Read this article in Français Deutsch Italiano Português Español

Industry opinions about the most promising power or fuel source for reducing emissions

08 May 2024

Editor’s note: this story was updated on 4/29/2024 to include input from AGCO.

It’s hard to believe there was a time when reducing engine emissions was all about finding ways to mitigate the results of burning fossil fuels. Today’s aggressive emissions goals, many of which are driving to net-zero emissions, have seen the introduction of several fuels and power technologies that are being adapted to vehicles and equipment for both on- and off-highway use.

With an eye for seeing where OEMs — both manufacturers of vehicles and/or equipment as well as engine makers — stand on the efficacy of alternative power sources on the road to net zero, Power Progress reached out to several asking them to answer the following question:

Of the variety of alternative fuels and energy sources available to reduce emissions while operating on- and off-highway equipment, which one do you think has the most promise in the next 3-5 years? Why?

What follows are their responses. All respondents commented via email.

Embracing Diversity

Some manufacturers indicated that in the near term, they were embracing the various fuel and power choices at their disposal.

MAN Engines, which is a business unit of MAN Truck & Bus, cited the diverse industries where it has customers, such as commercial shipping, agricultural equipment and power generation.

“In the future, MAN Engines will be relying on pure combustion engines for hydrogen and regenerative fuels, battery storage systems and also complete electric drive systems to meet the various requirements in order to operate vehicles and machines locally with the lowest carbon dioxide (CO2) emissions,” said Mikael Lindner, head of MAN Engines.

Scania’s 13 liter biogas engine. (Photo: Scania)

Scania’s 13 liter biogas engine. (Photo: Scania)

Scania’s Jacob Thärnå, head of sustainability, said no single solution could solve all needs in the mid-term.

“The system needs to ‘defossil’ both new and rolling fleets,” he said. “Scania sees the climate and environmental benefits of rapid expansion of sustainable biofuels, biomethane and electrified vehicles running on green electricity in the next three to five years.”

John Deere said through a company spokesperson that it was also looking to diverse power sources, although it saw particular value in renewable fuels.

“John Deere views renewable fuels such as ethanol, biodiesel and renewable diesel — largely produced from crops grown by farmers — as a key solution for significantly reducing emissions among heavy machinery while also ensuring our customers’ productivity needs are met,” the company said. “To support this, we’re optimizing our engine lineup to create new value for customers and offer increased adaptability to integrate renewable fuels with combustion engines.”

Kelvin Bennett, senior vice president of engineering for AGCO, narrowed his thoughts down to both biodiesel and renewable diesel fuel.

“Biodiesel is produced using products grown on the farm, while renewable diesel is produced from various ‘green’ feedstocks instead of oil,” he said. “Both fuels provide impactful reductions in emissions and, when blended correctly, are nearly drop-in replacements for conventional fossil diesel. This capability means farmers can use these fuels to reduce emissions in their new equipment and much of their existing older equipment.”

Capitalizing on HVO

Several of those who shared their opinions suggested that hydrotreated vegetable oil (HVO), also known as renewable diesel fuel, shows significant promise for a variety of reasons.

“HVO is a drop-in fuel, meaning that it may be used directly without any modification to the engine,” said Markus Schwaderlapp, senior vice president of product development for Deutz. “HVO production may be scaled quickly and is readily available — right now.”

Sustainable fuel maker Neste’s refinery in Rotterdam, Netherlands, where the company manufactures HVO. (Photo: Neste Oyj)

Sustainable fuel maker Neste’s refinery in Rotterdam, Netherlands, where the company manufactures HVO. (Photo: Neste Oyj)

Schwaderlapp added, “When it comes to cost, the difference is minimal while the payoff is significant. HVO-powered engines emit 90 percent less CO2 while costing only 10 percent more than diesel fuel.”

Rolls-Royce said it sees similar value in HVO as a replacement to traditional diesel.

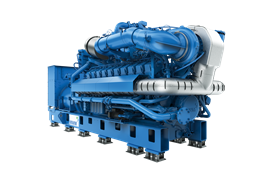

“The fuel used to replace fossil fuels is likely to have a much greater impact in the near future,” the company said through a spokesperson. “At Rolls-Royce’s power systems division, we clearly see HVO as the fuel of choice for the next three to five years to replace fossil diesel. This is because HVO is already available and ready for use today.

“Depending on the feedstock used to produce this diesel-like fuel, HVO reduces CO2 emissions by up to 90 percent. Around 80 percent of the portfolios with MTU engines from Rolls-Royce have now been approved by us for operation with HVO.”

Rolls-Royce added that its own testing showed no difference in power, load acceptance or fuel consumption among its already-released MTU common rail engines operating on HVO compared to traditional diesel. In addition to CO2 reductions, the company said HVO operation means a reduction in particulate matter (PM) of more than 40 percent and a drop in nitrogen oxide (NOx) emissions up to 8 percent.

According to Rolls-Royce, HVO will be used in even the largest applications.

“We have spoken to yacht captains, for example, who have been instructed by the ship’s owner to bunker HVO whenever it is available,” Rolls-Royce said. “And [German national railway company] Deutsche Bahn is already using this fuel in daily operations. Now it is important to produce HVO in really large quantities and make it available.”

According to the International Energy Agency (IEA), 2024 will see global HVO production of about 13 billion liters, or nearly 3,500 million gallons. The Alternative Fuels Data Center (AFDC) of the U.S. Dept. of Energy (DOE) indicates there are at present 16 U.S. plants producing HVO, with additional facilities expected to come online this year. Nameplate capacity for these plants is more than 2,800 million gallons per year. On its website, the AFDC said the U.S. also imports HVO, primarily from Finland-based Neste — 263 million gallons in 2022, which was a decline from 392 million in 2021 due to increased domestic production.

Decarbonizing with BEVs

Compact construction equipment maker Takeuchi said that over the next three to five years, it believes electric powertrains hold significant promise.

Takeuchi’s TB20e battery electric excavator. (Photo: Takeuchi)

Takeuchi’s TB20e battery electric excavator. (Photo: Takeuchi)

“Battery technology is improving rapidly, which allows equipment to perform heavy-duty applications for longer periods of time,” said Lee Padgett, product manager for Takeuchi-US. “Furthermore, battery charging times are decreasing, further making electric equipment better equipped for future growth. The infrastructure needed for charging vehicles and equipment is also advancing, making the use of electric vehicles and equipment more feasible for more people.”

Padgett added that because electric powertrains produce zero tailpipe emissions, air quality is improved — particularly in urban areas where clean air a focus. Tax credits and other incentives for electric equipment use are the result of this cleaner operation, he said.

Not Ignoring Hydrogen

Friedrich Baumann, executive board member of MAN Truck & Bus with responsibility for sales and customer solutions, said the company believes battery electric vehicles (BEV) will serve the needs of most customers, with hydrogen addressing special applications.

“We are continuing to focus on battery electric vehicles to decarbonize road freight transport,” he said. “These currently have clear advantages over other drive concepts in terms of energy efficiency and operating and energy costs. However, trucks powered by hydrogen combustion engines are a useful addition for special applications and markets.”

Baumann added that in addition to hydrogen internal combustion (IC) engines, hydrogen fuel cell technology may also be “a suitable supplement.”

While Daimler did not respond specifically to Power Progress’ request for comment, it did recommend reading a March 2024 blog post, “What(ever) it takes to decarbonize transportation,” by Andreas Gorbach, head of truck technology for the company.

“The decarbonization of commercial vehicles will not rely on one, but on two propulsion technologies: battery electric and hydrogen-based drives,” Gorbach said in the blog post.

While either technology can help customers address their specific needs, Gorbach noted that building infrastructures to support both BEVs and hydrogen vehicles would be less costly than only scaling the grid.

“While the initial cost of electric infrastructure is fairly low — you basically need to install chargers and connect them to the existing grid — the cost of upgrading the power grid is fairly high,” he said. “In contrast, as demand and utilization increase, hydrogen infrastructure decreases in relative cost. And as all economists — and this includes truck and bus customers — strive for the economic optimum, this clearly leads us to two infrastructures.”

Rolls-Royce said MTU hydrogen engines are currently in development, as are those that can run on methanol.

“We see hydrogen for stationary operation on land and methanol for shipping,” the company said. “However, these alternative fuels will only contribute to climate protection if they are produced using green energy from renewable sources, i.e. if they are not of fossil origin. We certainly see challenges in terms of availability in the near future.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM