07 July 2025

June preliminary North America Classes 5-8 net orders of 21,300 units represent a 39% y/y shortfall, according to ACT Research’s State of the Industry: Classes 5-8 Vehicles report. The report provides a monthly look at the current production, sales and general state of the on-road heavy- and medium-duty commercial vehicle markets in North America.

“Publicly traded for-hire fleets ended Q1’25 with the weakest net income margins since Q1’10,” stated Carter Vieth, research analyst at ACT Research. He noted that private fleets have spent the past two years adding fleet capacity with little need for additional supply.

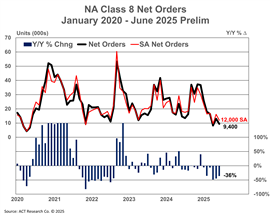

“On the vocational side, worsening housing and construction markets and regulation uncertainty has sapped strength that looked all but certain at the beginning of the year,” he continued. “With that in mind, preliminary Class 8 orders totaled 9,400 units, down 36% y/y.”

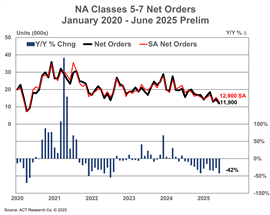

Regarding medium duty (Class 5-7), economic uncertainty and higher prices continued to weigh on demand in June. “Preliminary June NA Classes 5-7 orders fell 42% y/y to 11,900 units, the weakest net order tally since the pandemic, surpassing April’s ‘Liberation Day’ impacted orders for the ‘lowest-since’ designation,” said Vieth

Complete industry data for June, including final order numbers, will be published by ACT Research in mid-July.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM