Read this article in Français Deutsch Italiano Português Español

Trendlines: Tractor traumas

25 September 2025

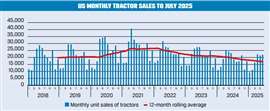

U.S. tractor sales have been falling for more than three years. There was a correction from the highs of the early pandemic years, but the downturn that started in mid-2022 has continued unabated. As the chart illustrates, rolling 12-month sales are now about 15% below pre-pandemic levels. This is based on monthly data published by the Association of Equipment Manufacturers (AEM).

The wisdom is that spending on ag equipment is directly related to farm incomes, as this provides a view of farmers’ capacity to invest in equipment. There is validity in this argument. The problem is that understanding, let alone predicting, farm incomes is complicated.

A big part of it comes down to commodity prices, which dictate how much farmers can earn for what they produce. Finding the sweet spot requires a harvest that is not bad (low yields so a low volume of poorer quality produce to sell), but also not too good (markets flooded and prices depressed).

Another important factor is input costs, such as fertilizer, fuel, seed and seasonal labor. Unfortunately, these were on their way up in 2023 and 2024 at a time when the income side of the equation was falling due to falling prices for agricultural commodities.

Finally, there is a question of international markets. Many countries that have historically bought American agricultural commodities are now tending to pull back and put tariffs on these products in retaliation for the wave of U.S. tariffs since the Trump administration took power. This tends to lower demand and prices of produce.

Tariffs

No article about market trends can be written at the moment without reference to August’s changes to the Section 232 tariffs on steel and aluminum to include steel-derived products. Tractors are one of the product groups which would be included, and as they are machines which are mostly steel, the tariff will be much closer to 50% than the baseline rate for whatever the country of origin is.

Imported machines account for about a third of the tractors sold in the U.S., so the tariffs will have a big impact. In addition, American-made tractors will go up in price due to price increases for imported steel-containing products. Even “American” components are likely to be more expensive as they have some foreign content from somewhere along the supply chain.

Of course, the situation with tariffs is a fluid one. With foreign governments and domestic bodies alike pointing to the damage the new Section 232 measures will cause, it seems likely the administration will find a face-saving way to reduce them. But saving face still demands that there have to be some tariffs in place.

Chris Sleight is the managing director of Off-Highway Research, a market research and forecasting business specializing in analysis of the global construction and agricultural equipment markets. Formed in 1981 as part of The Economist Intelligence Unit (EIU), it is now the largest consultancy of its kind in the world, with offices in Chile, China, Germany, Japan, India, the U.K. and the U.S. OHR is part of the KHL Group. www.offhighwayresearch.com

Chris Sleight is the managing director of Off-Highway Research, a market research and forecasting business specializing in analysis of the global construction and agricultural equipment markets. Formed in 1981 as part of The Economist Intelligence Unit (EIU), it is now the largest consultancy of its kind in the world, with offices in Chile, China, Germany, Japan, India, the U.K. and the U.S. OHR is part of the KHL Group. www.offhighwayresearch.com

Outlook

All in all, the outlook for tractor sales is not a bright one in the near future.

Although the U.S. Department of Agriculture’s (USDA) economic research service expects farm incomes to rise this year, the forecast boils down to an increase in the value of animal and animal product receipts slightly offsetting another fall in crop receipts. It is arable farming that matters the most for tractor sales.

Combine that with the headwinds of tariffs (we don’t know what they will ultimately be) pushing up equipment prices, and it looks like the tractor market will fall further before it recovers. This view is echoed in the latest investor relations materials from producers like AGCO, CNH and John Deere, which are all forecasting double-digit downturns in the North American market this year.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM