Read this article in 中文 Français Deutsch Italiano Português Español

Commercial vehicle market outlook weakens further

15 May 2025

Entering 2025 in an already weakened state, current economic uncertainty has added to the expectation of another challenging year for for-hire carriers and the commercial vehicle industry, as indicated in the latest release of the North American Commercial Vehicle OUTLOOK published by ACT Research. The OUTLOOK reports on the trucking industry forecast, providing a status of commercial vehicle demand, tactical and strategic market analysis and forecasts ranging out five years.

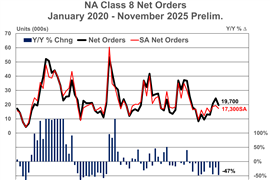

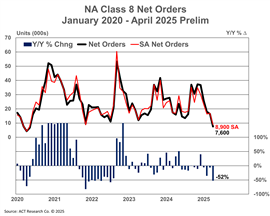

“Tractor market demand was already under pressure from uncertainty alone, but preliminary data show the weaker economic outlook is now weighing further on demand,” said Kenny Vieth, ACT’s president and senior analyst. “Preliminary Class 8 order data for April of 7,600 units, a 52% y/y decline, represented a 59-month low, a level unseen since the onset of the pandemic, when uncertainty was comparably high.”

Orders for medium-duty Classes 5 to 7 vehicles also fell in April to a preliminary volume of 11,600, down 41% from last April’s level.

When released by ACT mid-month, net orders for North American Classes 5 to 8 are expected to be at 19,200 units, the lowest volume since May 2020.

“If there is a silver lining for the industry, it is the expected delay in targeted GHG-3 mandates that promised to make for a particularly challenging environment in the 2028-2030 period, as different segments of the Class 8 market were targeted,” Vieth stated. “Trump’s EPA, while still on the fence for the EPA’s Clean Truck mandate in 2027, has signaled that GHG-3 is viewed as regulatory overreach and unlikely to survive, allowing forecasts to float higher.

“In addition to possibly seeing some production moved back to the U.S., the industry is likely racing to add as much inventory as they can before tariffs are fully enacted,” he continued. “Hence, while we cut our forecasts and lower 2025 expectations, tariffs and the threat of more to come are actually boosting activity in the near term. As is always the case with pulling activity forward, there are paybacks.”

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM