Read this article in French German Italian Portuguese Spanish

Trendlines: Get on with it!

16 October 2024

Equipment sales suffer as central banks around the world are too slow in cutting interest rates.

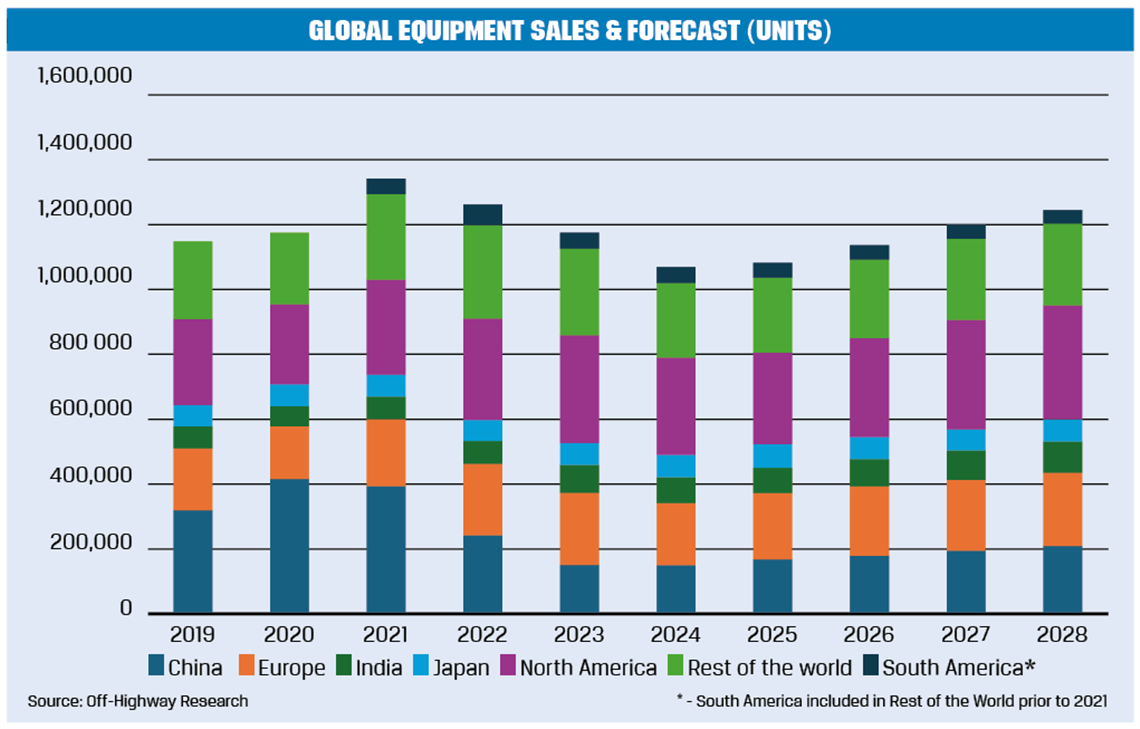

The slowdown in global construction equipment sales will be a little more severe than previously expected this year, according to Off-Highway Research’s updated forecasts. The root cause is the persistently high interest rates that continue to prevail around the world, putting the brakes on homebuilding and also making machines expensive to finance.

Central bankers are finally getting the message. Inflation isn’t the problem anymore – anaemic economic growth is the issue that needs tackling today. Thankfully, the Fed finally cut interest rates for the first time in four years in September, reducing the cost of borrowing by 0.5 percentage points.

Elsewhere in the world, the European Central Bank has made two 0.25 percentage point cuts so far this year. Meanwhile, the Bank of England made a single cut of 0.25 points in August, but at its most recent meeting in September, decided not to cut rates further for now.

Too Little, Too Late

Off-Highway Research’s view is that, particularly in the case of Europe, these cuts are too little, too late. Homebuilding has slowed down significantly in Europe due to the persistently high interest rates, and as a result, construction equipment sales are now expected to fall 14% this year.

In Noth America, the equipment market is expected to drop 10%, a forecast that remains unchanged from the start of the year. It has to be said that the underlying factors look better in North America. Homebuilding has proven resilient, with a soft landing in 2023 after the excesses of the pandemic years. Data on building permits is now trending upwards overall, with single-family houses just offsetting a downturn in multi-family projects.

Global Sales Drop Expected

Chris Sleight, managing director, Off-Highway Research.

Chris Sleight, managing director, Off-Highway Research.

Elsewhere in the world, things are a little better than previously expected. There should be a sliver of growth in South America; the Chinese equipment market looks likely to bottom-out rather than fall further this year; and the Indian General election proved less disruptive to the market than usual. The only bad news is a slight downgrade to the forecast in Japan, but this is now for a leveling off at a high volume, rather than for the previously expected modest growth.

All in all, global equipment sales are seen falling 10% this year, rather than the previously expected 9%. Volumes are still very high as these falls are coming from the record sales of the pandemic years, but a drop is nevertheless a drop.

Equipment markets that are falling now should bottom-out in late 2024 and early 2025, with growth returning later next year. That obviously depends on central banks continuing to cut interest rates, and ideally speeding things up.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM