EIA: More Than Half Of New Electricity Capacity To Come From Renewables In 2019

10 January 2019

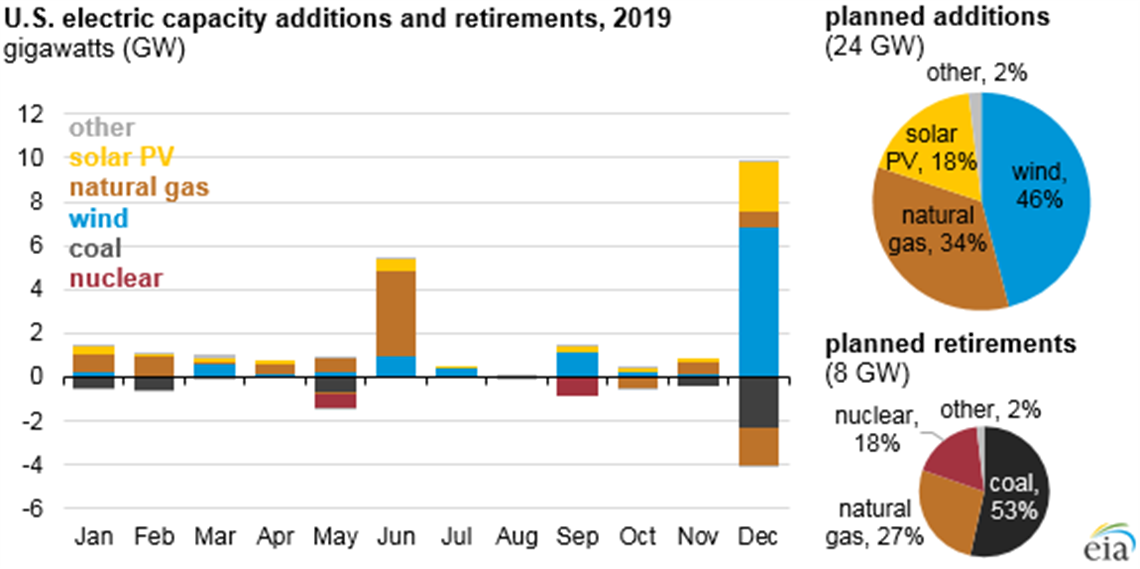

According to the U.S. Energy Information Agency’s (EIA) latest inventory of electric generators, 23.7 GW of new capacity additions and 8.3 GW of capacity retirements are expected for the U.S. electric power sector in 2019.

The utility-scale capacity additions consist primarily of wind (46%), natural gas (34%), and solar photovoltaics (18%), with the remaining 2% consisting primarily of other renewables and battery storage capacity. A total of 10.9 GW of wind capacity is currently scheduled to come online in 2019. Most of the capacity will not come online until the end of the year, which is typical for renewable capacity, the EIA said. Three states—Texas, Iowa, and Illinois—will be home to more than half of the 2019 planned wind capacity additions.

Planned natural gas capacity additions are primarily in the form of combined-cycle plants (6.1 GW) and combustion-turbine plants (1.4 GW). Most of the natural gas capacity is scheduled to be online by June 2019 in preparation for high summer demand. Of the planned natural gas capacity additions, 60% will occur in Pennsylvania, Florida and Louisiana.

Nearly half of the 4.3 GW of utility-scale electric power sector solar photovoltaic (PV) capacity additions are located in three states: Texas, California, and North Carolina. In addition to the electric power sector, other sectors, such as the residential and commercial sectors, also install solar PV, e.g., distributed PV or rooftop systems. In addition to utility-scale capacity, EIA’s Short-Term Energy Outlook expects an additional 3.9 GW of small-scale solar PV capacity to enter service by the end of 2019.

Scheduled capacity retirements for 2019 primarily consist of coal (53%), natural gas (27%), and nuclear (18%), with a single hydroelectric plant in the state of Washington and other smaller renewable and petroleum capacity accounting for the remaining 2%.

Most of the coal retirements are scheduled to occur at the end of 2019. Half of the planned retirement capacity for coal is at a single plant, Navajo, located in Arizona that first came online in the 1970s. The 4.5 GW of coal-fired capacity expected to retire in 2019 is relatively small compared with the estimated 13.7 GW that retired in 2018, which was the second-highest amount of coal capacity retired in a year.

The scheduled natural gas retirements (2.2 GW) consist mostly (2.0 GW) of steam turbine plants. The natural gas steam turbine plants that are scheduled to retire are all older units that came online in the 1950s or 1960s. Most of the retiring natural gas steam turbine capacity (1.6 GW) is located in California.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM