Read this article in Français Deutsch Italiano Português Español

Uncertainty, headwinds weigh down 2026 CV outlook

13 November 2025

The outlook for 2026 commercial vehicle orders appears to be a continuation of 2025’s downward trend. (Photo: Becky Schultz)

The outlook for 2026 commercial vehicle orders appears to be a continuation of 2025’s downward trend. (Photo: Becky Schultz)

Thus far, 2025 has proven a challenging year for commercial vehicles markets and there doesn’t appear to be any relief in sight.

According to ACT Research’s latest North American Commercial Vehicle OUTLOOK, tariffs continue to sow uncertainty among for-hire carriers, and even if the Supreme Court reiterates Congressional authority over IEEPA (International Emergency Economic Powers Act) tariffs, the short-term damage has already been done.

“The initial tariff roll-out in April sparked a mini-prebuy and pushed Class 8 tractor retail sales above replacement levels, further prolonging the longest for-hire downturn in recent memory,” according to Ken Vieth, ACT’s president and senior analyst. “On top of the IEEPA tariffs, the trucking industry is contending with the new §232 tariffs, a 25% levy on the value of foreign content in imported medium- and heavy-duty trucks and buses.

“Seeing as we are nearing Year 4 of generationally low carrier profits, and freight rates remain sluggish, the sudden and onerous cost increase will reduce already weak new U.S. vehicle demand, at a time when backlog cushions should be accumulating.”

That weak demand was evidenced in preliminary data reported in ACT’s State of the Industry: Classes 5-8 Vehicles report, issued in early November. It indicates total net orders of 40,000 units, a decline of 17% year over year.

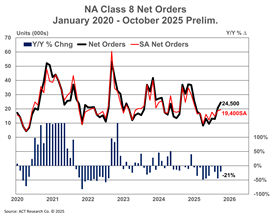

Figures are especially stark in the heavy-duty vocational segment, with preliminary Class 8 orders totaling 24,500 units in October, a decrease of 21% year over year – what Carter Vieth, ACT research analyst, described as “a notably weak number when you take into consideration October is seasonally the strongest month for orders with a 25% seasonal factor.”

“This is the time of year when next year’s backlogs get built,” he continued. “Rising costs, still weak spot rates and ongoing uncertainty continue to hamper for-hire carriers, and as a result, have led to a muted order season to date. Additionally, private fleet demand has slowed after recent expansion.”

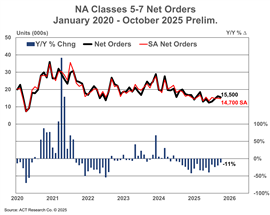

Preliminary net orders for North America Classes 5-7 were only modestly better, declining 11% year over year to 15,500 units. Carter Vieth cited economic uncertainty and rising consumer pessimism as continuing to weigh on demand.

Compounding the problem is a long list of headwinds likely to continue to diminish 2026 commercial vehicle demand, ACT Research noted in its N.A. CV OUTLOOK, including:

- Freight rates and for-hire carrier profits mired at recessionary levels

- A freight air-pocket happening now that follows an extended tariff-avoiding freight pull-forward

- Accelerating tariff-driven goods inflation that will weigh on freight volumes

- A pullback by private fleets after significant fleet expansion in 2023-2024

- Specific uncertainty surrounding EPA’27

- Macro-level uncertainty around U.S. economic policy

Thus, tariffs boosting new vehicle prices on top of recession-level market conditions are just one more obstacle in an already obstacle-strewn 2026 demand outlook.

That said, Ken Vieth sees the market as resilient longer term. “Vocational, like the tractor market, continues to be hampered in the short to medium term by policy fluctuations related to tariffs, federal funds and emissions regulations,” he commented. “However, secular trends regarding utilities, roads and data centers remain positive for vocational in the long run.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM