Read this article in Français Deutsch Italiano Português Español

Class 8 orders plunged 35% year over year

22 July 2025

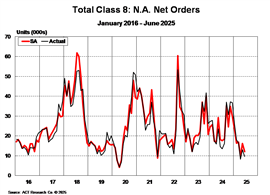

Final North American Class 8 net orders totaled just 9,463 units in June, down 35% year over year (y/y), as reported in ACT Research’s latest State of the Industry: NA Classes 5-8. The monthly report covers the current production, sales and general state of the on-road heavy- and medium-duty commercial vehicle markets in North America.

Carter Vieth, research analyst at ACT Research, cited “weak fundamentals, current regressive trade policy and uncertainty over the every-changing carousel of new tariff rates/deadlines” as impeding decision making on the part of fleets.

“The pain is especially pronounced in the for-hire market, as we’ve now entered the 13th quarter of freight recession in that market segment,” he pointed out.

Vieth described fleets as “cash strapped” and either unable to afford new equipment or seeing little need for it in light of tariffs raising equipment costs and negatively impacting goods demand.

“Consequently, tractor orders were down 42% y/y. Vocational orders were down 23% y/y, as equipment price increases, regulatory uncertainty and softness in housing and private construction have greatly reduced demand for vocational equipment,” he stated.

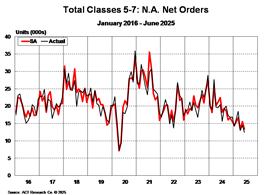

Regarding medium duty, Vieth said, “Total Classes 5 to7 orders fell 40% y/y to 12,387 units. MD orders have slowed across the past six months, as current bloated inventories and a weaker economic outlook weigh on new orders.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM