Read this article in 中文 Français Deutsch Italiano Português Español

Trendlines: North America’s contradictory construction equipment sales

06 March 2025

The North American construction industry is in a pretty good place, so why are construction equipment sales falling?

If you were to take a look at the various components of construction in North America, there is not much to grumble about.

Housing starts were up last year, and the number of permits issued remained high (if slightly down) despite persistently high interest rates. Infrastructure spending continues to rise at a slow and steady rate, and nonresidential building is flying high on the back of a number of major semiconductor plant projects.

What’s more, this segment is tipped for strong growth due to massive investment in new data centers, which are needed by the tech giants to meet anticipated future demand for cloud computing and AI services. A boom in power plant construction is expected to go hand in hand with this due to the staggering amount of energy (mostly for cooling) that data centers consume.

Despite all these positive indicators, sales of construction equipment in North America fell around 10% last year, and a further decline of about 5% is expected in 2025. Surely there’s a contradiction here?

Source: Off-Highway Research

Source: Off-Highway Research

Historical Context

The historical context is that 2021 to 2023 saw three consecutive records set for construction equipment sales in North America. This has provided a fleet of construction machines that is big enough to take on the region’s construction backlog.

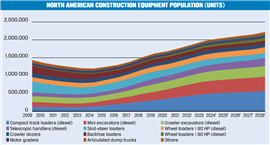

Off-Highway Research estimates the equipment population in the U.S. and Canada is 2.04 million machines, which is 20% more than it was as recently as 2020, and some 70% higher than 10 years ago.

Now for the counter-intuitive part. Even though equipment sales fell 10% last year, the equipment population grew around 3%. And this year’s anticipated 5% drop in year-on-year sales will still see the active fleet grow by another 2% or so.

The reason is that, although sales are lower year on year, they are still substantially higher than they were eight to 10 years ago. That is the crucial point. Equipment sold in the early to mid-2010s are the units now being retired out of the population and there are a lot more new units coming into fleets to replace them.

Growth Continues

For example, North American construction equipment sales in 2014 stood at 207,000 units, but in 2024 the volume of new sales was around 302,000 machines. That illustrates that there was a net gain of around 95,000 machines into the population last year. (Although the model for estimating equipment population is a lot more sophisticated than a blanket 10-year lifespan for all machines.)

Even though the market will be in something of a trough for the next year at least, as the chart illustrates, the population of machines should continue to grow. It will just grow at a slightly lower rate than it did in the early 2020s.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM