not just because they offer lower CO2 emissions and zero exhaust emissions, but because they run quietly too.

But are they, as a new research paper suggests, “a better choice” than diesel in the current market?

That’s what a senior technology analyst at research and consultancy company IDTechEx, Dr James Jeffs, has claimed.

IDTechEx has predicted that the electric construction machinery market was about to “take off” with a 10-year compound annual growth rate (CAGR) of 37%, although this is starting from a small base, with electric machine sales considerably lower than diesel.

Mini excavators are one of the biggest construction machine markets by volume and the report suggested that their small size and lighter workloads made them an ideal fit for electrification.

It went on to offer three important reasons “why electric should be an easy choice over diesel”.

Those reasons were:

1) “Equal or better performance”:

IDTechEx claimed that electric machines have “equivalent or even superior power when compared with their diesel counterparts”. It pointed to the example of the JCB19C-IE, whose motor has a peak power of 20kW, around 33% more than diesel examples in IDTechEx’s database and “nearly double” the 11.7kW of the engine in JCB’s diesel equivalent. The report also found that electric mini excavators offer 6-8 hours of continuous operation, which it said was “enough to get most operators through a normal working day”.

2) “Better environment for workers”:

The research cited zero exhaust emissions as a major benefit of transitioning to electric. “With open cabins and stationary vehicles, the air quality that an excavator operator and surrounding workers are exposed to can be very poor,” the report said. By contrast, zero emission machines would offer a quality-of-life benefit to construction workers” by improving air quality.

3) “Cheaper”:

The report claimed that electric machines could offer “a significant reduction in the total cost of ownership” over diesel equivalents. It argued that while batteries add a premium to the cost of building and purchasing the vehicle, the cost of batteries was “coming down”, with OEMs like John Deere, Caterpillar and XCMG bringing more electric products in house and producing them in larger volumes. IDTechEx predicted that an electric mini excavator owner “could expect to see a return on their investment in as little as six to eight years”, assisted by maintenance and fuel savings.

Challenges for electric mini-excavators

While few could disagree that electric machines would offer a better working environment for construction workers through cleaner air, the current case for electric mini excavators over their diesel equivalents may be less clear cut than it first appears.

First off, it isn’t a given that battery prices will continue to fall. While lithium—ion battery costs fell continuously from 2010 until 2021, according to BloombergNEF’s 2022 Lithium-Ion Battery Survey, prices increased 7% in 2022 compared to 2021. Amid higher input costs and increasing demand as the on-road EV market grows, there is no guarantee that battery prices will continue to fall.

When it comes to performance, the peak power electric machines may be higher but the continous power of the JCB19C-IE cited by IDTechEx is 9kW.

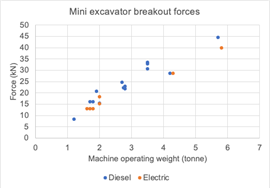

What could possibly serve as a better comparison between the two types of machine is how they perform when it comes to breakout force.

Responding to International Construction, Dr. Jeffs performed additional analysis on breakout forces and found that they were competitive compared to diesel machines (see graph below). “It would be fair to say that electrics have equivalent performance by this metric but are not as powerful as the motor peak implies,” he commented.

A graph comparing diesel and electric mini excavator breakout force (Credit: IDTechX)

A graph comparing diesel and electric mini excavator breakout force (Credit: IDTechX)

Asked about whether electric machines could really produce 6-8 hours of continuous work on a full charge in real-world conditions or in lower temperatures, Dr. Jeffs said, “This was based on the claims of OEMs, which will likely have picked more moderate example duty cycles when measuring their vehicles’ endurance. Under heavy continuous usage, most machines will fall short of an 8-hour day. It is also a good point regarding low temperatures, as the effects on electric cars are well known. It is not something currently being discussed by construction OEMs in their literature on EVs. It will likely reduce running time by something like 10-20%.”

When it comes to charging, while its possible to recharge rented machines at a depot overnight if they are only required for a day, many construciton tasks are likely to take longer than a day, leaving them parked up on site. Sites may not have grid connections, potentially leaving machines to be charged by diesel generators.

But Dr. Jeffs argued that some electric mini-excavators have tethering options to allow the user to have as much endurance as needed while working in a small area. And he claimed that most machines had a charge time of an hour or less. “This means they could be charged over lunch. Certainly charging overnight will be easy,” he added.

International Construction also asked IDTechEx about how it arrived at a return period of 6-8 years when it came to its assumptions on total cost of ownership, given that mini excavators may not necessarily last that long.

Dr Jeffs said that the 6-8-year investment period was based on IDTechEx’s own research into electric machines in the two-tonne range, having a $10,000-$15,000 price premium compared to diesel machines. The estimate is based on the time taken for fuel and maintenance savings to equal the price increase.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM