Read this article in 中文 Français Deutsch Italiano Português Español

S&P report on how US tariffs affect truck OEMs

12 February 2025

Tariffs could result in a 9% increase in prices and a 17% drop in volumes

Paint line at the Escobedo Assembly plant in Mexico (Photo: International)

Paint line at the Escobedo Assembly plant in Mexico (Photo: International)

On February 1, the United States government announced that it would implement 25% tariffs from February 4 on virtually all goods entering the country from Canada and Mexico. That has now been pushed back to March 4, but implementation of the tariffs still remains a strong possibility.

Following on from this, S&P Global has published a report looking at how the tariff would affect commercial vehicle (CV) sales in the United States.

According to the material, the US tariffs, in combination with retaliatory actions of Canada and Mexico, would had have a ‘significant’ impact on the trucking industry, cutting short-term vehicle sales volumes. It is further put forward that the tariffs have the potential to reshape the commercial vehicle manufacturing landscape.

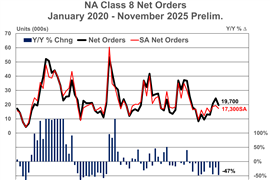

According to S&P, the tariffs would be ‘particularly sensitive’ for medium- and heavy-duty commercial vehicles, covering models in US Class 4 through 8. This, largely because NAFTA and other trade agreements have seen a doubling of volumes coming into the US from its northern and southern neighbours, to where those units represent almost one-third of new vehicle demand.

The sales percentages differ across model classes. Where little more than 25% of light-duty CVs comes from Canada and Mexico, more than 40% of Class 8 trucks sold in the US are produced in these countries.

OEM distribution is also varied. In one case, Ram produces 100% of its light CVs in Mexico. On the hand, Volvo has zero production there. But in most cases, OEM activity is split between the two.

Looking at suppliers, these companies have little or no room to absorb a 25% increase in costs. OEMs are only in slightly better position. In some cases, parts and components cross and recross the border multiple times before reaching their point of use.

In one such case, engines for Class 8 trucks are widely produced in the US and shipped to Canada and Mexico for installation. Should retaliatory tariffs be put in place, this will impact those costs.

S&P has calculated that the initial net impact on tariffs on new truck prices in the US will be about +9%. But should the tariffs continue through the end of 2025, this could see demand for new CVs drop by as much as 17%.

The report states that the level and duration of the tariffs are of equal importance. A longer tariff period will see OEMs reschedule shipments to minimise tariff impact, reducing costs. Longer term, there could be a shift of assembly from Canada and Mexico back to the United States – ultimately the goal of the Trump administration.

But S&P notes in closing that its Global Mobility’s MHCV forecast team ‘see a scenario with more or less permanently elevated tariffs among the three USMCA members as unlikely’.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM