Read this article in Français Deutsch Italiano Português Español

Data shows decline in zero emission bus adoption in Canada

30 July 2024

The latest data from the Canadian ZEB Database revealed a decline in zero emission bus (ZEB) adoptions across Canada since the 2023 report. A product of the nonprofit Canadian Urban Transit Research & Innovation Consortium (CUTRIC), the database is a consolidation of Canadian transit agency electrification plans that provides quantitative data on the status of vehicle and charger adoption across the country. This fourth edition of the database report said ZEBs dropped almost 9 percent between Oct. 31, 2023 and Jan. 30, 2024.

According to the report, the total number of ZEBs across the adoption spectrum in Canada — from announcement to deployment — is 4,945 as of the end of January. This is down from 5,426 in the previous report published in December, which covered ZEBs in various stages of adoption from September 2022 through October 2023. It represents a decline of 8.9 percent.

On June 14, 2024, Nova Bus announced that OC Transpo, which provides transit services across Ottawa, Ontario, and into Gatineau, Québec, is acquiring 51 Nova Bus LFSe+ electric buses. (Photo: Nova Bus)

On June 14, 2024, Nova Bus announced that OC Transpo, which provides transit services across Ottawa, Ontario, and into Gatineau, Québec, is acquiring 51 Nova Bus LFSe+ electric buses. (Photo: Nova Bus)

The first ZEB Database report, which was published in June 2022, showed that prior to April 2022, the ZEB count in Canada stood at 1,696 — again, in various stages of adoption. The second report revealed that between May and September 2022, there were a total of 1,922 ZEBs in Canada for an increase of 13.3 percent. By the third report, the number of ZEBs had grown across Canada by a whopping 182 percent.

The Canadian government has a goal of deploying 5,000 ZEBs by 2026, CUTRIC said.

Josipa Petrunic, president and CEO of CUTRIC, said that while electrification in transit continues to take hold across Canada, inflation is taking a toll on adoption.

“The actual number of zero emissions buses moving forward to procurement has dropped compared to 2023,” she said. “Today’s dollar buys fewer electric buses and chargers than it did last year.”

The latest report indicated that in addition to inflation, funding availability as well as vehicle and infrastructure lead times are having a negative impact on ZEB adoption.

While Canada as a whole experienced a ZEB decline from October 2023, that was not true for every province individually. The report indicated that Quebec, British Columbia and Manitoba experienced growth, while Alberta, Ontario and New Brunswick saw ZEB numbers fall.

Battery Electric Majority

Of the 4,945 ZEBs reflected in the latest report, the overwhelming majority are battery electric (BE) buses: 4,845, or 98 percent. The remaining 100 (2 percent) are fuel cell electric vehicles (FCEVs). Despite the decline in the number of ZEBs since the third report, the percentage breakout by power source remained unchanged. That was not the case with the composition of buses in the first and second report, which also included compressed natural gas (CNG) vehicles:

First report (prior to April 2022)

- Battery electric: 55 percent

- CNG: 42 percent

- FCEV: 3 percent

Second report (May – September 2022)

- Battery electric: 61.2 percent

- CNG: 34.8 percent

- FCEV: 2 percent

As of the latest Canadian ZEB Database, Ontario and Quebec have the highest adoption of battery electric (BE) buses in Canada, with 2,398 and 1,614 BE buses respectively. (Map: KHL Staff. Data: CUTRIC/Canadian ZEB Database. Created with Datawrapper)

As of the latest Canadian ZEB Database, Ontario and Quebec have the highest adoption of battery electric (BE) buses in Canada, with 2,398 and 1,614 BE buses respectively. (Map: KHL Staff. Data: CUTRIC/Canadian ZEB Database. Created with Datawrapper)

Despite this majority, adoption of BE buses is not uniform across all Canadian provinces. Ontario has 2,398 such vehicles, the data indicated, with Quebec having the second highest number at 1,614. British Columbia and Alberta are a distant third and fourth with 363 and 293 respectively.

Coming in with less than 100 BE buses each are Manitoba, New Brunswick, Nova Scotia, Northwest Territories and Prince Edward Island. The ZEB Database revealed that Newfoundland, Nunuvut and Yukon have neither initiated BE bus plans nor decarbonization strategies.

CUTRIC said the high numbers of BE buses in Ontario and Quebec could be due to those provinces’ higher population density and more urban areas having more public transit systems and government support. Nonetheless, Ontario saw a 16.6 percent decline in BE buses over 2023 numbers. The number of vehicles increased in Quebec, however, by 15.3 percent year-over-year.

About 82 percent of the BE buses in the ZEB Database have supplier information attached. CUTRIC said that Saint-Eustache, Quebec-based Nova Bus, which is part of the Volvo Group, accounts for 62 percent of all vehicles. New Flyer, which is part of Winnipeg, Manitoba-based NFI Group, is a distant second at 33 percent. Proterra accounts for 3 percent of all BE buses, and Vicinity and BYD are tied at 1 percent.

Stages of Adoption

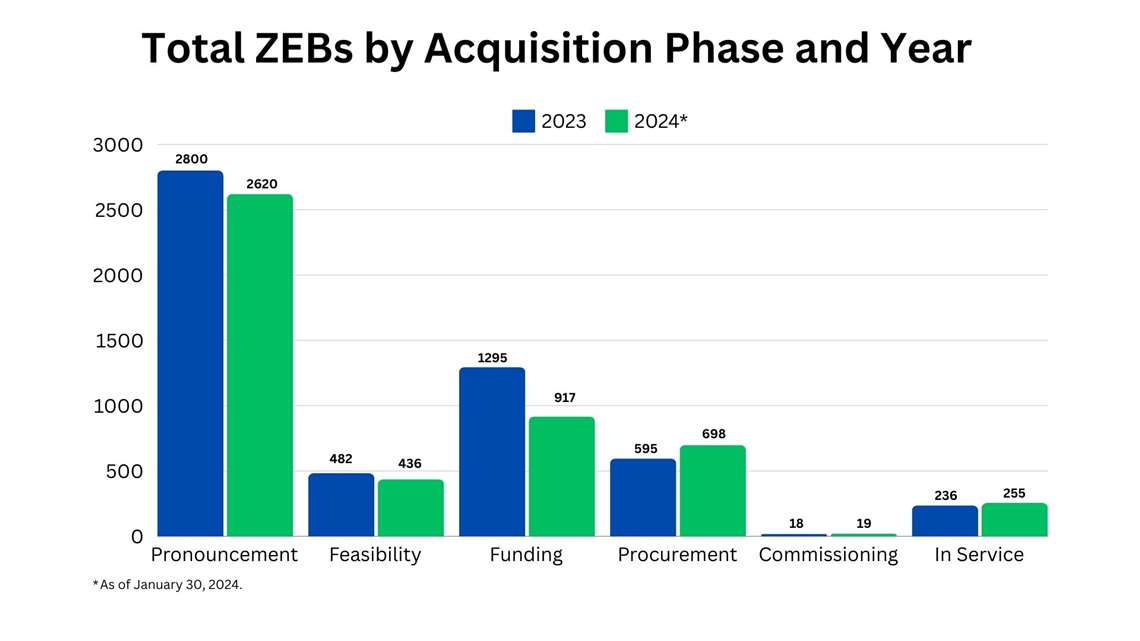

According to CUTRIC, the stages of ZEB adoption include pronouncement (a public statement of intent), feasibility studies, funding, procurement, commissioning and in-service operation. The latest data shows that while the majority of ZEBs are in the pronouncement phase (2,620, or 53 percent), this is down slightly (6 percent) from 2023. Also down compared to 2023 are the number of ZEBs in the feasibility and funding stages.

Chart: KHL Staff. Data: CUTRIC/Canadian ZEB Database.

Chart: KHL Staff. Data: CUTRIC/Canadian ZEB Database.

By comparison, the number of vehicles in procurement — 698 — represented a 17 percent increase over 2023, and at 255, the number of vehicles in service rose by 8 percent compared to 2023. CUTRIC said this shows that ZEBs are moving through the transition process.

Data shows that all the in-service vehicles are BE buses. The CUTRIC report said that BE technology is believed to provide a lower total cost of ownership (TCO) over the life of the vehicle. Quiet operation, perceived superior reliability and expected improvements in battery technology have also contributed to their popularity, CUTRIC said, as have expectations of cost-effective operation and reduced maintenance.

Nonetheless, these electric vehicles face challenges in adoption. CUTRIC cited high capital costs at more than twice that of a comparable diesel-powered bus.

Infrastructure costs are also a concern, the report said, with low-powered depot chargers costing as much as C$560,000 and higher-power opportunity chargers running more than C$1 million. Electricity and demand charges are also hurdles.

Other challenges include equipment availability as well as difficulties finding equipment suited to operation in the harsh Canadian winters. Workforce is also an obstacle, as the report said transit agencies sometimes struggle to find staff knowledgeable enough of the new technologies to plan and implement transition plans.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM