Read this article in French German Italian Portuguese Spanish

Headwinds negatively impact HD and MD truck demand

16 September 2025

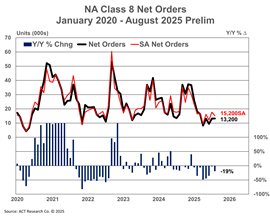

With 2026 order boards opening in September, the next three to four months of Class 8 orders will be critical for 2026, but uncertainty abounds, according to the latest release of ACT Research’s North American Commercial Vehicle OUTLOOK, with preliminary North America net orders in all classes continuing their downward trend.

“On the tractor front, carrier profitability remains under pressure, inching closer to year four of the for-hire market downturn. The group of publicly traded TL carriers’ aggregated margins in Q2 were near 2008 recession levels, and the frontloading of goods ahead of tariffs in 1H of this year elevates the risk of a freight air pocket into the end of 2025,” stated Ken Vieth, ACT’s president and senior analyst. “Additionally, while the U.S. consumer has remained resilient, signs of labor market weakness, and the fact that the full brunt of tariff costs has yet to be passed on to the consumer, are further risks to goods demand.”

August preliminary North America Class 8 net orders fell 19% year over year to 13,200 units, per ACT’s State of the Industry: Classes 5-8 Vehicles report. Tim Denoyer, VP & senior analyst at ACT Research, attributed the double-digit decline to the beleaguered for-hire market, soft activity in housing, fleet margin pressure and related factors.

“Vocational demand has taken its knocks as well this year on a combination of regulatory uncertainty, tariffs, and elevated interest rates,” he said, “though data centers remain an area of strong activity.”

Vieth cited a trio of headwinds reducing vocational demand. “First, the EPA’s March ‘review’ announcement quickly ended vocational prebuying ahead of EPA’27, with many fleets believing that EPA’27 low NOx regulations ceased to be a future concern,” he noted. “On top of regulatory matters, there are funding freezes delaying infrastructure project starts, despite Congress having already appropriated the funding. Lastly, deepening softness in housing and a construction pullback, solid freight generating segments, adds to vocational woes. Currently, elevated new home inventories are an added obstacle to recovery.”

While vocational inventories are just off record levels, backlogs are at five-year lows, he said. “Steep production cuts have already occurred to help alleviate backlog pressure, but elevated inventory remains a challenge for future production.”

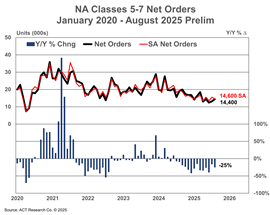

Preliminary orders for medium-duty (MD) vehicles (Classes 5-7) rose by 1,250 units month over month to 14,400 units in August.

“While up 9.5% m/m, MD net orders fell 25% y/y,” Denoyer pointed out. “Historically, August is the beginning of stronger orders for Classes 5-7 vehicles as school bus order season gets underway.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM