Read this article in 中文 Français Deutsch Italiano Português Español

Down and changing: ICm20 crane manufacturer ranking

03 December 2025

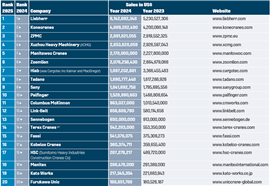

Our long-running ranking of the world’s largest crane manufacturers has this year shown a decline approaching a billion dollars. Alex Dahm reports

A drop in the headline total value of the output of the world’s 20 largest crane manufacturers was already anticipated in 2024’s ICm20.

In this year’s table that drop was 2.7 per cent for sales in 2024 against 2023. The 2024 ICm20 being up 5.6 per cent was a surprise since revealed as being short-lived. It is a misconception that a reduction is unusual. In the last ten years, this year is the sixth (thankfully not consecutive) where the total is lower than the year before.

The total for all ICm20 companies in 2025 is US$ 32,664,051,687, down from $33,568,385,966 in 2024. Looking back further, however, at the long game, this year’s ICm20 is still up 30 % from the 2015 total a decade ago.

Continuing uncertainty around the world, war and terrorism, all lead to a reluctance to invest, both in construction projects and the equipment to build. The collapse of the Chinese market continued to bite in 2024. Three of the four manufacturers from China, all of them still in the top half of the ICm20 table, posted declines. Largest of these in percentage terms was Zoomlion, down 23 %. XCMG was also down, just into double digits.

In all, more than half (12) of the top 20 companies posted lower sales for 2024 than 2023. The decline equates to a reduction in total sales of US$904, 334,279 spread across those companies.

Exchange rate fluctuation between 12 months ago and now will have contributed positively, helping to apparently reduce the amount of drop in the table’s total value.

In the charts

The 2025 ICm20 table of the world’s largest crane manufacturers by sales. Image: International Cranes and Specialized Transport/KHL Group

The 2025 ICm20 table of the world’s largest crane manufacturers by sales. Image: International Cranes and Specialized Transport/KHL Group

At the top of the 2025 ICm20 again, where it has been for all but two years in the last 13, is Liebherr. The world’s largest crane manufacturer by sales revenue is up strongly with an 8 % increase on last year, calculated in its reporting currency so without any exchange rate effect. Liebherr’s forecast is that 2025 will show a lower increase.

Konecranes in second place also posted a rise, of 6.6 % but the gap to the leader has widened. Chinese port and industrial crane maker ZPMC in third place, managed to gain two despite a 3 % decline in sales. Next, XCMG maintained its 4th place even with its aforementioned almost 11 % decline in sales.

Next, Manitowoc in 5th, gained two places while also showing a drop in sales, of 2.2 %. The USA-headquartered manufacturer reported sales were down in Europe and Middle East Asia Pacific.

For the third year running Zoomlion hung on to 6th place even with the impact of its previously mentioned double digit drop.

If you are wondering how two of the above companies, both with lower sales year on year, still managed to improve their placing in the table then here’s a primary reason: Big changes at Cargotec saw its position in the table shift from third to seventh place.

As the year 2024 started, Cargotec had three business areas: Hiab, Kalmar and MacGregor. Already at the beginning of that year Cargotec had a plan to split into three independent companies. “The transformation process was executed according to its plans,” the company said.

Cargotec took Kalmar out in June 2024, making it a separate company and separating it from its remaining Hiab and MacGregor businesses. Kalmar had transferred its heavy crane-related business to RainbowCo in China and it was only still in the Cargotec group for half the year so its crane-related contribution for our purposes would have been minimal.

Also in 2024, Cargotec agreed the sale of its MacGregor maritime crane and equipment division for €480 million, around half of which had previously been estimated to be crane-related. The sale has only recently (July 2025) completed but was made by Hiab a discontinued operation at the end of September 2024.

With just the Hiab division now remaining, Cargotec has changed its name to reflect this, with its associated existing Moffet rear mounted forklift, Jonsered forestry cranes and other brands remaining within that. Hiab restated its financial information, including a figure for just that segment in 2024 plus, for comparison purposes, an equivalent figure for the year before which we have substituted in this year’s table.

More change ahead

If you think that is confusing, there are several other acquisition effects coming up in the pipeline liable to further change the ICm20. Columbus McKinnon acquired Crosby earlier this year so the impact of its $1.1 billion sales will hugely boost CM.

This year’s table is the last one with Manitex as a separate company, having been acquired by Japanese crane maker Tadano and its contribution included since 1 January 2025 (helpfully neat). Tadano, up 4 % in our table, forecasts a 2.4 % increase in mobile crane sales in 2025 over 2024 and a group total increase of 16.6 % to JPY 340 billion, up nearly JPY 50 billion on the 2024 total.

In addition, Tadano’s future financial reporting will also include the contribution made by its acquisition of the IHI crane business which completed on 7 January 2025 (also neat timing).

Then there will be the removal from the ICm20 of Terex, having just (3 November) completed the sale of its crane divisions to Raimondi, perhaps leading to the Italian tower crane specialist taking a place at the table.

Back to this year, it should be noted HSC, in 17th place, is only down because of getting a more accurate figure for the crane element’s contribution. Also from Japan Kobelco, having resolved its engine supply issues, managed to increase its sales, as did Sany, Link-Belt, Fassi and Furukawa Unic. Just outside the top 20 tower crane manufacturers Favelle Favco, including Krøll, and China’s Yongmao, both posted double digit increases.

Image: International Cranes and Specialized Transport/KHL Group

Image: International Cranes and Specialized Transport/KHL Group

Notes on the ICm20

Figures used in this ICm20 table for November 2025 are from calendar year 2024 or the 12 month financial year to 31 March 2025. Where possible the year-on-year percentage change figures for sales revenue mentioned in the article are calculated in the reporting currencies of the manufacturers. This is to avoid the effect of exchange rate fluctuation. In some cases the figures are supplied by the manufacturers.

Where stated, the percentage changes are calculated from the figures given in the table which are conversions to US dollars from the various reporting currencies. For the figures in this year’s table the exchange rates from the reporting currencies into US dollars are listed in the table below.

Each year’s table should be taken as a snapshot in that there are occasionally changes in one table made to the previous year’s figure the next year, for example, if new data for the year becomes available after one year’s table was published that data may be substituted in the next table. Attempts are made at appropriate explanation in those instances.

Some companies, often based in Asia, are changing their reporting from an April to March financial year to a January to December calendar year. In those cases three quarters from April to December plus the first one of the following year will be used in the first instance until the first full new calendar year of figures is available.

Exchange rates on 03 November 2025 from xe.com (Table does not account for exchange rate fluctuations from year to year)

- Euro/Dollar exchange rate: Euro1 = US$ 1.15 US$1 = 0.87

- Japanese Yen/Dollar exchange rate: US$1 = JPY154

- China RMB/Dollar exchange rate: 1 CNY= US$0.140 / US$1 = CNY7.12

- RM Malaysian Ringgit (MYR)/US Dollar exchange rate: RM(MYR) US$1 = 4.20 MYR

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM