Read this article in 中文 Français Deutsch Italiano Português Español

Class 8 truck production surges forward

20 June 2024

Class 8 overcapacity boosts inventory expectations for 2024, said ACT Research

Production of Class 8 vehicles came in above expectations in April, said ACT Research’s latest report. (Photo: KHL Staff)

Production of Class 8 vehicles came in above expectations in April, said ACT Research’s latest report. (Photo: KHL Staff)

(Updated June 21, 2024)

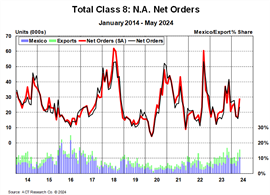

While trailer and Class 4-7 forecasts remained largely unchanged in April, Class 8 production maintained its surge forward, according to the latest release of the North American Commercial Vehicle OUTLOOK from ACT Research. That trend continued in May, with final North American Class 8 net orders totaling an unseasonally high 23,560 units (29.2k seasonally adjusted), up 51% y/y. Total Classes 5-7 orders for May fell 4.9% y/y to 19,306 units (20.9k seasonally adjusted), per the latest State of the Industry: NA Classes 5-8 report.

The N.A. CV OUTLOOK reports on the trucking industry forecast, providing a status of commercial vehicle demand, tactical and strategic market analysis and forecasts ranging out five years. The State of the Industry: NA Classes 5-8 report provides a monthly look at the current production, sales and general state of the on-road heavy- and medium-duty commercial vehicle markets in North America.

According to Kenny Vieth, ACT’s president and senior analyst, “Not only did April build not slow in the face of tough freight fundamentals, falling backlogs and near-record inventories, production of Class 8 vehicles came in well ahead of expectations. Still strong production and an upwards adjustment to our inventory-carrying assumptions boosts 2024 output while reducing 2025.”

Source: ACT Research

Source: ACT Research

The momentum remained ongoing in May, ACT Research reported, despite unexpected headwinds. “Between strong production and softening U.S. tractor sales over the past eight months, Class 8 inventories have risen quickly. The reported inventory decrease from March to May is attributed to a fire that broke out at a supplier plant, requiring OEMs to red tag units. Given build was 6,900 units above retail sales in April and May, inventories should have risen, rather than fallen the past two months,” Vieth explained. “On that adjusted basis, Class 8 inventories have risen over 22,000 units the past nine months, reaching levels not seen since August 2019.”

Vieth described the uptick in 2024 expectations into working conditions as “a coin toss,” noting that while the outlook may miss the timing, “shallower sooner or deeper late appear to be the options” for Class 8 production.

While the N.A. CV OUTLOOK indicates there are still pockets of strength in the Class 8 market, it noted:

- for-hire carrier profits are at levels not seen since 2010;

- deep into the bottom of the cycle, there has been no capacity rationalization to date, only additions;

- capacity expansion has left freight rates at recessionary levels, continuing to prolong the downturn;

- while still expanding, the pace of the economy’s recovery is running at about half the 4+% GDP rate of the second half 2023.

“Class 8 overcapacity persisting longer in 2024 and weighing more heavily on carrier profitability is not just a risk to Class 8, but also to the trailer forecast,” Vieth cautioned. “If current market demand reflects EPA’27 prebuying, that prebuying comes at the expense of better freight rates sooner.

“While over-the-road carriers are under considerable pressure, we would be remiss not to note that vocational truck markets are in better shape than tractor markets, though even here, inventories are getting extended.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM