Read this article in Français Deutsch Italiano Português Español

Class 8 orders decline again in June

22 July 2024

Source: ACT Research

Source: ACT Research

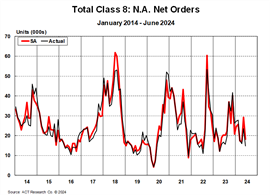

June 2024 saw final North American Class 8 net orders totaling 14,604 units (18.2K seasonally adjusted), a decline of 13% year-over-year, according to ACT Research’s latest State of the Industry: NA Classes 5-8 report. The report provides a monthly look at the current production, sales and general state of the on-road heavy- and medium-duty commercial vehicle markets in North America.

“The Class 8 backlog fell 15,516 units m/m in June to 127,917 units. With two fewer production days, June’s build rate increased to an incredibly strong 1,609 units per day,” stated Kenny Vieth, ACT’s president and senior analyst. “Given where we are on the calendar, stronger build than orders should continue to push the backlog lower in the coming months.”

Source: ACT Research

Source: ACT Research

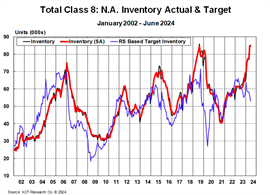

Vieth cited a plant fire in April 2024 that caused “red tagging” of a number of units, making assessing Class 8 inventory levels more challenging. “On ACT’s calculated basis, the Class 8 inventory rose to an all-time high – close to 92,500 units in June versus the 85,400 units reported. Our calculated inventory surpasses August 2019 on the ‘we’ve got an inventory problem’ list.”

Class 8 retail sales were down 19% year over year at 24,267 units (22.8K seasonally adjusted). Veith said “the decline was more than covered by tractors,” which he noted fell 26% year over year, while vocational units rose 2.7%.

“On that seasonally adjusted basis,” he continued, “June’s retail number was the weakest since February 2022, back when supply chains were constraining the market.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM