Read this article in Français Deutsch Italiano Português Español

Class 8 truck orders dip sharply in December

05 January 2024

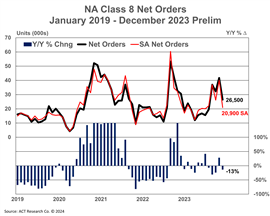

Class 8 net orders. (Source: ACT Research)

Class 8 net orders. (Source: ACT Research)

December preliminary North America Class 8 net orders came in at 26,500 units, falling by 15,000 from the previous month, ACT Research reported. The decline follows a surprisingly strong November, which saw orders jump to 41,700 units, the highest monthly intake since October 2022.

“After a strong and upside-surprising November, Class 8 orders surprised in the opposite direction in 2023’s last report,” said Kenny Vieth, ACT’s president and senior analyst. “With the largest seasonal factor of the year, seasonal adjustment pushes December’s intake sharply lower to 20,900 units. The full-year 2023 Class 8 order tally fell 7.0% yeav-over-year to 278,500 units.”

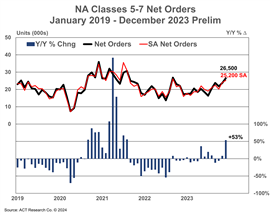

Class 5-7 net orders. (Source: ACT Research)

Class 5-7 net orders. (Source: ACT Research)

Vieth noted that net orders for Classes 5 to 7 remained flat in December but up 53% from year-ago levels. “Unlike Class 8, MD seasonality is modest in December, lowering the seasonally adjusted order tally to 25,200 units, up 4.6% from November, and the best month of the year on both a nominal and seasonally adjusted basis,” he said. “For all of 2023, Classes 5-7 orders were 245,700 units.”

Complete industry data for December, including final order numbers, will be published by ACT Research in mid-January in its State of the Industry: Classes 5-8 Vehicles report. The report provides a monthly look at the current production, sales and general state of the on-road heavy and medium duty commercial vehicle markets in North America.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM