Read this article in Français Deutsch Italiano Português Español

Europe sets natural gas storage record

08 May 2023

Warm winter made for mild heating season

Europe’s second-warmest winter on record led to a record in natural gas storage inventories, according to the U.S. Energy Information Administration (EIA).

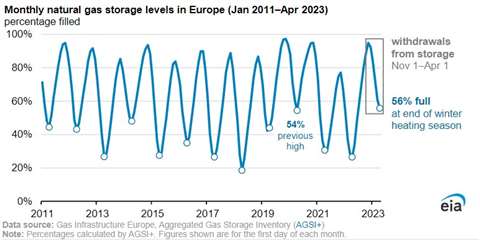

As of April 1, Europe’s natural gas inventories were 56% full—the highest percentage on record for the end of a heating season (November 1 through March 31)—according to data from Gas Infrastructure Europe’s Aggregated Gas Storage Inventory (AGSI+).

On April 1, natural gas storage in Europe totaled 2.02 trillion cubic feet (Tcf), exceeding the previous record of 1.98 Tcf at the end of winter 2019–20 and the five-year (2018–22) average of 1.21 Tcf. Europe also experienced its warmest January on record, according to data from the National Oceanic and Atmospheric Administration (NOAA).

“Most (97%) of the world’s liquefied natural gas (LNG) is consumed in the Northern Hemisphere, which experienced its fifth-warmest winter on record,” the EIA reported. “Europe’s relatively full storage results from exceptionally warm winter temperatures, which reduced heating demand. Europe‘s effort to conserve natural gas and record-high LNG imports also helped offset lower imports by pipeline from Russia. Reduced demand for spot LNG in Asia because of a very warm winter and limited onsite storage, which remained full during most of the winter season, redirected record volumes of LNG from Asia to Europe.”

In large part because of the Russian invasion of Ukraine and the subsequent loss of natural gas supplies from Russia, European governments enacted policies requiring storage operators to maximize storage injections during the refill season to ensure the availability of natural gas supply during winter. As a result, storage stocks on November 1 were 95% full, compared with the 12-year (2011–22) average of 89%, exceeding storage levels at the start of the heating season in 2021.

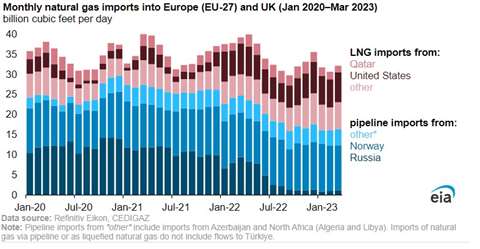

Europe and the UK typically rely on natural gas imports to meet more than 80% of natural gas consumption. Russia’s natural gas exports to Europe, which had averaged 8.8 billion cubic feet per day (Bcf/d) during winter 2021–22, declined by 87%, averaging 1.1 Bcf/d this past winter. Although natural gas imports by pipeline from Norway increased to 11.3 Bcf/d in 2022 (3% more than in 2021) and averaged 11.5 Bcf/d during the winter, a significant increase in LNG imports helped to refill storage inventories and balance the market, offsetting the decline in pipeline imports from Russia.

Europe’s LNG imports remained high throughout 2022, averaging 14.9 Bcf/d, 65% (5.8 Bcf/d) more than in 2021. During this past winter, LNG imports averaged 16.3 Bcf/d, reaching an all-time monthly high of 17.9 Bcf/d in December. Europe was the main destination for U.S. LNG exports in 2022. Last year, the United States remained the largest LNG supplier to Europe for the second year in a row, accounting for 44% (6.5 Bcf/d) of LNG imports into the region during 2022.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM