Manufacturing technology orders slide in June from peak

18 August 2023

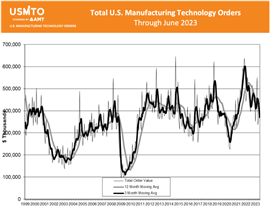

New orders of manufacturing technology totaled $411.3 million in June 2023, according to the latest U.S. Manufacturing Technology Orders (USMTO) Report published by AMT – The Association For Manufacturing Technology, which represents U.S.-based providers of advanced machinery, devices and digital equipment for manufacturers. Orders for the month rose 12.6% over May 2023, but were down 1.7% compared to June 2022.

Source: AMT – The Association For Manufacturing Technology

Source: AMT – The Association For Manufacturing Technology

The USMTO Report is based on the totals of actual data reported by companies participating in the USMTO program. Compiled by AMT, it provides regional and national U.S. orders data of domestic and imported machine tools and related equipment, and serves as a leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity, AMT stated.

June’s new orders figure brings total orders through the first half of 2023 to nearly $2.5 billion, 13% short of the first half total in 2022.

“Orders of manufacturing technology have continued their downward trend since peaking in the second half of 2021. However, for perspective, they remain above historical averages,” said Douglas K. Woods, president of AMT. “Even in non-IMTS (International Manufacturing Technology Show) years, the majority of orders tend to come in the second half of the year.

“Despite some headwinds, including fears of a recession, it would seem reasonable that manufacturing technology orders could outperform some of the more pessimistic expectations if we return to that historical trend.”

Job shops, the largest customer segment, increased spending by 4.2%, well under the industry growth of 12.6% from May to June 2023, AMT said. They also decreased the number of units ordered, while the industry remained about flat.

“Job shops tend to be smaller to medium-sized businesses, and the effects of economic uncertainty, coupled with higher interest rates, have begun to take a toll, causing some to delay capital investments,” said Woods.

A bright spot proved to be manufacturers of automotive transmissions, which have been noticeably increasing investment in manufacturing technology. Year-to-date orders for manufacturing technology from the automotive transmission and powertrain parts manufacturing sector are at the second-highest level since the first half of 2015.

Woods said the scale of these investments show “manufacturers are preparing for a prolonged transitional period from internal combustion engines to electric vehicles.”

“Moving toward electrification means facing numerous supply and logistical hurdles,” he continued, “from the sourcing of elements to grid reliability. Auto manufacturers recognize that until these challenges are overcome, demand for internal combustion engines will justify further investment.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM