Read this article in 中文 Français Deutsch Italiano Português Español

Renewable diesel gains market momentum

23 July 2024

Neste is currently the world’s largest producer of HVO (hydrotreated vegetable oil), or as it is known in North America, renewable diesel. The fuel is a drop-in replacement for fossil-derived diesel, so much so that a series of major engine OEMs have already approved HVO/renewable diesel for use in their diesel models. In addition to that flexibility, renewable diesel offers a series of benefits over its crude oil-derived cousin – but more on that later.

From its headquarters in Espoo, on the western edge of Finland’s capital, Helsinki, Neste now operates four refineries around the world: Porvoo, located to the east of Helsinki; in Rotterdam, The Netherlands; in Singapore; and a joint-venture operation in Martinez, California.

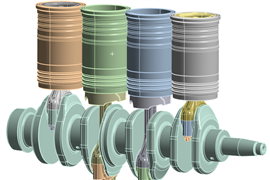

Carrie Song, Neste (Photo: Neste)

Carrie Song, Neste (Photo: Neste)

“We have an annual nameplate capacity of approximately 5.5 million tonnes,” says Carrie Song, senior vice president, Renewable Products, at Neste, who spoke with Power Progress International in an exclusive interview. “We’re investing about $1 billion to expand production capacity at our Rotterdam site and, together with other capacity investments in Singapore, we are projecting that we will reach annual production of 6.8 million tonnes (approx. 2.3 billion gallons) of renewable products by the end of 2026.”

Asked about the range of products now manufactured by Neste, Song starts by explaining that Neste produces renewable diesel – not biodiesel. “They’re two completely different products,” she says with conviction. In addition to HVO/renewable diesel, the company also produces SAF, or sustainable aviation fuel, while a third product range includes feedstocks (such as renewable naphtha) used in the polymer and chemical industries.

Refining process

The products delivered by Neste are all derived from what would otherwise be considered waste, including used cooking oil and animal fats. Song says that waste and residual raw materials account for more than 90% of Neste’s total production around the world. She explains that once these materials are brought back to the respective plants, the first step is a pretreatment process to remove impurities.

That material then enters the refining process, which according to Song starts with oxygen removal. This results in formation of aromatic-free hydrocarbon molecules; ‘aromatics’ are molecular impurities in fossil fuels which create additional emissions (particulates, NOx, etc.) when burned. One of the final steps involves isomerization of the product, essentially dewaxing of the fluid to improve ‘cold flow’ properties.

Unlike the fractional distillation process used to produce fuel from crude oil, which produces a series of other byproducts in addition to petrol and diesel fuel, the process used by Neste generates very few byproducts – these are limited to renewable propane, naphtha and water.

The circular economy of renewable diesel (Photo: Neste)

The circular economy of renewable diesel (Photo: Neste)

Asked about emissions from the production of renewable diesel, Song explains: “We don’t look at the GHG (greenhouse gas) emissions from specific steps like production or tailpipe emissions. Instead, we have an end-to-end approach, looking at how emissions are reduced across the product lifecycle. This is particularly important when looking at older engines. The benefits, the improvement in air quality and reduction in particulates when using renewable diesel in an older engine, these are proportionally higher.”

Sourcing feedstock

As might be expected, identification and collection of the raw feedstock is a major hurdle to efficient volume production of renewable diesel. While geopolitical upheaval plays a significant role in setting the price of fossil fuel, feedstock availability is a primary driver in renewable diesel prices.

“We believe there are ample feedstock sources,” explains Song. “There are existing sources and we’re always looking for new streams. In addition, we’re looking to streamline the collection process, make that more effective. We have fully-owned companies focused on locating and collecting feedstock.”

In addition to these known streams, R&D teams at Neste are continuing to look for wholly new sources. Song says that forestry waste is one area of interest, while production based on algae is also under investigation. “It comes down to having the resources to maximise collection opportunities, while also expanding the potential pool of possible candidates,” she explains.

“We have fully-owned companies focused on locating and collecting feedstock” Carrie Song, Neste

Neste declined to offer specific numbers covering the volume of feedstock needed to produce a given quantity of renewable fuel. That is because the different feedstocks can deliver different volumes and quoting figures based on a single feedstock type would not give an accurate estimate of anticipated results.

Fuel stability

Going back to the benefits of renewable diesel, the final product is reported to be far more stable than standard diesel or biodiesel. According to Song, the chemical properties of the renewable diesel mean it attracts very little water.

The Singapore refinery operated by Neste (Photo: Neste)

The Singapore refinery operated by Neste (Photo: Neste)

“Because of the stability of the molecules that make up renewable diesel, the product has an amazing shelf life,” says Song. “Production started about a decade ago and we periodically take samples from those early batches to check the quality. Even now, the product meets all related specifications.”

She says that biodiesel might have a shelf life of a few months, while fossil diesel remains viable for about a year. As such, the characteristics of renewable diesel which allow it to remain a viable fuel for many years mean it’s ideal for use with gen sets put in place to deliver backup power.

In addition, because there are no aromatics in the renewable diesel, the fuel burn is far cleaner. Less carbon buildup within the engine can support extended service intervals and reduced servicing costs, both in terms of downtime and also the need to replace filters and other components.

Adoption barriers

Renewable diesel can use all the same infrastructure as fossil diesel – this extends from the national distribution pipelines which move fuel across large geographic regions, through to the marine tankers, trucks and storage tanks. Due to its chemical similarity, the renewable fuel can mix with fossil diesel in any percentage combination.

“Renewable diesel doesn’t require any new infrastructure, unlike other alternative fuels,” Song points out. “If you look at hydrogen, all the supporting hardware has to be put in place, which represents a lot of investment.”

Yet despite ready accessibility in areas with the supporting distribution networks and infrastructure, renewable diesel remains more expensive than fossil fuel.

“Even with the available incentives, renewable diesel is expensive when compared to the fossil equivalent,” says Song. “I would argue that a large part of that difference is down to fossil fuel producers not incorporating the cost of the pollution generated from their product in the final retail price. We’re factoring that into the process and price, the fuel is produced sustainably and is fully traceable, so like-for-like it’s not necessarily a fair comparison.”

There’s also issues with supply and demand, which Song went on to describe: “Greater demand will play a role in cost reductions. But we also have to consider the cost if we do not start using renewable diesel, the potential impact on air quality and the environment. In my opinion, that outweighs the retail cost.”

Retail distribution

It might be assumed that fuel products produced by Neste are only available on a business-to-business basis and unavailable to private customers. But Song says that there are a limited number of outlets which now offer renewable diesel directly to the retail market.

“We have a really good market share in Finland, selling to retail customers,” explains Song. “We also have a series of partners in The Netherlands which are offering Neste MY Renewable Diesel. That has been available since 2019.”

In the US, Neste has a series of partners which offer renewable diesel. While these are not open to retail customers - the fuel is purchased by truck drivers using dedicated cards - the program has expanded outside California to where there are now outlets throughout the Pacific Northwest.

Fire truck being refuelled at Neste fuel station in Oakland, CA (Photo: Neste)

Fire truck being refuelled at Neste fuel station in Oakland, CA (Photo: Neste)

The fuel is stored by Vopak, which operates the Vopak Los Angeles Terminal within the Port of Los Angeles. The tanks were previously used to store fossil diesel; the switch to renewable fuel has helped with Vopak’s own energy transition.

User diversification

While a series of new power technologies are now making their way into the off-highway and road transport sectors, this will have little impact on the existing global fleet of diesel engines.

“We don’t expect those assets, those existing diesel internal combustion engines, to go offline anytime soon,” says Song. “From a capital investment perspective, it doesn’t make sense for a company to scrap their fleet of internal combustion-powered machines and switch overnight to a new technology.

“We believe that renewable diesel offers a way to mitigate the emissions from those engines. Maybe some will be replaced over time by new technologies, but until then the fuel can help to reduce the collective environmental impact.”

Then there are the applications which have very high power requirements, such as mining and marine. Song says that the expectation is that a high percentage of these will have no choice but to stick with internal combustion. Again, in these cases, renewable diesel offers a route to off-setting emissions related to using fossil diesel.

Volpak Los Angeles Marine Terminal (Photo: Volpak)

Volpak Los Angeles Marine Terminal (Photo: Volpak)

Song follows this up by saying Neste is not against diversification of power solutions. But she adds that the given solution should be both practical and economically viable. As such, electrification (as an example) is not viewed as ‘the enemy’; instead, it’s simply one of many solutions which can be leveraged on a use-case basis.

“A company should procure EV trucks where those a suitable,” Song says. “I expect to see continued portfolio diversification, but that should not be at unnecessary cost or impact on efficiency. Renewable diesel is just an option which supports choice.”

Future challenges

A litre of fuel bought from Neste means a litre of fuel not bought from the major oil companies. Asked if this had generated any negative response to Neste’s products, Song replies that to the contrary, most oil companies are now starting production of their own renewable fuel products.

With their reach and marketing might, the move could be seen as a threat to Neste. But again, the start of production by oil companies is instead viewed as a necessity.

“It doesn’t make sense for a company to scrap their fleet of internal combustion-powered machines and switch overnight to a new technology” Carrie Song, Neste

“As demand spreads [for renewable diesel], from California to the wider United States, we will need more output. That supply will create stable demand and that, in turn, will give investors the confidence to support our company.”

According to Song, the setup cost of the joint-venture production site in California was around $1 billion. She says that more than 50% of diesel product in California is now made up of renewable fuels, but the Neste joint-venture with Marathon Petroleum is still reported to be operating at just 50% of capacity.

“I would like to see more states follow the lead set by California,” she says. “Possibly supported by government policy, replacing diesel with renewable product would eliminate a significant amount of carbon emissions.”

In April of this year, New Jersey Natural Gas (NJNG) made the switch to Neste MY Renewable Diesel. Across the company’s fleet of 70 medium-duty trucks, NJNG will use 57,000 gallons (168 tons) of fuel each year. Producing 75% less CO2 than standard diesel (calculated over the total lifecycle), this is an annual emissions reduction of 550 tons. The fuel is delivered by Neste distributor Diesel Direct, described as the country’s largest mobile on-site fuelling company.

Song: “We see some customers making the switch [to renewable diesel] voluntarily. But it is more difficult to promote that switch without policy support, from a cost perspective. If we want to scale up East coast expansion, it will require the government to speed up support for clean fuel products.”

Pipeline delivery

Refinery pipelines (Photo: AdobeStock)

Refinery pipelines (Photo: AdobeStock)

Neste produces the only renewable diesel product which has achieved ‘top tier’ certification. When it comes to distribution via national pipelines, the product is clearly going to mix with standard diesel – how does this affect the sustainability credentials?

“Normally, pipelines will issue a standard spec for renewable diesel,” responds Song. “The pipeline is shared, so there is a standardised product level. We’re very proud of our renewable diesel product, it has a very high specification.”

Product taken from the pipeline is certified as ‘renewable’ based on the volume of fuel added to the system. Using a mass balance system, customers can receive certification that the fuel they withdraw is equivalent to an equal volume of renewable diesel which has been pumped into the network.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM