Read this article in Français Deutsch Italiano Português Español

UPDATED: Commercial vehicle demand continues to weaken

14 August 2025

Tractor and vocational demand continued downward trend in June and July

Updated Aug. 18, 2025

ACT Research continued to pull back on out-year expectations based on a number of negative factors cited in the latest release of its North American Commercial Vehicle OUTLOOK*, which reports on the status of commercial vehicle demand, tactical and strategic market analysis and forecasts ranging out five years. These negative factors included:

- Weak carrier profitability and ongoing lack of traction in freight rates;

- expected tariff-driven goods inflation;

- a “freight air pocket” likely following the goods pull-forward in first-half 2025;

- and uncertainty surrounding U.S. economic policy and the status of the EPA’s low NOx Clean Truck regulation.

“This is the time of the year that heavy truck orders are weak. That seasonal weakness has been compounded by the aftershocks of April’s tariff and policy announcements, which continue to reverberate,” stated Kenny Vieth, ACT’s president and senior analyst. “Policy uncertainty coupled with still weak for-hire rate and profitability fundamentals have exacerbated that seasonal order weakness.”

Based on June data, the tractor order trends for the past 12-month, six-month SAAR (seasonally adjusted annualized rate) and three-month SAAR reflected a downward slide, coming in at 176,000, 129,000 and 97,000, respectively, Vieth noted. Tractor sales, on the other hand, have risen since the onset of tariffs as companies sought to take advantage of tariff-free equipment in inventory. As that inventory is consumed, ACT expects retail sales to cool in the coming months as prices move higher.

Vocational demand has shown a similar order trend, said Vieth, with the 12-month, six-month SAAR and three-month SAAR order levels at 86,000, 60,000 and 54,000 units, respectively.

July slide

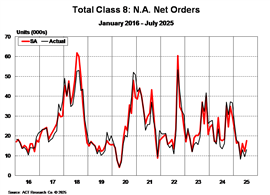

The slide was further reflected in July, with final North American Class 8 net orders totaling 13,172 units, down 2.1% y/y, per ACT’s latest State of the Industry: NA Classes 5-8 report. This was the seventh consecutive month of year-over-year Class 8 order declines.

Tractor orders rose 6.6% year over year to 8,314 units. However, with July historically the weakest month for orders, Carter Vieth, research analyst, ACT Research, said delayed planning due to tariffs is likely responsible for the modest bump, given the weak fundamentals that remain in place.

Vocational orders totaled 4,858 units, declining 14% y/y, on what Carter Vieth described as a “troika of headwinds”:

- Uncertainty of EPA 2027 low-NOx rules, with most fleets now thinking a complete repeal is likely, removing the need for prebuying;

- A slowdown in housing, manufacturing and private construction, plus continued elevated financing costs weakening demand in key vocational sectors;

- Tariff-related equipment costs/uncertainty, which is keeping fleets on the sidelines longer.

Medium-duty also fell for a seventh month, with Classes 5-7 orders dipping 16% y/y to 13,159 units. The decline was attributed to still elevated inventories and a weaker economic outlook.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM