Read this article in French German Italian Portuguese Spanish

Trendlines: Unexpected revolution

24 July 2025

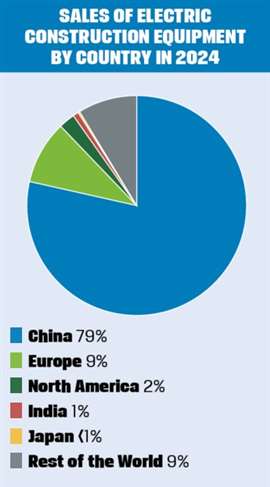

Global electric construction equipment sales grew 110% last year, but it might not have been in the markets and product groups you expected

When the first electric construction equipment was launched at shows like Bauma and ConExpo-Con/Agg a few years ago, the emphasis from most international manufacturers was on compact machines such as mini-excavators and small wheel loaders. Ask them today how that worked out and most would admit it’s been disappointing.

Although relatively easy machines to electrify due to their low power requirement (small battery), they tend to have a low utilization, making it hard to recoup purchase prices that are two to three times that of the equivalent diesel machine. Add to that the fact that these machines are often used in situations where there isn’t an easy or obvious place to charge them, and the reasons for the lack of adoption become clear.

This stall in adoption for many international OEMs has no doubt contributed to the general cooling of enthusiasm for electrification.

Where Larger Electrics Dominate

But in China, the focus on mid- to large-sized wheel loaders (equivalent to 220 hp and above) and more recently on wide-bodied dump trucks has seen electrification take off. Electric machines made up more than 20% of wheel loader sales in China last year – by far the largest wheel loader market in the world – and electric wide-bodied trucks were more than 10% of that market.

Subsidies and scrappage schemes have helped, but the underlying drivers of adoption in China are also solid. These machines are mainly used in mining and quarrying, where utilization is high, and the sites where they are used are on the power grid (or generate their own electricity), which means it is easy to charge the equipment overnight.

Photo: LiuGong

Photo: LiuGong

For those not familiar, wide-bodied dump trucks are a uniquely Chinese equipment type, where a wide dump body (the clue is in the name) capable of loads up to 100 tons is fitted to a chassis with more of an on- than off-highway heritage. They are far less durable and less capable than off-highway dump trucks, but their low price has seen them wipe out the country’s market for rigid dump trucks under 100 tons.

First Movers

As a result of the product and application focus in China, this market accounted for almost 80% of the 18,600 electric construction machines sold globally last year, and the market was entirely served by indigenous brands. A further 10% of the global electric market last year was sales of this type of equipment by Chinese OEMs in emerging economies.

Although international manufacturers are now moving more towards heavier models in their electric portfolios, the Chinese OEMs are securing first-mover advantage in many significant markets around the world.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM