Read this article in Français Deutsch Italiano Português Español

Class 8 tractor, vocational truck orders strengthen

18 December 2024

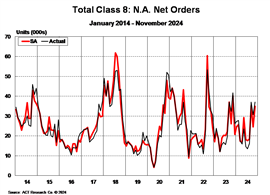

Final North American Class 8 net orders totaled 37,200 units in November on very strong tractor demand, according to ACT Research’s latest State of the Industry: NA Classes 5-8 report, which provides a monthly look at the current production, sales and general state of the on-road heavy- and medium-duty commercial vehicle markets in North America.

“Given the generationally weak profits experienced by for-hire carriers in 2024, and the relative youth of private fleet, tractor orders of 28,700 units are a high-side surprise,” Kenny Vieth, ACT’s president and senior analyst, indicated. “While some of this month’s strong orders likely came from post-election optimism in for-hire, we suspect that private fleets worried about future supply chain disruptions continued as the larger driver of tractor demand in November.”

Vocational truck orders reached 8,600 units, which Vieth said is another historically strong number. It suggests that the vocational market is seeking to get ahead of EPA’27 and GHG-3 requirements.

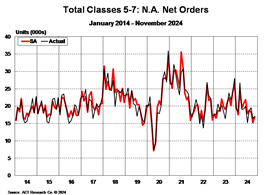

Regarding medium duty, Vieth noted, “Total Classes 5-7 orders decreased 28% y/y to 17,100 units. Orders have slowed the past three months, and that trend is likely to continue as record-high inventories take some air away from new orders.”

Revised vocational truck outlook

November’s strong figure for vocational truck orders follows an all-time best month reported in September at 20,000 units, and 9,500 units in October. Such figures have led ACT Research to adjust its 2025 and 2026 outlook.

“Last month, we boosted our vocational truck outlook for the 2025 and 2026 on solid fundamentals: U.S. industrial policy and infrastructure spending stimulus plans have manufacturing and private construction expenditures running at record levels,” Vieth explained. “And much of the ~$2 trillion in stimulus (CHIPS, IRA, IIJA) put in place in 2021 and 2022 continues to be deployed into the economy, providing healthy tailwinds. To date, only around 40% of that money has been deployed.”

He added, “With well supported end markets and technology-forcing regs on the horizon, vocational truck buyers not only have a willingness to get a head start on refreshing their fleets, but clearly the ability, as well.”

As such, on the vocational truck side, ACT Research believes queuing for 2026 (EPA’27) has begun. “With tractor demand suspect, vocational truck production appears to be well supported into 2025,” Vieth concluded.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM